CIO Viewpoint: Europe - Meaningful Change or Business As Usual?

Debt crisis, low growth, deflation, negative interest rates, value trap, and Euroscepticism have dominated the headlines of the European market after the financial crisis.

With major economies stepping out of the COVID-led recession and gradually returning to “normal”, the question for Europe is: which “normal” to return to? The much-in-troubled post-2008 period? Or are there signs suggesting potential changes in the economy and the market?

German election: potential changing political landscape

The just concluded German election could suggest some changes in Europe’s largest economy, which may end up with its first-ever three-party coalition government. The old model of the two dominant big parties is being replaced by something much more fragmented.

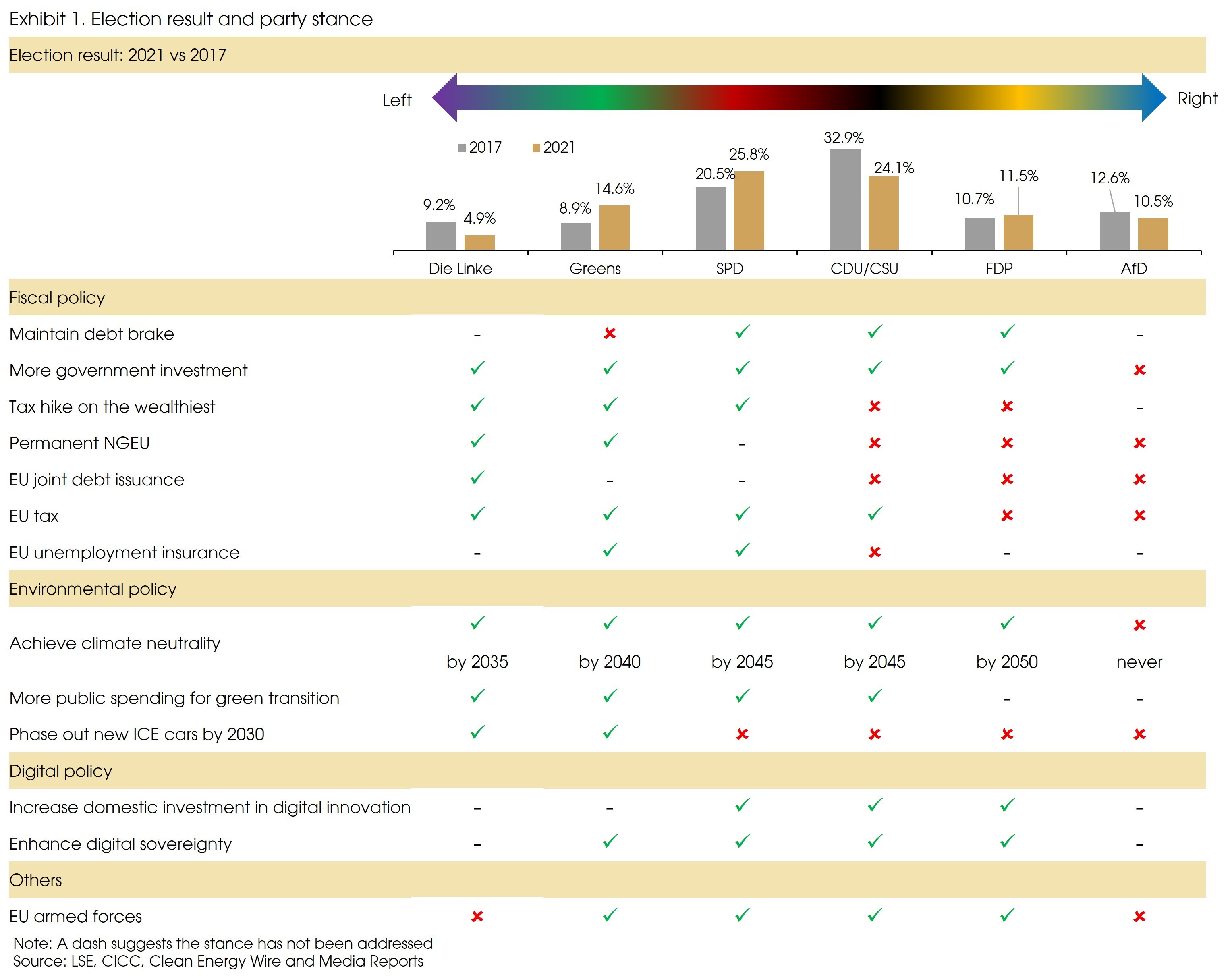

For the two largest parties, the center-right CDU/CSU and center-left Social Democratic Party (SPD), neither managed to get more than a quarter of the vote this time, given the notable challenges from the environmentalist Greens on the left, and the Free Democratic Party (FDP) and even the nationalist Alternative for Germany (AfD) on the right. After the SPD recorded its worst election result in 2017, now, the CDU/CSU’s voting rate fell to the lowest in history at 24.1% (Exhibit 1).

That said, the SPD did much better than last election, with its voting rate increasing from 20.5% to 25.7%. The SPD’s candidate, the incumbent Minister of Finance, Olaf Scholz’s personal reputation and the party’s more pro-growth fiscal agenda clearly gained popularity among voters.

The other party with ascending support from the voters is the Greens (from 8.9% to 14.8%), which insists that combating climate change is the top political agenda. Although, given the election result, the Greens has not grown strong enough to challenge the biggest two parties, it is overwhelmingly popular among the voters under 30, and is seen as the party of the future.

Such a result leaves Germany in limbo, as there are no clear signs of which parties will be forming the next German government or who will become the next Chancellor. In the following month(s), the parties will seek to form coalitions with each other to have more than 50% of the seats in the Parliament.

Pure math suggests that it is a question about the three-combination of a set with four parties (AfD is ruled out by all major parties to collaborate with, and the Left party failed to reach the 5% threshold). The result includes four possible outcomes: the “Traffic Light Coalition” (SPD + Greens + FDP), “Jamaica Coalition” (CDU/CSU + Greens + FDP), and the two coalitions that include both CDU/CSU and SPD.

