Focus: The Rise of Chinese Tech and Why it Matters

David Ho

The renowned macro investor Ray Dalio recently wrote an article titled “Don’t be blind to China’s rise in a changing world”. The world is changing at a rapid pace, not only does China’s rise have significant political and economic implication, but Chinese tech is also leading the West in certain areas. We want to showcase why it matters through two case studies.

Case 1: Pinduoduo (PDD) : The fastest growing e-commerce company that disrupted the status quo

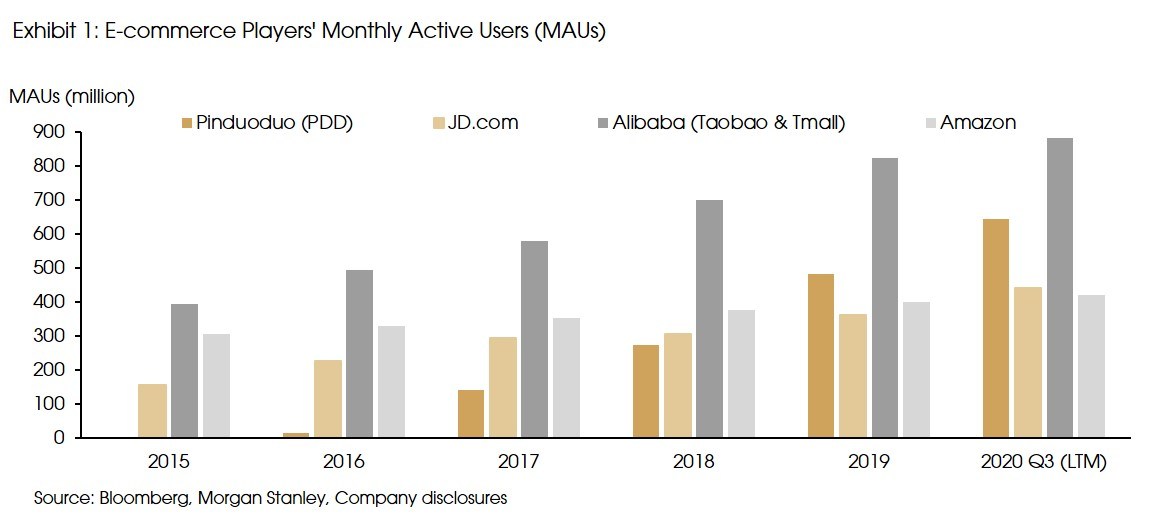

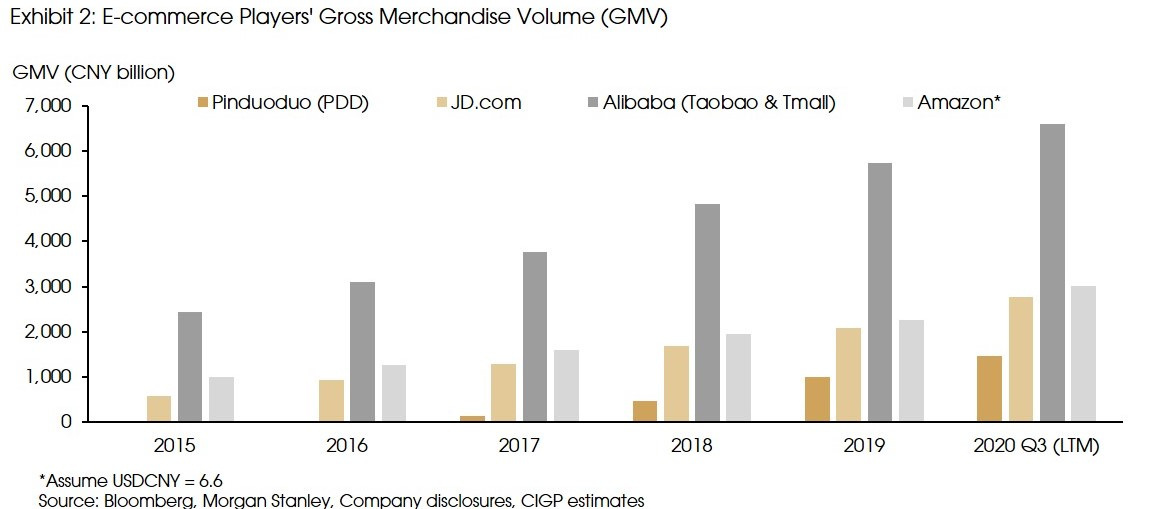

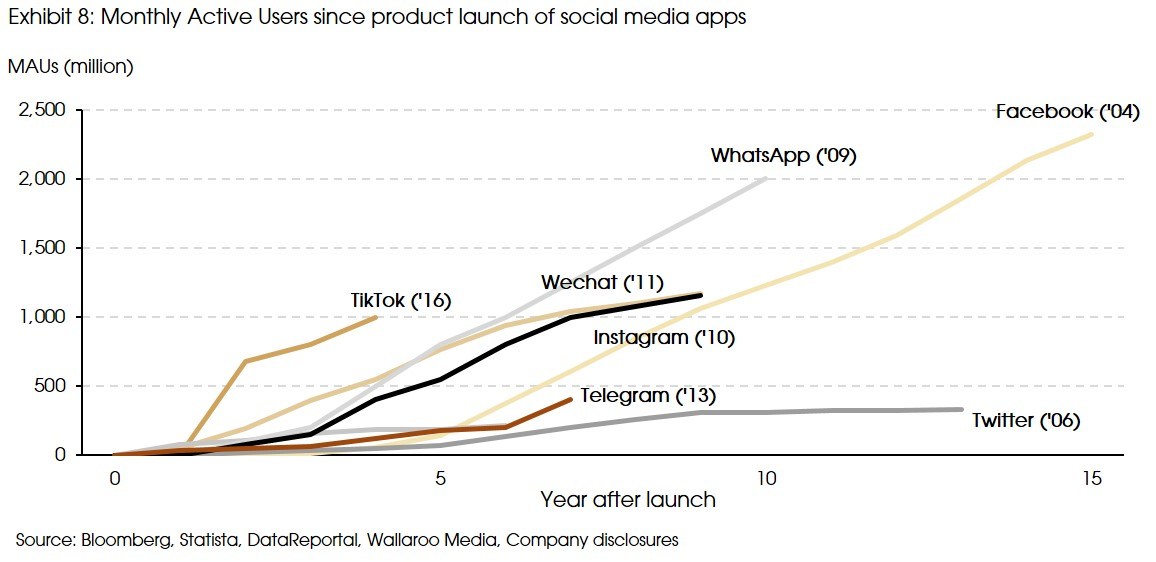

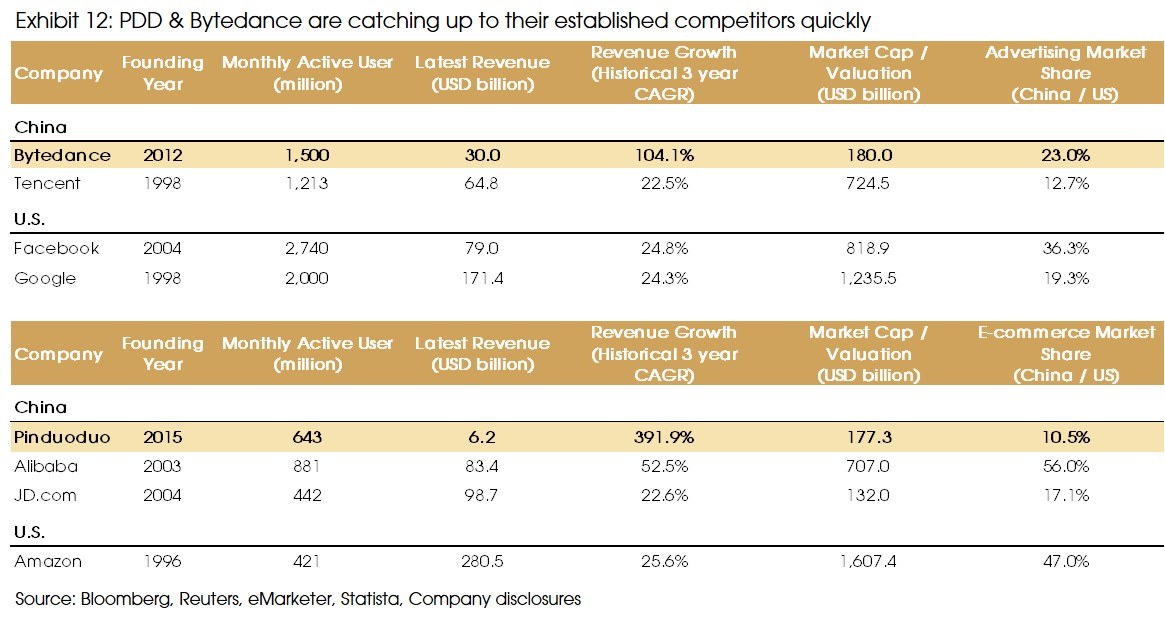

