CIO Viewpoint: Megatrends

Market volatility has remained high throughout 2020 with the COVID-19 pandemic still ongoing, and investors trying to anticipate the impact this will have on companies and the economy. The VIX index reached record highs in March 2020, not seen since the 2008 Financial Crisis. Five months into the pandemic, volatility remains elevated and fears of a second, or third, wave are ever present. Throughout this year, we have been cautious in our investment choices, but have stuck to our four megatrends which guide our investment decisions.

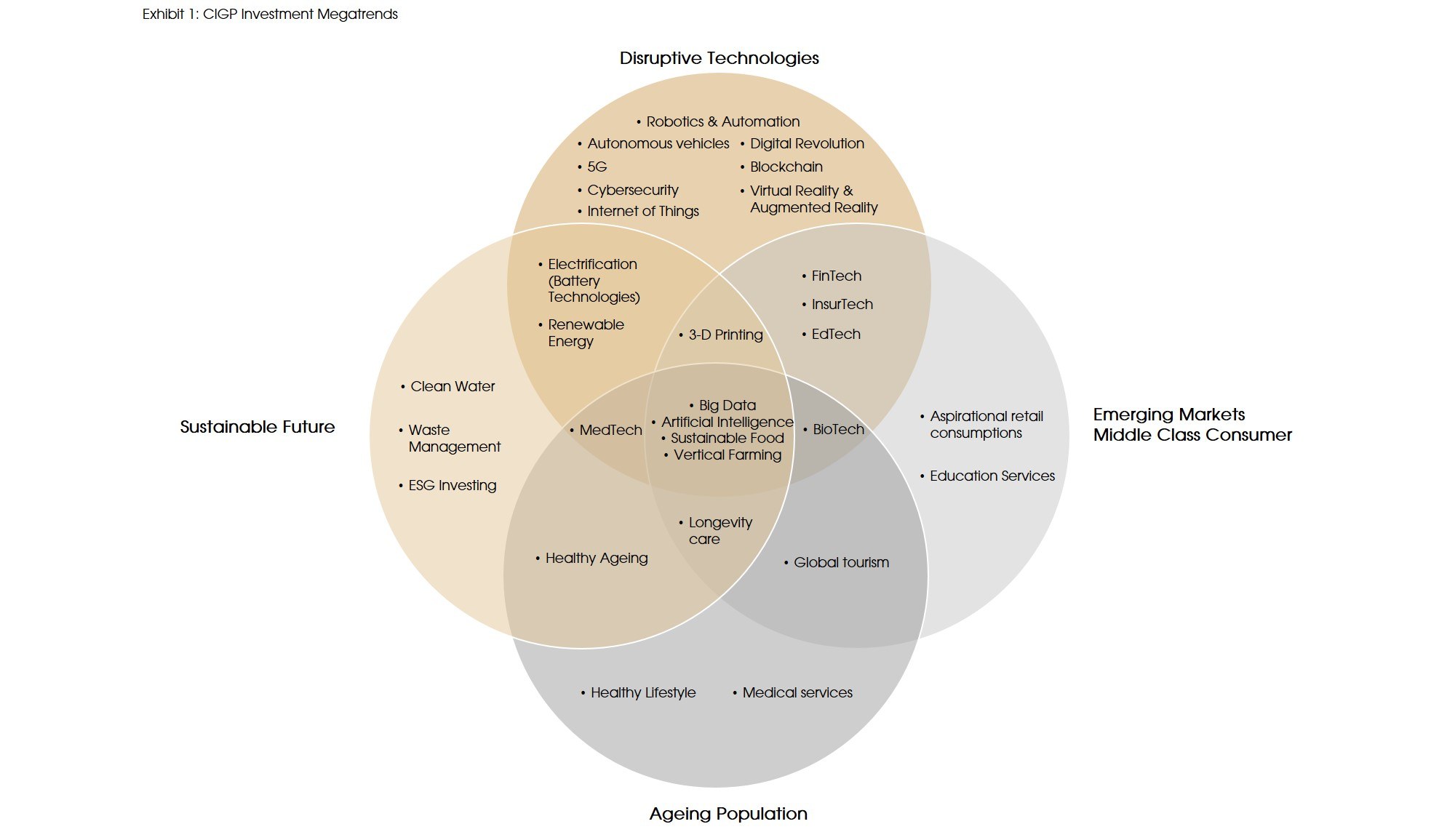

These megatrends were chosen based on underlying secular or structural shifts that we believe are irrefutable and have strong tailwinds that will allow them to continue into the future. We believe that a megatrend is a force of human activity’s development that will bring about long-term, profound changes to societies as a whole. These megatrends are namely an ageing population, rising emerging market middle class, disruptive technology and a shift to a sustainable future. We utilize these megatrends as the origins of all our sub-themes that we highlight below.

In light of recent events we have either witnessed a more global acceptance of our megatrends or in some case an acceleration of the shifts that lead the trends. We remain convinced on the attractiveness of the trends and of the importance they will have achieved in the coming years.

Ageing Population

A Demographic Shift

Thanks to improvements in healthcare, technology advancements and the general welfare of individual’s, life expectancies have risen sharply. It has increased from a global average of 49 years in 1955 to 72 today. Global life expectancy at birth is expected to continue to increase and reach 77 for those born in the year 2045-2050.