It might be too early to call any of the possibilities, but the SPD-led “Traffic Light” and the CDU/CSU-led “Jamaica” are the more likely outcomes.

Even as the top runner, the SPD does not have many advantages, given the narrow lead. There is plenty of precedent in Germany’s postwar politics that the top runner failed to form the government. Now, it is the kingmakers’ (Greens and FDP) choice of which party they want to pick, CDU/CSU or SPD. (Exhibit 1) Party manifestos suggest that the Greens may be more willing to partner with the SPD, while FDP’s natural choice should be CDU/CSU.

Seen from the 2017 election, coalition talks between three parties may take more time than between two, and with higher risks of breakup. However, a minority government is also likely, and once all the options are exhausted, Germany’s president would have to dissolve the current parliament and call fresh elections.

Such an election result suggested the “old certainties fall away”, which may affect European asset prices and the euro. However, as the extreme parties or Eurosceptic parties are excluded, the impacts should be limited and short-lived.

On the other hand, the more fragmented votes also suggested that the citizens want change, and a party’s popularity is no longer decided by old loyalty but more by performance, which should become an incentive for the parties to try harder and to deliver better.

Fiscal stance turning more dovish?

It’s hard to have two parties perfectly align with their policy stances in every area, not to say three. Despite the coalition outcomes, Germany faces a new, more complex, more heterogeneous government, and probably with more internal tensions.

Exhibit 1. perfectly shows that it is hard to find consistently similar views on all the key policy agenda items among any three out of the four major parties (SPD, CDU/CSU, Greens, and FDP). However, there are several consensuses.

First, all four major parties support a more accommodative fiscal stance. The fiscal austerity after the financial crisis has led to significant under-investment from the public sector. According to KfW Development Bank, the municipal investment backlog has kept rising. School buildings account for nearly a third of the shortfall and roads just under a quarter. Endlessly delayed mega-projects such as Berlin’s airport, the rusting bridges, and shaky phone signals all suggest that the public sector has failed to invest adequately or wisely.