Imagine a 5-year-old US e-commerce company growing so fast that it is threatening Amazon’s long-established leadership. This analogy is true between PDD and Alibaba in China. In just 5 years, PDD’s Monthly Active Users (MAU) grew to 643 million, which took Alibaba 15 years to achieve, while PDD’s Gross Merchandise Volume (GMV) reached half of Amazon’s GMV. PDD’s business model resulted from its unique understanding of the consumer, and its rapid rise has changed how people think about many things related to e-commerce in China.

In 5 years, PDD surpassed JD.com to become the second largest in China, just after Alibaba

The Hidden Problem: The loss of production efficiency in the long-tail demand

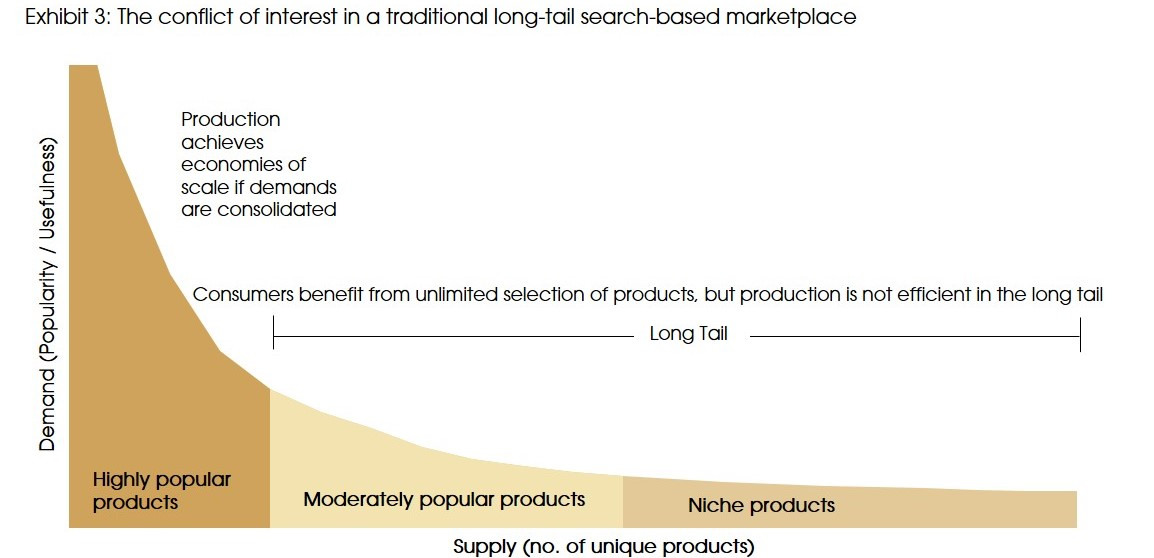

E-commerce marketplaces like Amazon allow buyers to search for what they need out of “unlimited” selections. Modern consumers are shifting away from highly popular product, and they want products that fit their individual need. The long-tail demand refers to the demand for low volumes niche products wanted by many different people. Companies like Amazon can capture the long tail demand and realize significant profit by selling obscure hard-to-find items, rather than selling popular best sellers. E-commerce marketplaces therefore provide niche products to attract different consumers with diverse interest.