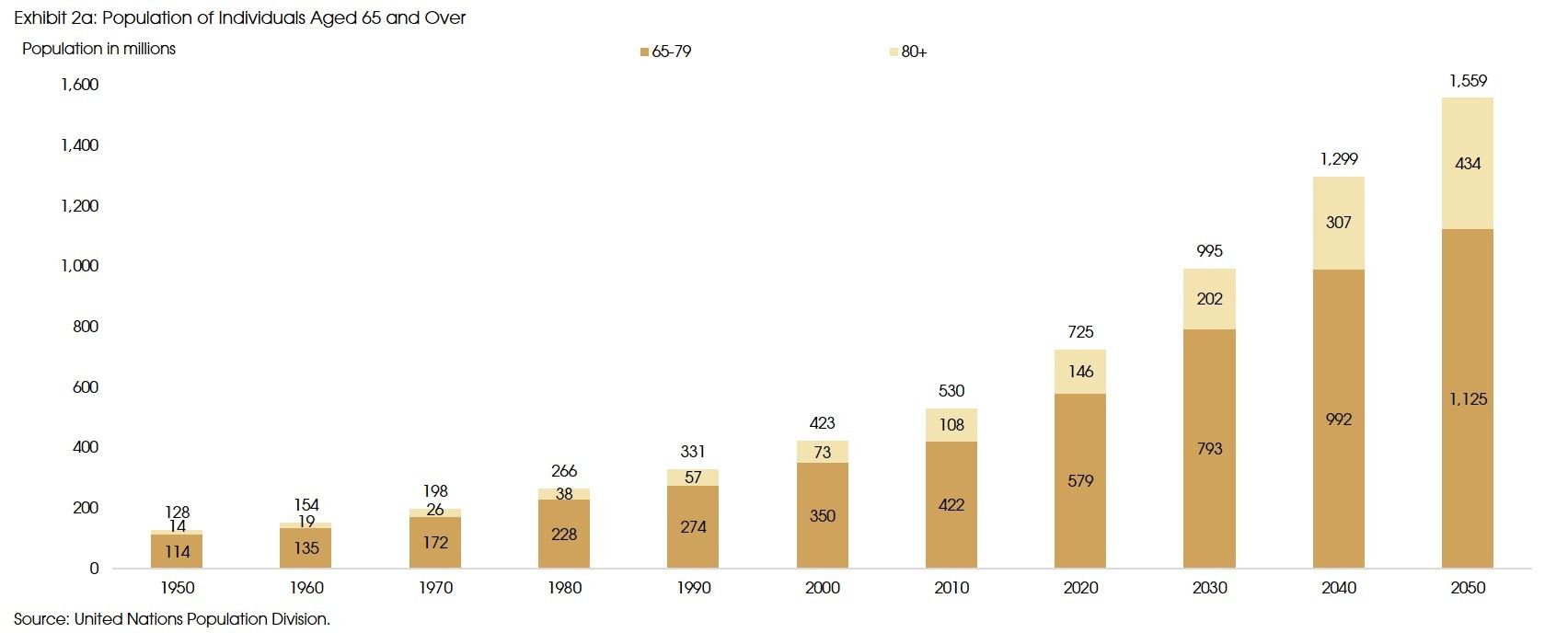

This is leading to the population of individuals aged 65 and older to increase dramatically. As shown in the chart below, the number of individuals aged 65 and over has more than doubled in a span of thirty years from 1990 to 2020. According to the United Nations (UN) Population Division, this group is expected to more than double again from 2020 to 2050, and reach more than 1.5bn people in 2050. Even more striking is the growth that is predicted in the 80 plus age group. It is forecasted, from the current 2020 number, to double by 2040 and almost triple by 2050.

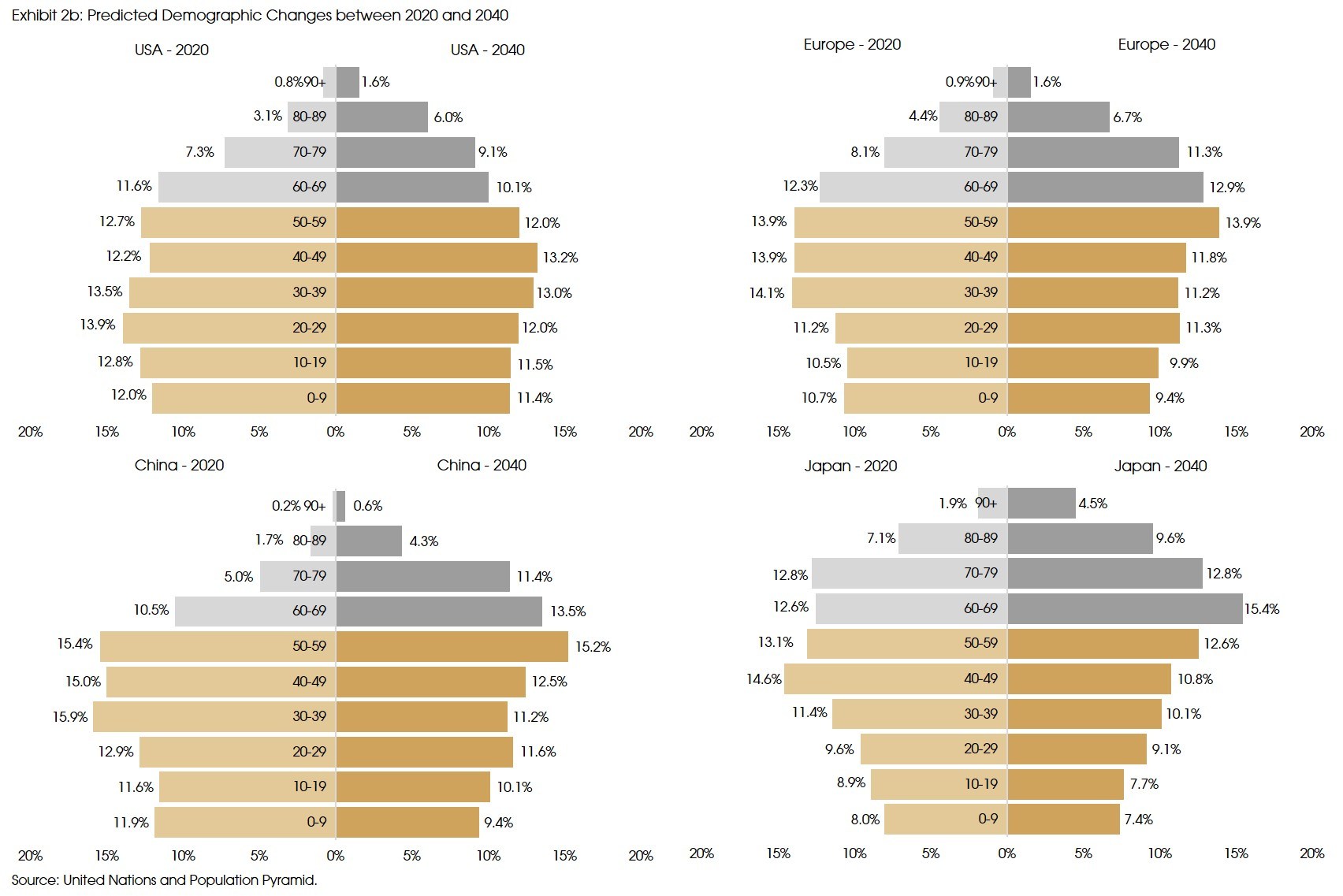

This trend is leading to a shift in the demographic makeup in regions across the globe as indicated in the chart below. In our view, the most remarkable change is in China. The proportion of their population that is expected to be over 60 is predicted to increase from approximately 17% in 2020 to 30% in 2040, almost doubling in a span of twenty years.

This highlights that contrary to popular belief, an ageing population is not only a phenomenon seen in developed countries, but is also true in developing countries. Two-thirds of the world’s seniors actually already live in developing countries. For example, China and India alone have 131mn and 74mn people over the age of 65 respectively. The current senior population just in China is larger than US, Japan, Germany, Italy and France combined. The UN projects the number of seniors in China will exceed 355mn by 2045. This is larger than the entire current US population.

Consumer Spending: The Silver Economy

Global ageing will reshape consumer spending. In developed markets, which already have a relatively larger portion of their population aged over 65, these impacts are already taking place. Seniors are continuing to make up a greater and increasing share of wealth and spending. According to the US Bureau of Labour Statistics, the 55 and over population spends twice as much as Millennials in the US. This is also true in Japan, where, according to the Nippon Foundation, almost 50% of total consumption is driven by senior households. From this, we can safely predict that this will likely hold true in developing countries too.

As one would expect, spending behavior and consumption choices of individuals evolves as they proceed through life. These changes can include additional spending on tourism, as individuals retire. Healthy ageing, defined by the World Health Organisation, as the process of developing and maintaining the functional ability that enables wellbeing in older age, is also a growing trend. This theme can incorporate healthy eating, assistive technologies for the elderly, skincare products and care facilities.