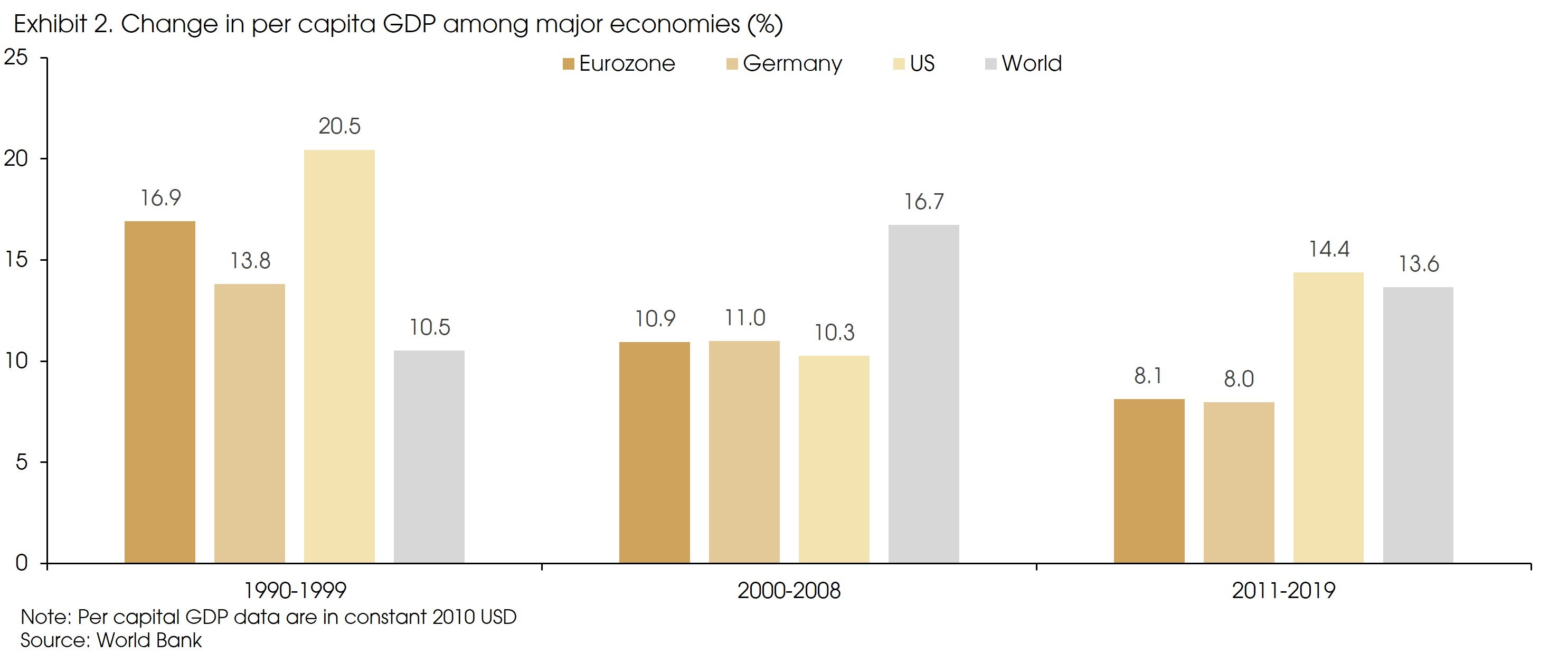

Germany kept a positive fiscal balance from 2012 to 2019 (which reached near 2% of GDP in 2018). During this period, the per capita GDP of Europe’s strongest economy only managed to increase by 8%, significantly lower than the increase from 2000-2008 or the years during the 1990s. Moreover, such growth in per capita GDP is also dwarfed by that in the US or the world’s average during the same period (Exhibit 2).

Although the negative fiscal pulse may not be the only reason for the sluggish economic growth in the past decade, it sounds problematic, given the inadequate aggregate demand in the economy, the high private savings, the deflation risks, the negative interest rates, and the increasing funding needs from public projects.

Therefore, it is a near-consensus among the major parties that public investments in important future fields will increase.

According to Goldman Sachs, under the “Jamaica Coalition”, the potentially positive fiscal pulse may boost Germany’s GDP by 0.5% relative to the current policy setting over the next four years, and the boost under “Traffic Light Coalition” is expected to be around 0.9% of GDP.