However, there is another side of the equation that is ignored. Factories are best at producing commonly needed products at scale rather than thousands of different niche products. Most production facilities are not built to be flexible in nature. To achieve economy of scale, production needs demand to be consolidated. In reality, demand becomes more scattered as there are more buyers demanding different choices, and efficiency are lost when supply tries to cater the scattered demand.

PDD’s Answer: “Less is more” and “Value for Money”

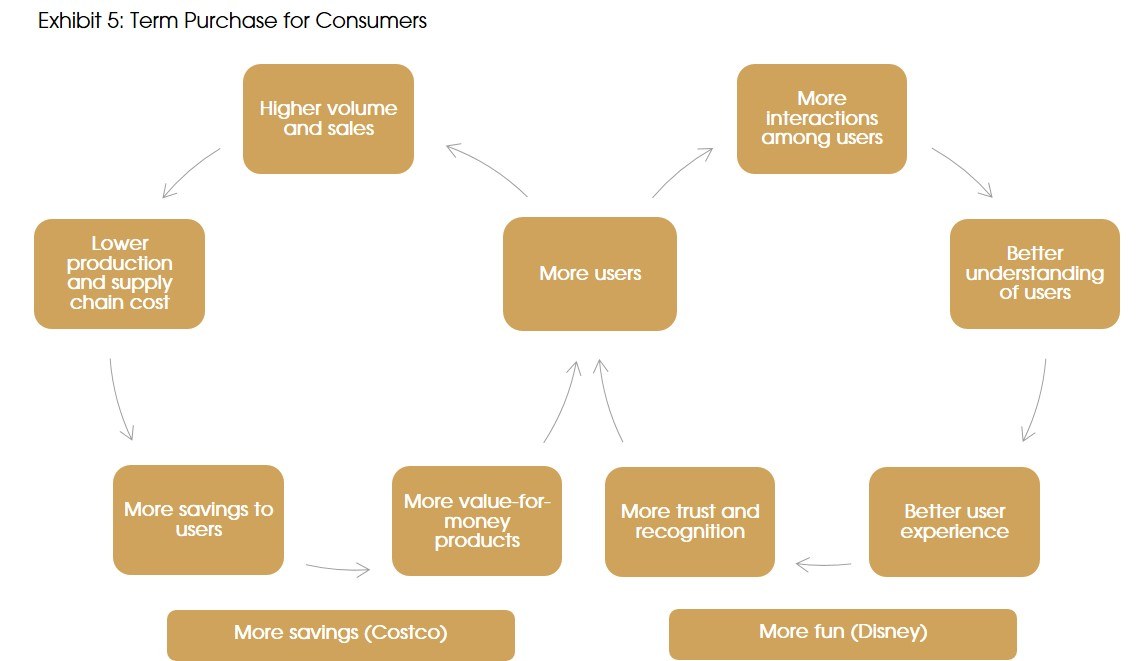

PDD compared itself to Costco for its focus on “Value for Money”. Rather than trying to monetize as many consumers by maximizing product selection to satisfy their long-tail demand, PDD consolidates similar needs among people into a limited variety of products through team purchase. With the concept of “less is more”, PDD compensates consumers with more “value” for the loss of personalized choices. When demand is consolidated, products can be made cheaper to consumers through economies of scale in production. While the world thinks about China’s consumption upgrade as a conviction trend, PDD understands that the pursue of “Value for Money” for consumers is universal regardless of one’s purchasing power. The same consumer could be buying a thousand-dollar iPhone and a box of fruit for as cheap as a dollar simultaneously. Instead of classifying consumers into “high-end” or “low-end” as competitors do, PDD aims to satisfy the multi-dimension demand of each consumer by being their Costco for each of their preferred products. To test this philosophy, PDD’s pioneered its Consumer to Manufacturer (C2M) model.