Healthcare: A Necessity for the Golden Age

The healthcare sector as a whole is expected to receive significant tailwinds from the ageing population. This includes pharmaceutical corporations, the medical testing and device sectors, hospitals, nursing homes and others. According to a study conducted by Oxford Economics, in the US alone, expenditure on home health care by seniors is expected to increase by almost USD90bn annually, and spending on medicine by more than USD40bn annually over the next 50 years. The devastating effect of the current pandemic on retirement homes leads us to believe that the trend in home health care will not only hold but actually increase.

Near and Long Term Turbulence

With this demographic shift also comes headwinds. As the proportion of seniors continue to grow worldwide, this will place pressure on social welfare and the workforce in general. This in particular can be a headwind for the healthcare sector as government regulations are put in place to decrease drug prices. A direct impact of this is the profitability of these pharmaceutical innovators, and an indirect impact could also be the ability and motivation of these companies to conduct research on new therapeutic solutions.

A mitigant to this is the rising importance of the medical devices and equipment segment. The pipeline for new devices, with particular focus on robotic surgery, diabetes and cardiology segments is growing. Evidence shows that governments are also placing stronger importance on this. An example is the US FDA improving its operations over the past five years to streamline and standardize the approval process of medical devices to shorten the time required for applications to be approved. The importance is growing, because these new devices can help to improve the efficiency of care. Studies have shown that through utilizing devices that have early detection or constant monitoring functionality, this could prevent individuals from entering the hospital system and thus place less pressure on healthcare and even reduce healthcare costs.

Emerging Markets Rising Middle Class Consumer

The Milestone

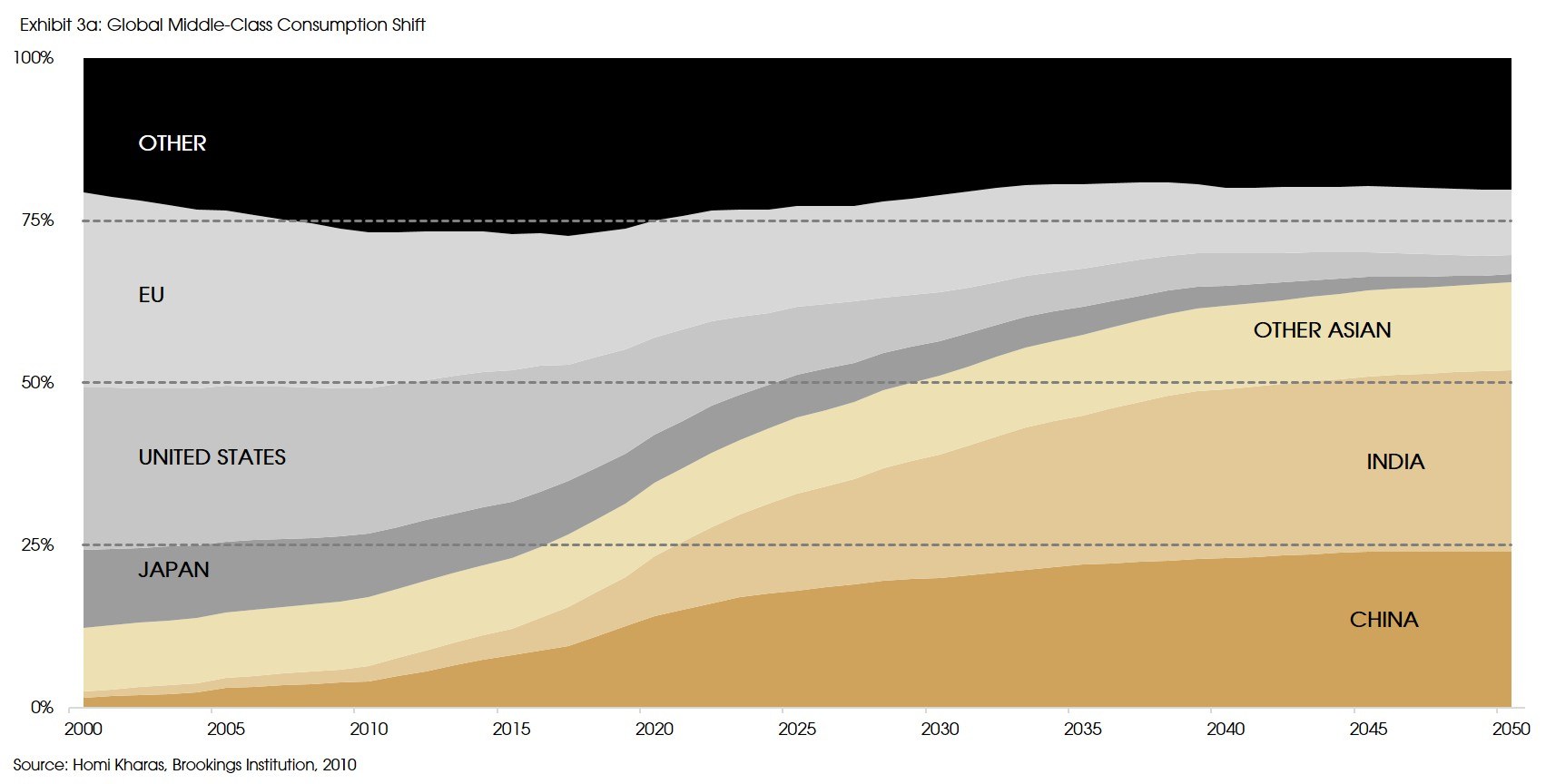

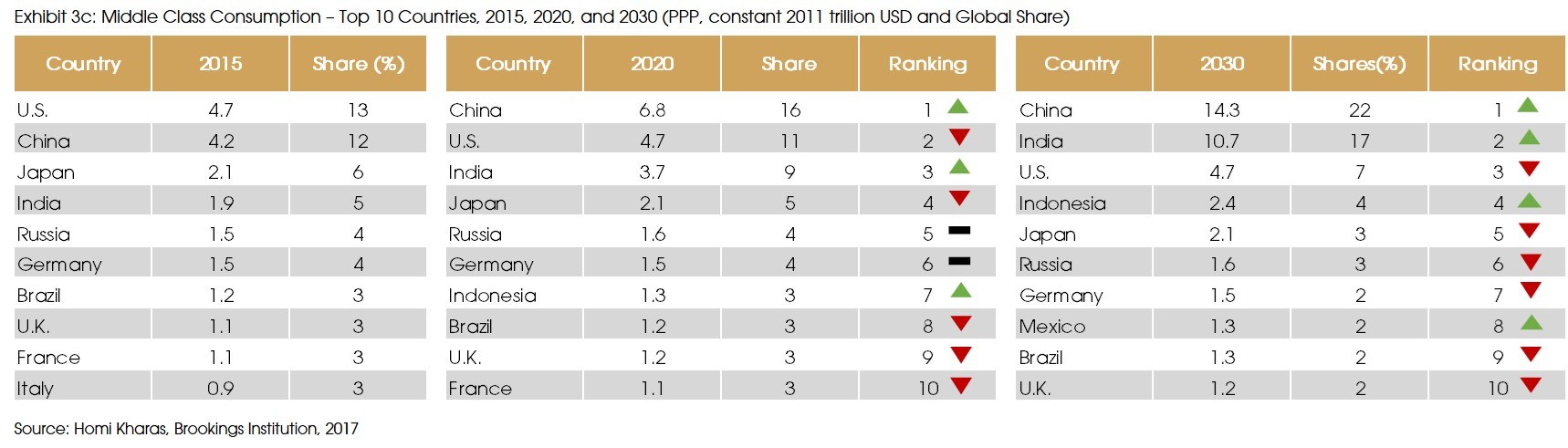

September 2018 marks an important milestone as the world’s population that is considered in the middle income group has reached just a little over 50% of the world’s population. The observation was made by Brookings Institute researcher Homi Kharas via a publication on the subject back in 2010. The 2010 publication went on to be widely used by researchers and institutions alike. In it, he suggested the global middle class consumption will shift heavily towards Asian countries (Excluding Japan), in particular China and India. Kharas argued that demand from those regions would drive global economic growth as middle class consumers in developed countries would continue to struggle to deal with the rising costs of their living standards caused by the Great Recession in 2008, on top of ever increasing income inequalities.