The second consensus is to promote the “green transition”. Climate issues overtook the pandemic and became the top concern among German voters, days before the election.

However, parties are divided in how aggressive the green transition should be. The Greens are calling for a fast transition towards renewable energy, but others (such as the FDP and CDU/CSU) are more concerned that a too aggressive plan may endanger the country’s industrial sector, increase costs for private companies, and lead to possible job losses.

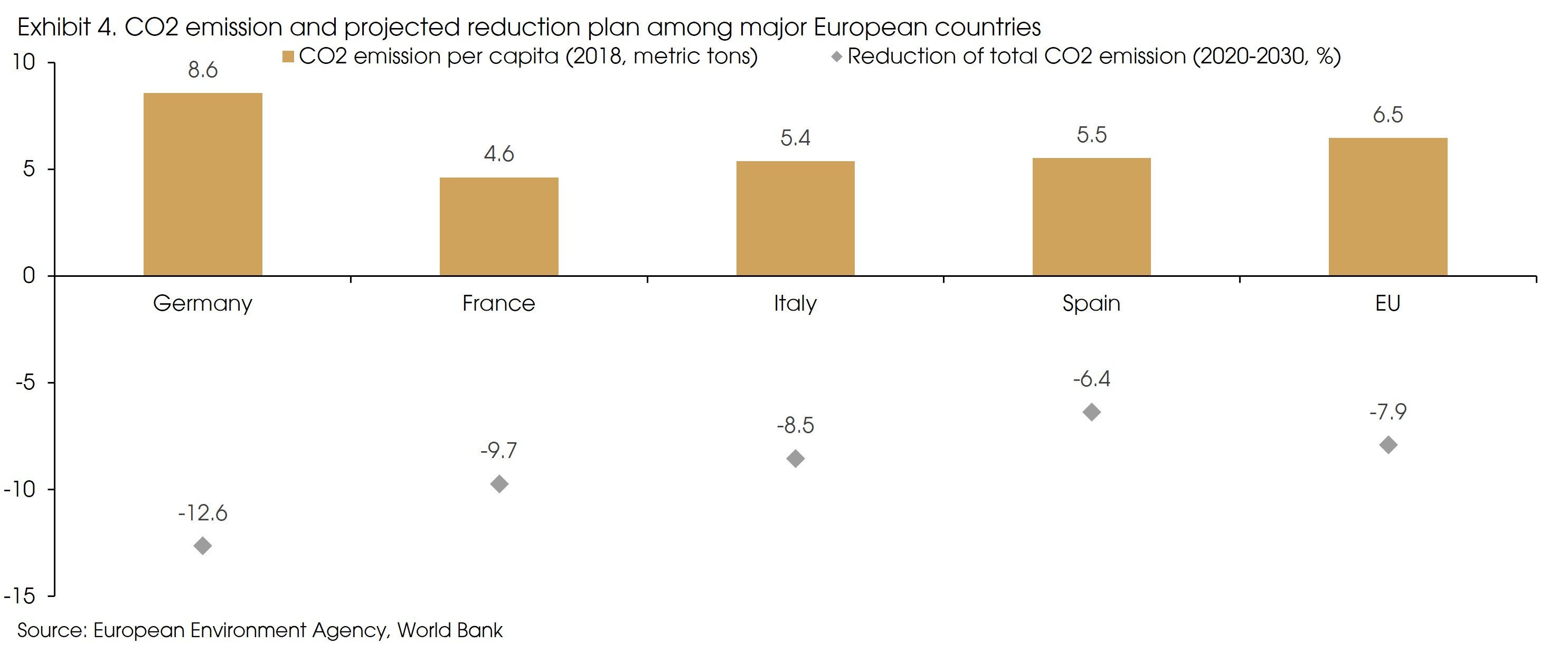

That said, compared to the existential threat posed by climate change, probably no party will question the long-term trend (except the AfD). Germany’s progress towards carbon neutrality lags behind its own agenda and also behind several other European economies (Exhibit 3). Therefore, the process is more likely to speed up in the coming years. More public investment in green infrastructure (such as the grids, charging piles, and buildings for solar panels) and clean technology is expected anyway under the next government.