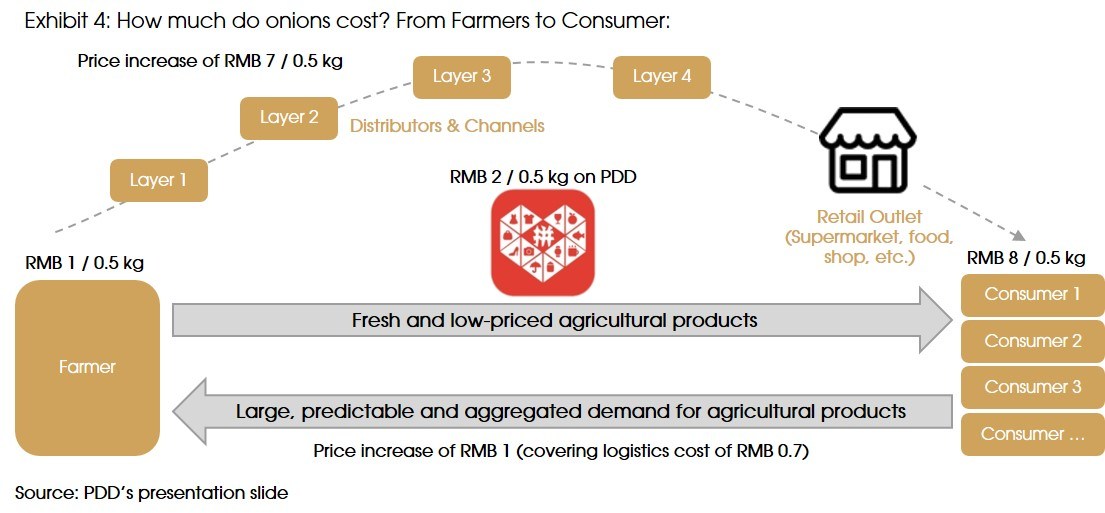

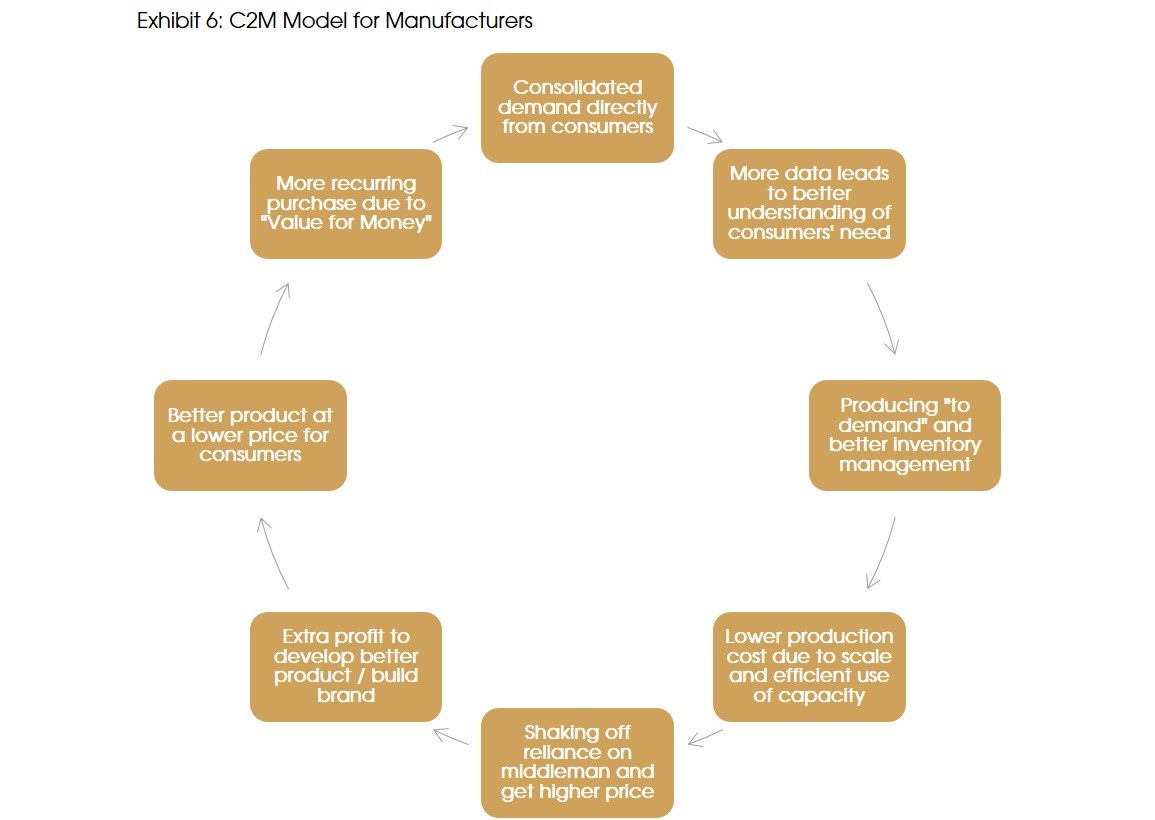

Consumer to Manufacturer (C2M): Cutting down the middleman and the cost to “Benefit All”

In traditional retail, manufacturers produce what they think consumers want, then distribute them through a chain of wholesalers. This can often be a hit-and-miss exercise with considerable waste, and the costs of which are built into the price that consumers pay. From day one, PDD has devoted itself to the mission of “Benefiting all”. In the C2M Model, consumers save money as the team purchase orders went directly to manufacturers, bypassing all the middle layers cost (e.g. distributors, retail outlets, and supermarkets). Manufacturers increase their income while still giving discounts because: 1). Their production cost is lower due to economy of scale from team purchase. 2). Directly selling to end-consumers allows them to charge the retail price instead of the wholesale price. 3).There is less waste by producing “to demand” backed by consumer data. The C2M model becomes a virtuous cycle for both manufacturers and consumers. Production efficiency leads to lower prices for consumers, which stimulate more team purchases for manufacturers.

The Viral Touch: AI data driven Mobile Feed, 80% e-commerce + 20% Social & Gaming

Unlike Alibaba, PDD is only available on mobile and does not have a shopping website. The reason is obvious, people in lower -tier cities might not have a computer, but almost everyone in China has a smart phone. In the early days, PDD uses the AI recommendation feed to push products to consumers instead of having them to search for products. Merchants pay for Alibaba’s advertisement to get a higher-ranking on a specific product search result. With PDD, merchants’ advertising spendings pay for exposures to the right consumer. PDD will push