Albeit differences in numerical brackets of the middle income group globally, a universal definition for the middle income group is households with enough discretionary expenditure that are not vulnerable to fall into poverty.

Overwhelmingly on point, as at the end of 2016, it was estimated that about 3.2 billion people are in the middle class income group. This was 500 million more than what Kharas expected. At that point, the middle class segment grew faster than the global GDP growth at about 4%. A fast growing majority from this phenomenon comes from Emerging economies, in particular Asia.

In relation to Kharas’ study, we believe this trend will continue as Emerging Countries get better access to education and healthcare, complemented by improved employment prospects and faster policy reforms. These aspects in turn will encourage innovation and support economic growth.

Millennials: A Driving Force

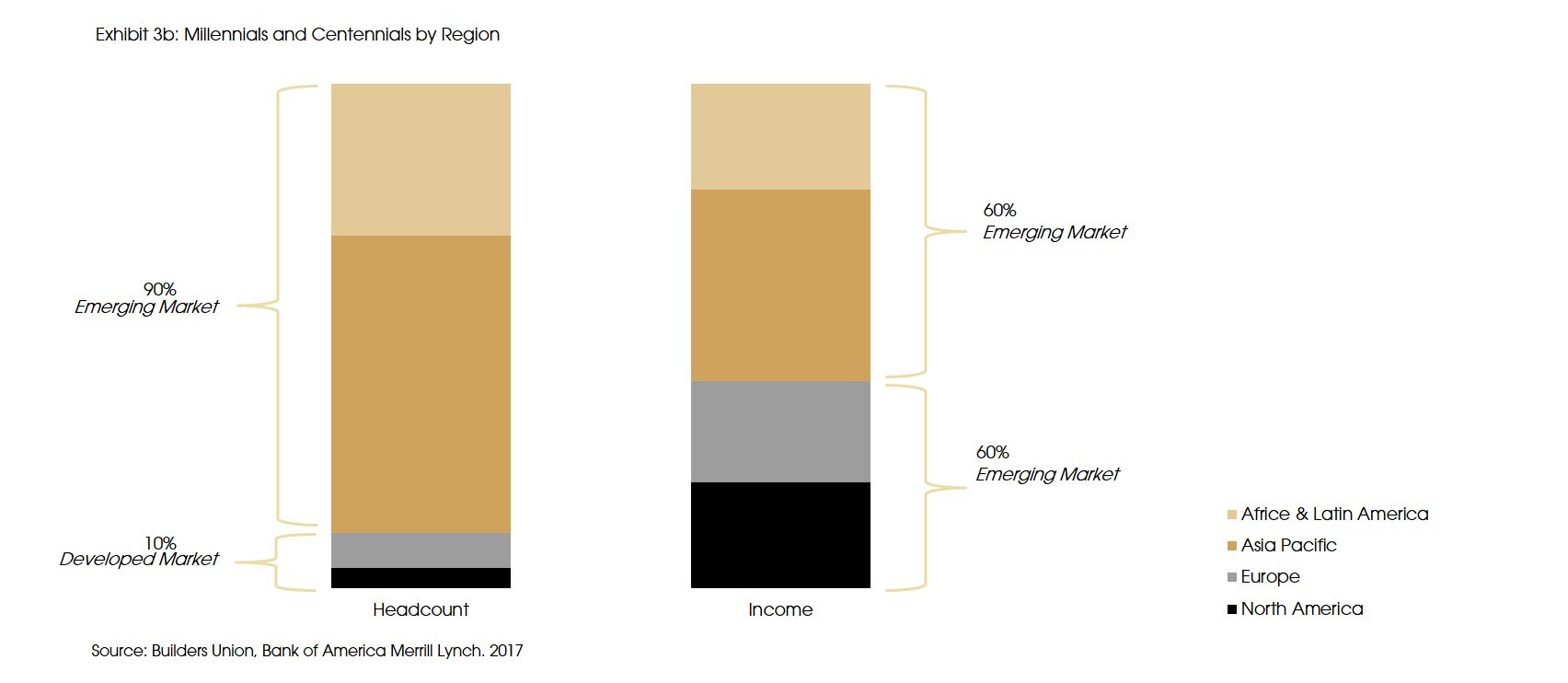

We think another particular driver to this theme is attributed to the expanding millennial population in Emerging Market Countries such as those in Asia Pacific, Latin America, and Africa. A research by Builders Union, an asset manager, suggested that within the global millennial population, over 90% comes from Emerging Markets.

The Millennials generation, well known for their unique spending behavior, represent over 60% of global consumer spending and 50% of global wealth today. Millennials in China, India, and Indonesia are said to be the highest income generation in the history of their countries. Kharas estimated that by 2030, China and India will overtake US as the top 2 countries with highest middle class consumption spending with Indonesia following on 4th.

New Consumption Opportunities in an Uncertain Environment

Owing to the above factors, global consumption patterns will inevitably change. This will offer investors attractive opportunities in areas such as digital economy, education, tourism, sustainable lifestyle and the likes.

We highlight the middle class income group as the one facing the greatest risk from the COVID-19 pandemic, which has already created millions of unemployed. We have yet to comprehend the full consequences but it is important to note that emerging economies, in particular, have been hit hard as they are often the ones with little to no safety net and healthcare systems that are not yet mature.

Disruptive Technologies

A World of Innovation, Invention and Disruption

The invention and adoption of technologies has impacted every aspect of our lives in the way individuals and businesses do things. Technology has an unquestionable role in increasing our productivity and boost outputs. This in turn has spurred innovations in search for the next ground breaking technologies. With this comes the term Disruptive Innovation which was first coined in 1995 by a Harvard University Professor, Clayton Christensen. The term has been dubbed as the most influential business idea in the 21st century.

Since then, we have seen growing forces in disruptors from Netflix to Amazon to Uber. A research by McKinsey and Company estimated that the potential economic impact of technologies across scaled applications could reach between USD 14 trillion and 33 trillion per annum by 2025. The exhibit below depicts the twelve emerging technologies, some still in nascent stages of application or adoption. These emerging tech trends are predicted to disrupt, if not already the case, and transform social and economic activity.

For this occasion, we in particular would like to highlight the opportunities stemming from the advancement of technologies in two sectors namely Robotics and Cybersecurity.