Moreover, according to European Commission’s Digital Economy and Society Index, Germany lags a number of European countries, only ranked in the middle. Most parties have mentioned the need to increase spending in digital infrastructure.

According to Morgan Stanley, both Deutsche Telekom and Vantage Towers have already begun to embark on projects aimed at covering areas with no/ weak wireless reception. More fiber and FTTH (Fiber To The Home) subsidies from the German government are also likely to enhance broadband speeds outside cities.

However, on European integrated fiscal measures, although all the major parties are pro-EU, Germany is still relatively conservative, even with the SPD and the Greens in government. Major parties oppose a potentially permeant NGEU or EU level debts issuance.

That said, as a traditional advocate for fiscal prudence and Europe’s largest economy, even a slightly dovish turn from the domestic fiscal stance may lead to a spillover effect in the region. The increased demand from Germany may lead to increased production in other countries. Moreover, many other countries, such as France, Italy, and Spain, have long demanded less strict debt limits. France and Italy even successfully blocked Germany and Netherlands’ objection last year, to launch the pan-EU pandemic stimulus.

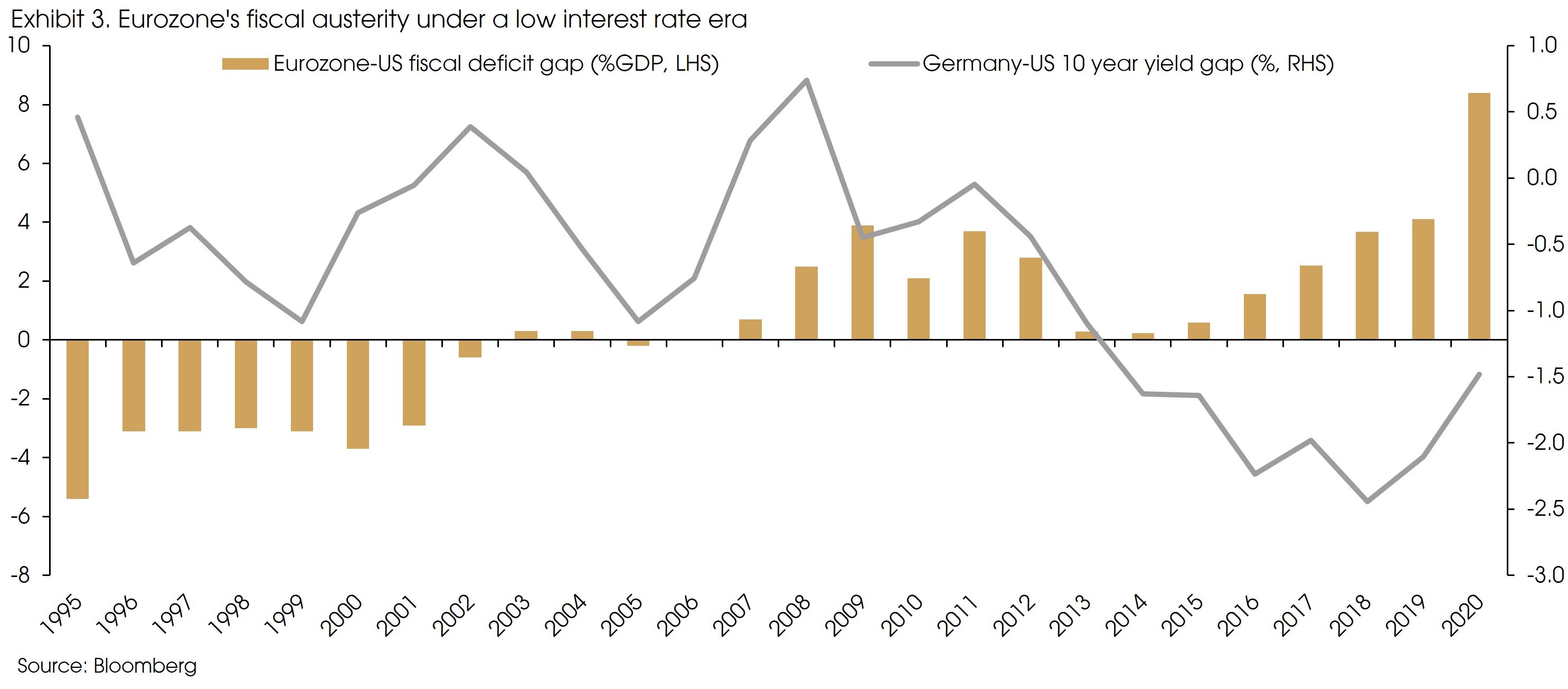

Thus, the more dovish turn in fiscal policy on the EU level is likely going forward. It may increase concerns on debt sustainability among investors, especially for peripheral countries. However, given Europe’s consistently fiscal austerity during the past decade (Exhibit 4), the currently stable yield gap between peripheral countries and Germany, and the ultra-low interest rates, we do not see that as a key risk for now.

Therefore, given the muted debt risk and the possibly more fiscal support, we do not expect a replay of the post-2008 period in the European economy. Higher economic growth, higher interest rates, and less deflation risks are likely going forward.

Narrowing gap on performance between European and US market?

Finally, the European market performed well YTD, similar to the US market. The European market only got its “value trap” title after 2008, when it consistently underperformed the US. The debt crisis, the sluggish economic growth, and the ever-trending-lower interest rates are likely behind this trend.