the relevant product recommendations to different consumers based on their interest, or better yet, pushing different products to the same consumer to satisfy his different needs. The search function is considered secondary in PDD’s mobile-based app. Mobile AI recommendation feed has been proven to increase sales dramatically. While competitors like Alibaba are copying the same AI recommendation feed feature, PDD’s viral growth secret remains in the social element of team purchase and its tie with WeChat.

PDD also compares itself to Disney and thinks that shopping should be fun. Users are rewarded with deeper discounts or even free products by sharing their shopping experience with friends on WeChat. As team purchase was first launched in low-value everyday goods like fruits, the discount incentivized users to frequently share the products with friends. Through users’ sharing on WeChat, PDD gains further insight into the users’ and their friends’ shopping preferences, which further improves the AI recommendation.

PDD also pioneered the “gamification” of shopping. “Duo Duo Orchard” is a game in PDD’s app designed to incentivize consumers to browse, share, and purchase every day. Users need virtual water and fertilizer to grow their virtual tree, and those items can only be collected through daily log-in, product sharing, spending time in-app, and product purchases. When the virtual tree is fully grown, PDD will deliver a box of real fruit for free to the user as a reward. Over 60 million users log on to play “Duo Duo Orchard” every day. As a result, PDD ordered tons of fruit from struggling farmers, helping them to improve their livelihoods while avoiding their good harvest to go rotten. The addictive “gamification” design is another “Benefit All” example: users have fun, PDD gets users’ attention, and farmers are helped.