Robotics: The Rise of Machines

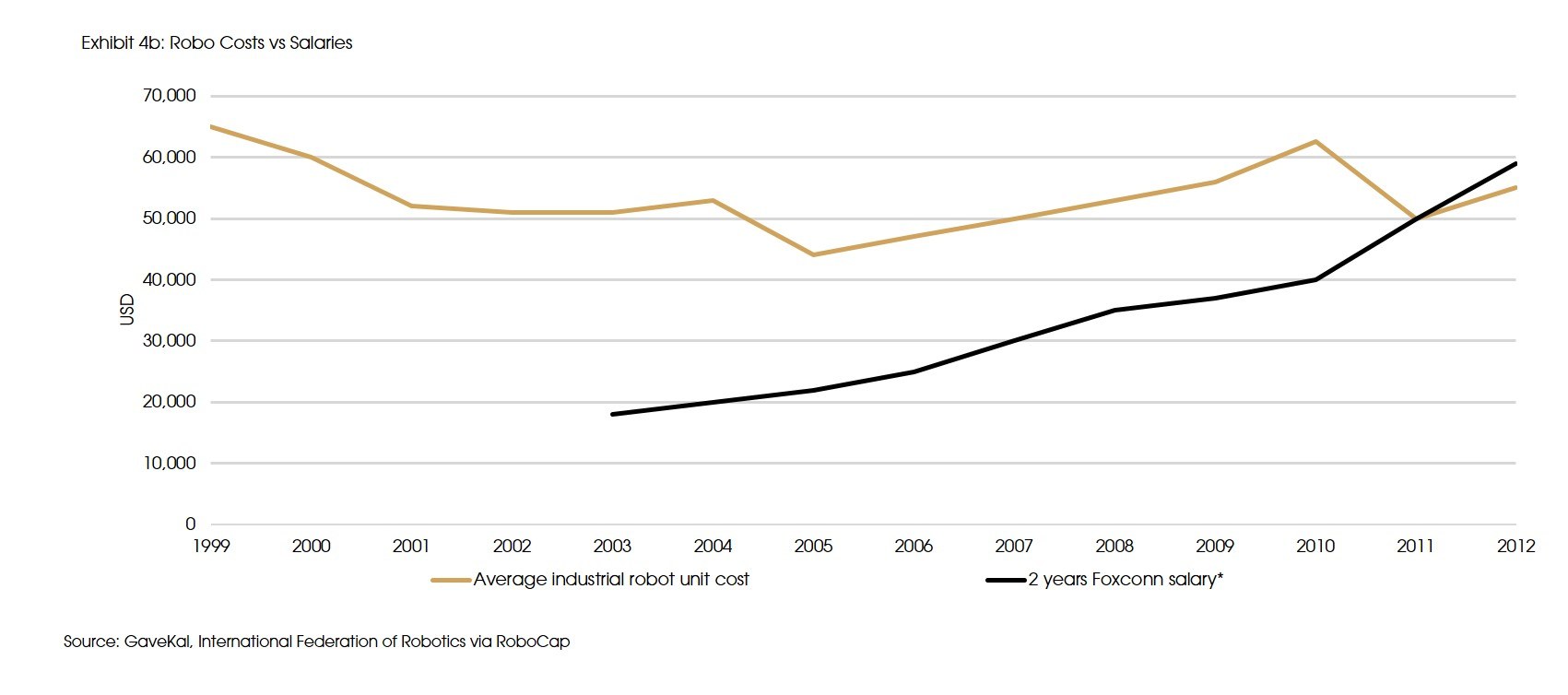

The adoption of robotic technologies has been made possible with the decreasing costs in industrial robot units. In a 2012 GaveKal study , it was observed that the 2-year salary of a Foxconn worker and the average industrial robot unit cost have intersected which made automation in certain sectors more cost efficient. According to McKinsey, the Robotics and Automation market could be worth over USD 10 trillion by 2025.

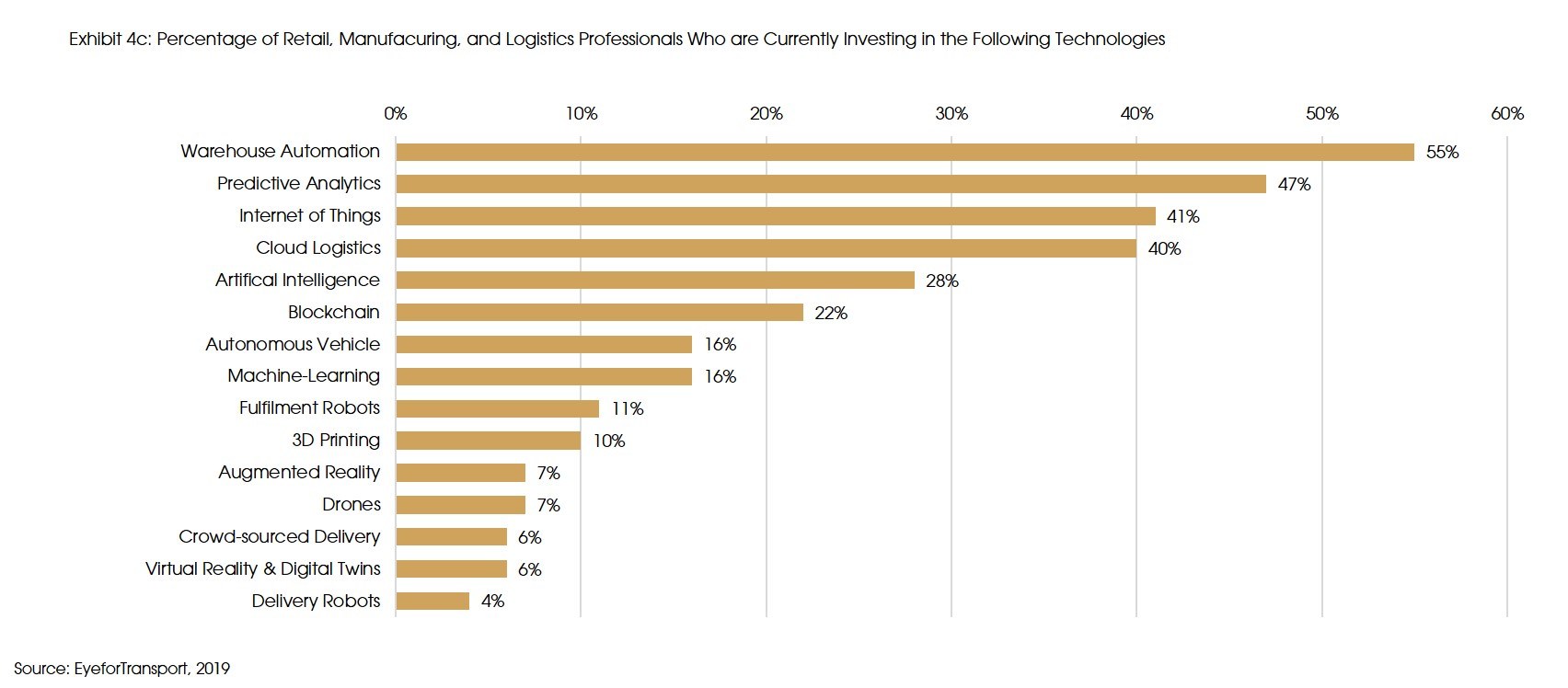

A survey conducted on retail, manufacturing and logistics professionals showed that over 61% of respondents expect capacity requirements for robotics and automation to increase over the next year. Amongst a range of subsets within Robotics technology, warehouse automation and predictive analytics were said to be the most widely used.