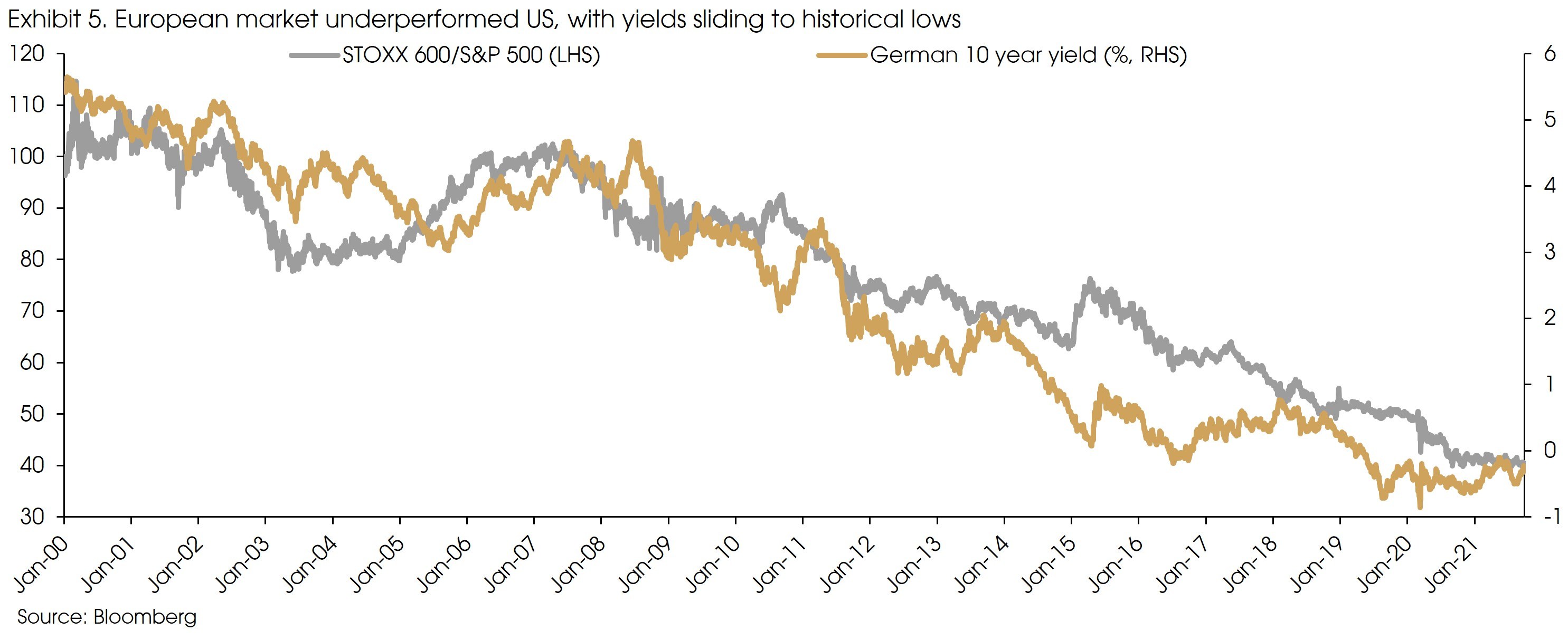

The German 10-year yield dropped from more than 4% in 2008 to -0.3%. The ever-lower bond yields may have boosted the relative valuation and performance of longer-duration, Tech-heavy markets like the US relative to those more tilted towards Cyclical or traditional Value industries, like Europe (Exhibit 5).

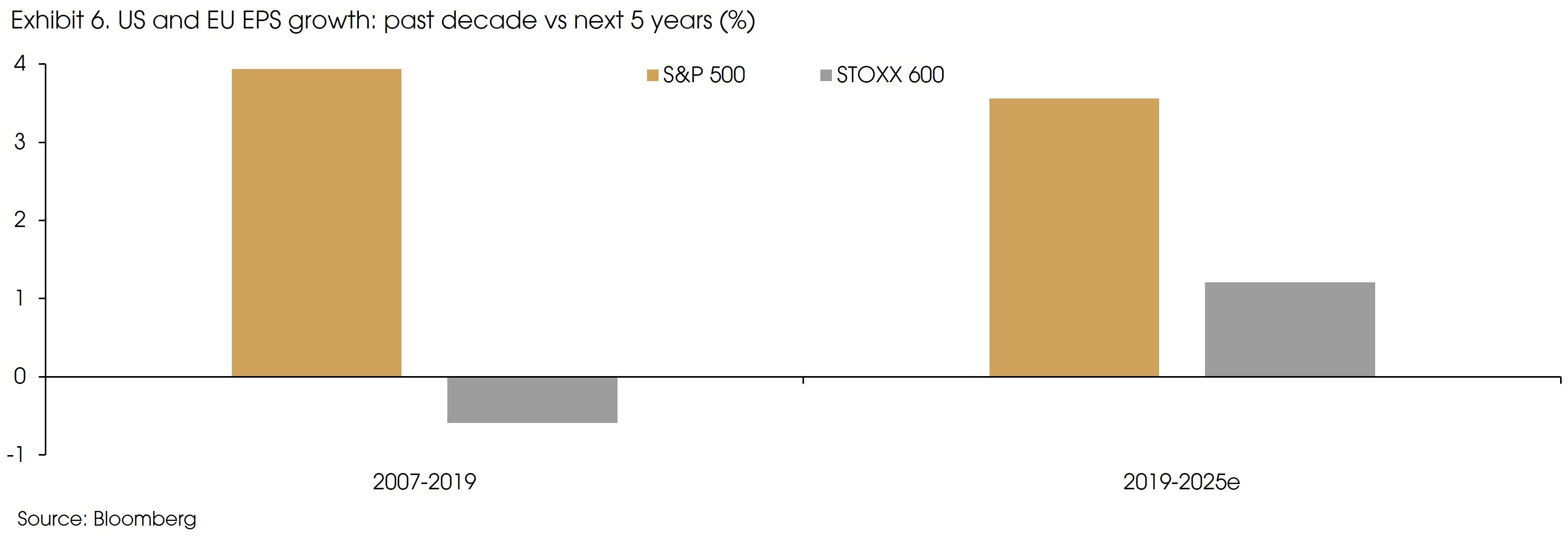

Moreover, part of the relative performance could also be explained by relative earnings growth. As Technology (heavily represented in the S&P 500) experienced much higher EPS growth than other sectors, the US easily outperformed other markets in the world, particularly Europe and Asia. Annualized EPS growth was 4% in the US between 2007 and 2019, while slightly negative in Europe (Exhibit 6).

However, some factors suggest possible changes going forward, at least to some extent.

First, differences in earnings growth may be less extreme. EPS growth between 2019 and 2025 is expected to remain higher in the US than Europe, but the differences are less significant. This is partly because the troubled sectors in Europe are facing fewer headwinds than in the post-financial-crisis era. It is also because non-US markets have changed in terms of composition. According to Goldman Sachs, most of the equity issuance in recent years is in the faster-growing part of the markets.