Going forward, while the technology behind robotics will most likely stay more or less the same (at least in near term), we believe the level of adoption will continue to increase in new and existing markets, providing a structural tailwind for the years to come. The Healthcare Industry, is one of the best example of new markets that could see an acceleration in automation. This could be in areas such as having a connected patient monitoring systems, advancements in robotic surgery, and the use of artificial intelligence to help deliver in patient treatments as well as assisting in clinical decisions by making accurate diagnostics.

Cybersecurity: New Threats, New Opportunities

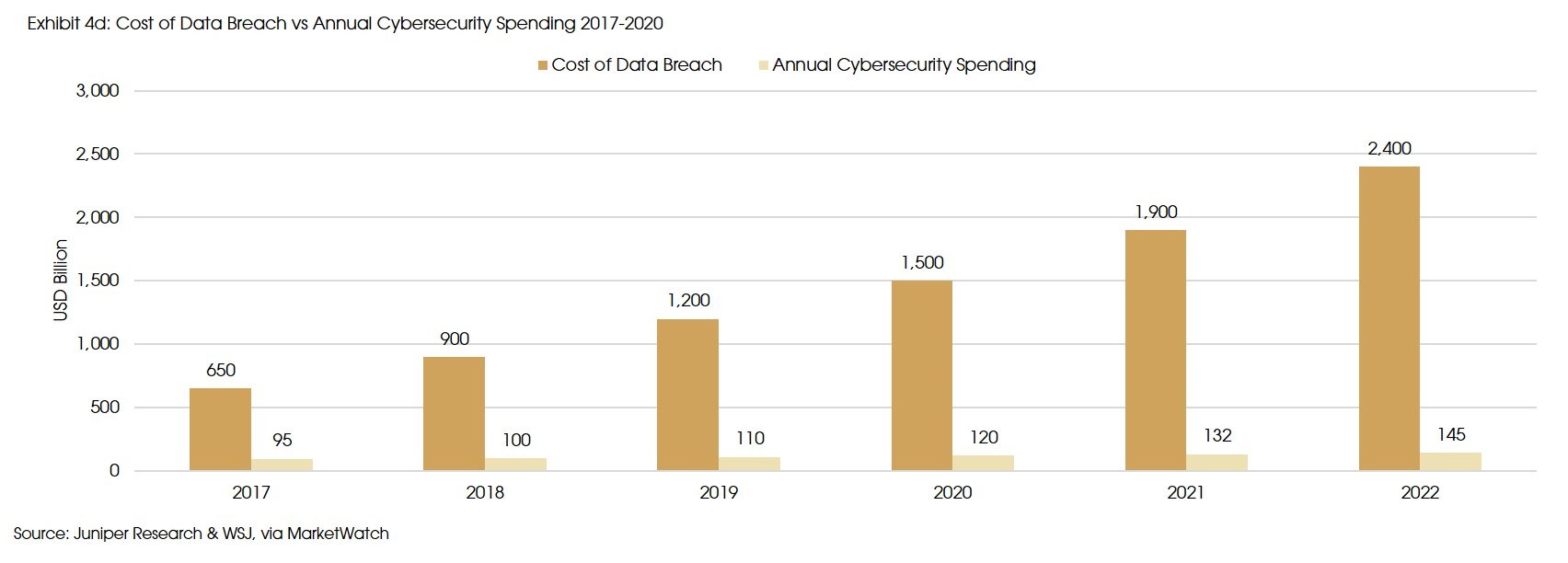

The increasing adoption in technology has created an abundance of opportunities for cyberattacks to take place. Since 2014, Accenture reported the number of security breaches have increased by 67%. From Equifax, Capital One, or the Cathay Pacific Data Breaches to WannaCry Ransomeware Attacks, these cybercrimes have costed companies millions to billions of dollars in damages, not to mention reputational damages incurred. Accenture estimated that across various sectors, cybercrimes cost somewhere between USD 5 – 15 million in average annually.

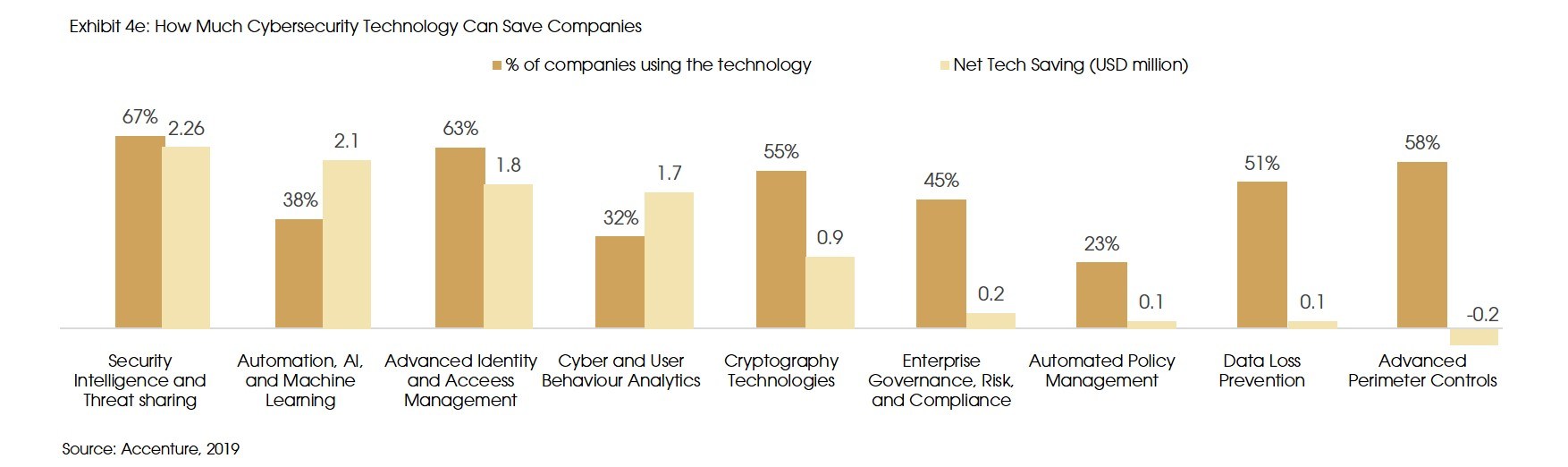

The chart below highlights the benefits of adopting a cybersecurity technology that could save millions of dollars for companies.

We believe this has created a pressing need for a sound and secure technology infrastructure. Unfortunately, cybersecurity continues to be neglected by many, unaware of the repercussions of these attacks and risks. We think that the adoption of cybersecurity is still lagging behind the more mature Tech industry. From 2004 to 2017, the digital economy grew at a rate of 5-6%, whereas the cybersecurity market expended its size by 35 times. Despite this exponential growth, cybersecurity is still playing catch up with the increasing complexity, volume, and cost of cyber threats, hence it is expected to still be one of the fastest growing sub-sector in tech in the next 5-10 years. As with the case with the acceleration of automation, COVID-19 has acted as a catalyst in the adoption of cybersecurity infrastructure. A survey by McKinsey and Company reported that approximately 70% of business organizations have planned to increase their investments in cybersecurity solutions post COVID-19 era.

Creative Destruction

Reliance on technology, advances in robotics and automation, remote working, adoption of smart cities and the imminent advent of 5G are all positive tailwinds for technological disruptions. However, caution is necessary as the world evolves but laws and regulation lag and try to play catch up. This world of opportunity looks bright but is also full of bumps and possible discomfort for some. In the same way the car disrupted transportation by making horse carriages and stables obsolete, so will new disruptive technologies. Governments and people will have to find a way to incorporate these changes and find new innovative paths for people who will feel left behind.

Sustainable Future

Meeting Today's and Tomorrow's Challenge

Sustainable development is advancing to meet the needs of the present without compromising the ability to meet the needs of future generations. Investing in a sustainable future is typically linked to the environment with topics such as recycling, water management, renewable energy and fair trade. However, with the United Nations Sustainable Development Goals and ever increasing activism across the globe, investing in a sustainable future has broadened. This now also includes building businesses to help benefit lower-income societies, greater equality and more ethical governance practices. As this theme incorporates a number of topics we will focus on two main areas. First being the rise of ESG investing, which we believe will push companies and actors to an even more sustainable future, and secondly the renewable energy revolution.

ESG: A Force for Change

Growth of ESG investment has been powered by a number of factors. These include new regulations surrounding responsible investing, constant focus and growing awareness on challenges surrounding sustainability and most importantly a growth in demand from individuals, particularly millennials. The millennial generation is increasingly putting emphasis on investing in companies and products in line with their values. As their savings grow, so will their investment abilities and therefore their voice in the global investment landscape.

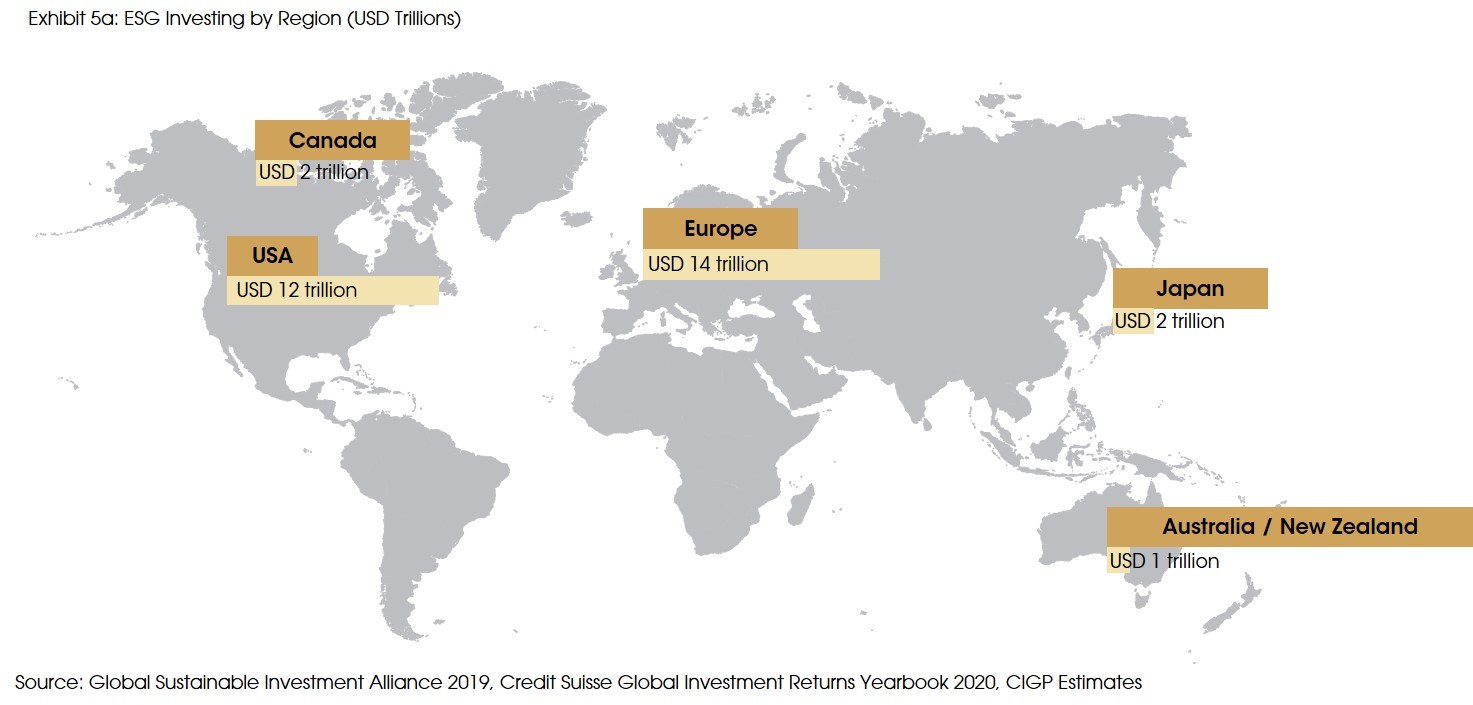

According to Credit Suisse, investment products linked to ESG criteria had a total value of USD 31 trillion in 2018, a 34% increase over a two year period. Estimates for 2019 are leading to a market value of USD 40 trillion. While the leading ESG-oriented region is Europe, as shown in the chart below, the trend is growing faster in the US.

Responsible investors are becoming larger shareholders of global corporations. This will therefore induce a knock-on effect on company’s management to stay on a sustainable path. Large institutional shareholders also have a growing responsibility due to the weight they carry on strategic decisions or because of their involvement on the board’s of those companies. For example, the German conglomerate Siemens faced criticism because of its role in a controversial Australian coal-mining project. Not only was Siemens criticized, Blackrock, one of the largest asset managers, was also blamed for not actively contesting Siemens’ decisions. These types of events cause negative publicity for companies and there is a growing concern and fear over them.

Another impact of the growing trend of ESG investing is the reduction of investments in heavy polluting sectors. Giant money managers like BlackRock or State Street are starting to divest from companies that emit excessive carbon like coal producers and oil E&P companies if they do not show a willingness to work on improving their operations and meeting environment friendly goals. Norway’s Government Pension Fund, the World’s largest sovereign wealth fund at over USD1 trillion in assets, announced in 2019 that it would divest from oil and gas companies unless these had significant renewable divisions such as BP and Shell.

Energy Revolution: Paradigm Shift

The above hints towards our next focus on the renewable energy revolution. With ever-growing calls to reduce man-made greenhouse gases, renewable clean energy investment is advancing.