Second, although the low-rates, low-growth scenario may probably continue, interest rates in Europe probably will not drop by another 4% going forward. Therefore, given the currently significant valuation difference between the US and Europe (even after adjusting for the same sector weights), there might be greater catch-up potential in valuation for the laggard markets.

That said, it may be too bold to predict that the EU will outperform the US, but what we are trying to say is that the gap may become less significant.

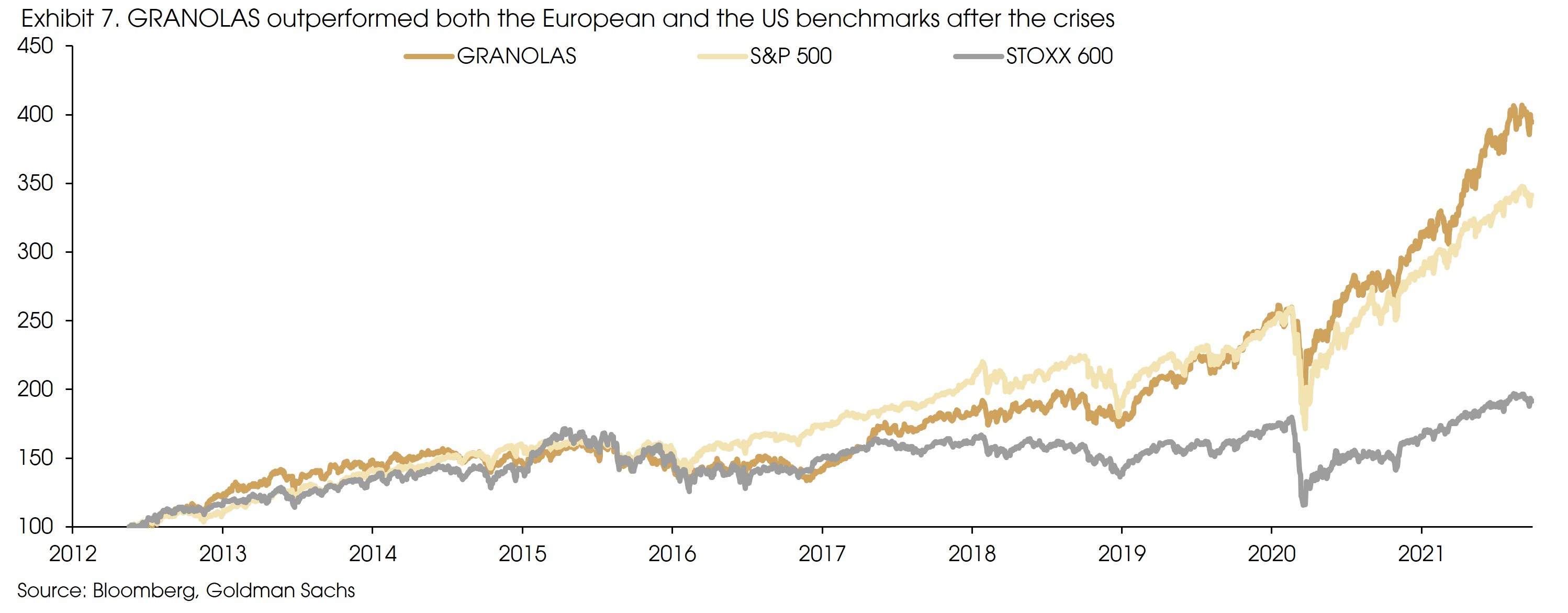

Moreover, given the expected narrower performance gaps between markets and sectors/factors, alpha generation has become more important for investment. Therefore, sticking to the solid names in the sectors with long-term tailwinds remains a reasonable strategy. For the European market, such potential names could be the GRANOLAS (which consistently outperformed the European benchmark and the US market, Exhibit 7), and the solid names in 5G, digital economy, and clean energy sectors.

Sources: Bloomberg, Clean Energy Wire, European Commission, European Environment Agency, Goldman Sachs Research, LSE, Morgan Stanley Research, World Bank and CIGP Estimates.