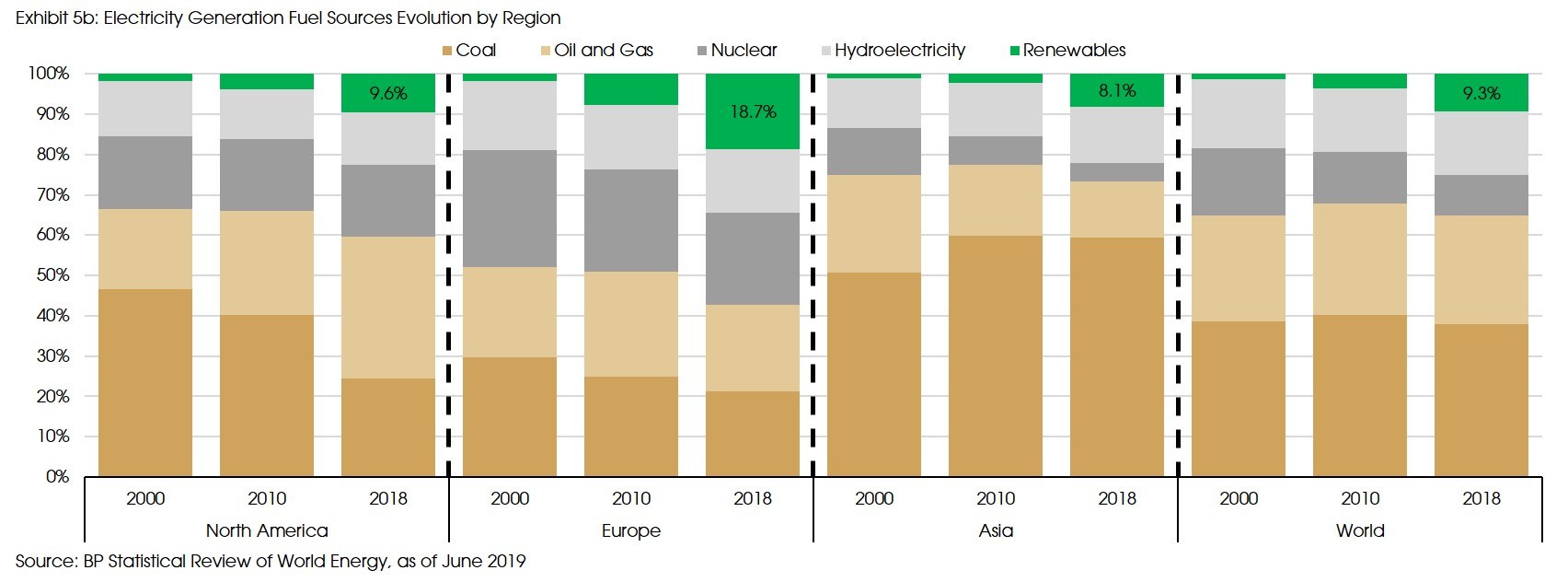

In the graph above, we can see that as of 2018, renewable energy, excluding hydroelectricity, is still a small portion of electricity production. Europe is at the forefront, with 18.7% of energy generated from renewable energy, North America and Asia are still quite behind with 9.6% and 8.1% respectively.

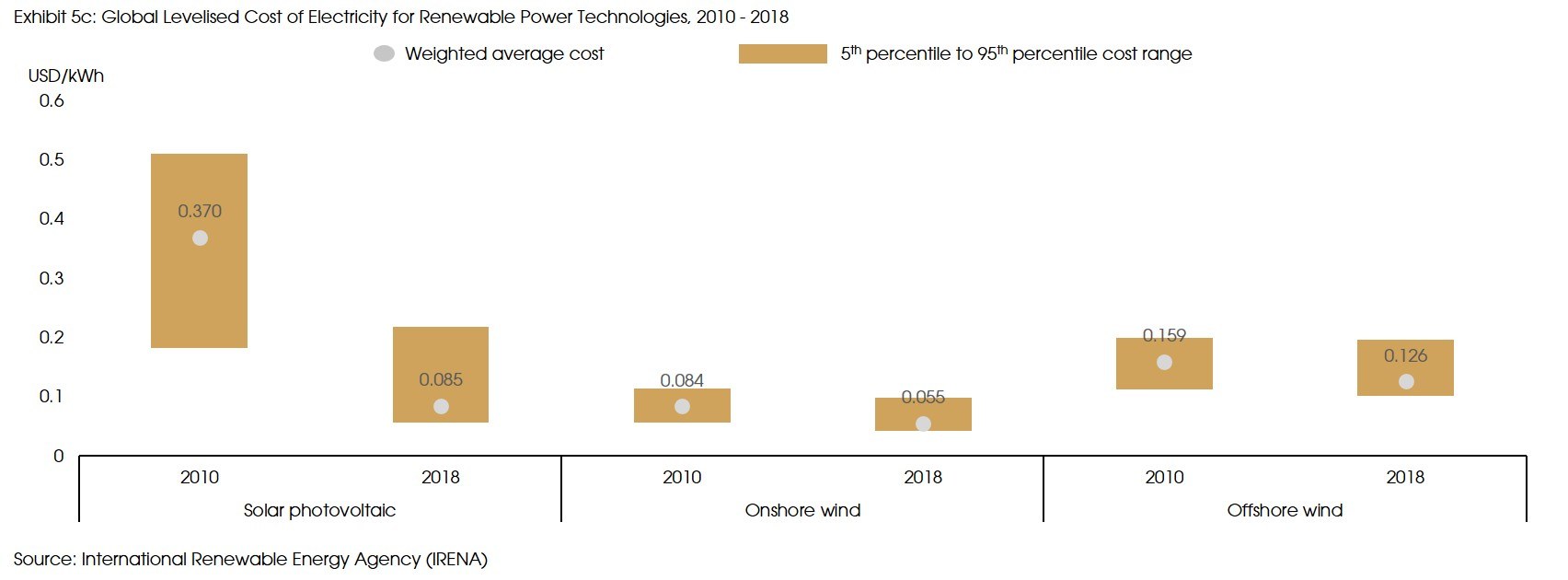

Technological advancements have made renewable energy more affordable. This is indicated in the graph below which shows the global levelised cost of electricity for renewable power technologies from 2010 to 2018. In the graph, we highlight the cost of three renewable power technologies, solar photovoltaic, onshore wind and offshore wind, which are currently the most popular options. Within the short period of eight years, significant advancements have been made, particularly in solar photovoltaic technology. To put these advancements in perspective, in 2020, the cost of solar energy is roughly one quarter of the costs projected by the International Energy Agency [IEA] in 2010.

Cautious Optimism

Although all of the above are strong tailwinds for the megatrend of a sustainable future, headwinds for this trend include changes in government regulations or an economic slowdown. If there are changes in political priorities in certain regions, regulations put in place to improve society and the environment as a whole may be stifled, thus slowing down the growth of this trend. In addition, it is also unclear how periods of economic slowdown will impact the willingness of companies to continue to promote and advance ESG goals. We remain optomistc as the challenge of 2020 has not slowed down the message but in some case has brought to the forefront the need for a comprehensive answer to global challenges.

Sources: Absolute Return Partners, Accenture, Bank of America Merrill Lynch, Bloomberg, BP Statistical Review, Brookings Institute, Builders Union, Credit Suisse, Global Sustainable Investment Alliance, International Energy Agency, International Renewable Energy Agency, McKinsey & Co., Oxford Economics, Population Pyramid, The Financial Times, The One Brief, The Wall Street Journal, United Nations, US Bureau of Labour Statistics, US Food and Drug Administration, World Health Organisation, and CIGP Estimates.