PDD's Virtuous Circles and the Flywheels

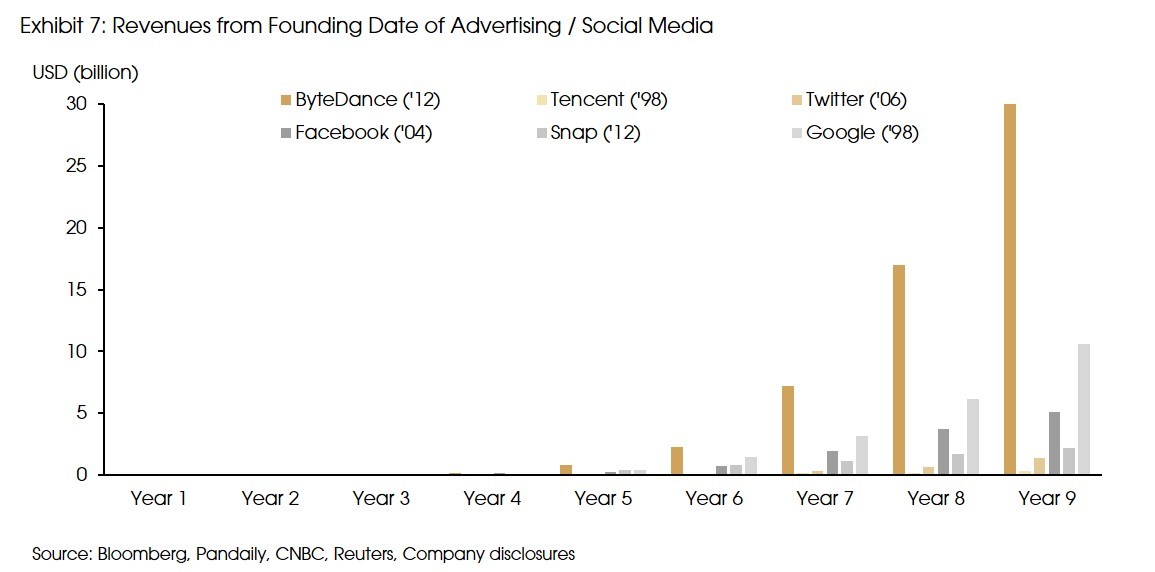

Case 2: Bytedance: The first Chinese tech company that succeed in social media outside of China

When it comes to Advertising / Social Media, people think about Google / Facebook in the US, or the BAT (Baidu, Alibaba, Tencent) in China. Through its signature short video app TikTok & Douyin (TikTok in China), Bytedance has proven itself to be a force to be reckoned with. In just 8 years, Bytedance has grown faster than all its social media peers since its founding and is on the way to make USD 30 billion revenue this year.

Toutiao (Today’s Headline): A news app powered by AI algorithm with no reporters or editors.

Most people know Bytedance from TikTok, but its first viral product is an AI-based News app in China called Toutiao. Toutiao was launched in 2012. It uses machine learning algorithm to source content that users will find most interesting. Toutiao learns about readers’ preferences through their behaviors like taps, swipes, pauses, time spent per article, and comment etc. It does not require any explicit input from the users. Toutiao builds users’ profiles by showing various different articles to test users’ interests. Unlike traditional news media that send one universal newsfeed to every subscriber, stories are personalized based on different users’ interest to maximize long term engagement, which no human editor can match. Toutiao significantly reduces editors’ bias in choosing content, changing the way people consume news.

Disrupting how information is transferred: Personalized Product and Precision Ad Targeting

During the 2016 Olympics, Toutiao’s AI bot published stories on major events quicker than any traditional media (2 seconds after the event ended). Finding and continuously updating the content is a process-intensive task that AI has a distinct advantage over human. Tuotiao’s value proposition is that it makes news free, instant and delivers personalized product with 10x lower cost. Toutiao saves users time on searching by centralizing and optimizing the distribution of information. The more time users spent on the platform, the better the AI becomes, and the better the experience users get. Competitors have launched similar apps, but it has been difficult to match the accuracy and efficacy of Toutiao. Toutiao monetizes by matching relevant advertisements to users, and users are more likely to engage in advertisements that come with precisely targeted news. Toutiao’s MAU has reached 360 million and is still growing. Precision targeting from Toutiao saves cost for advertisers while making their advertisements more effective by targeting the right traffic.

Douyin & TikTok: The short video apps that have taken the world by storm

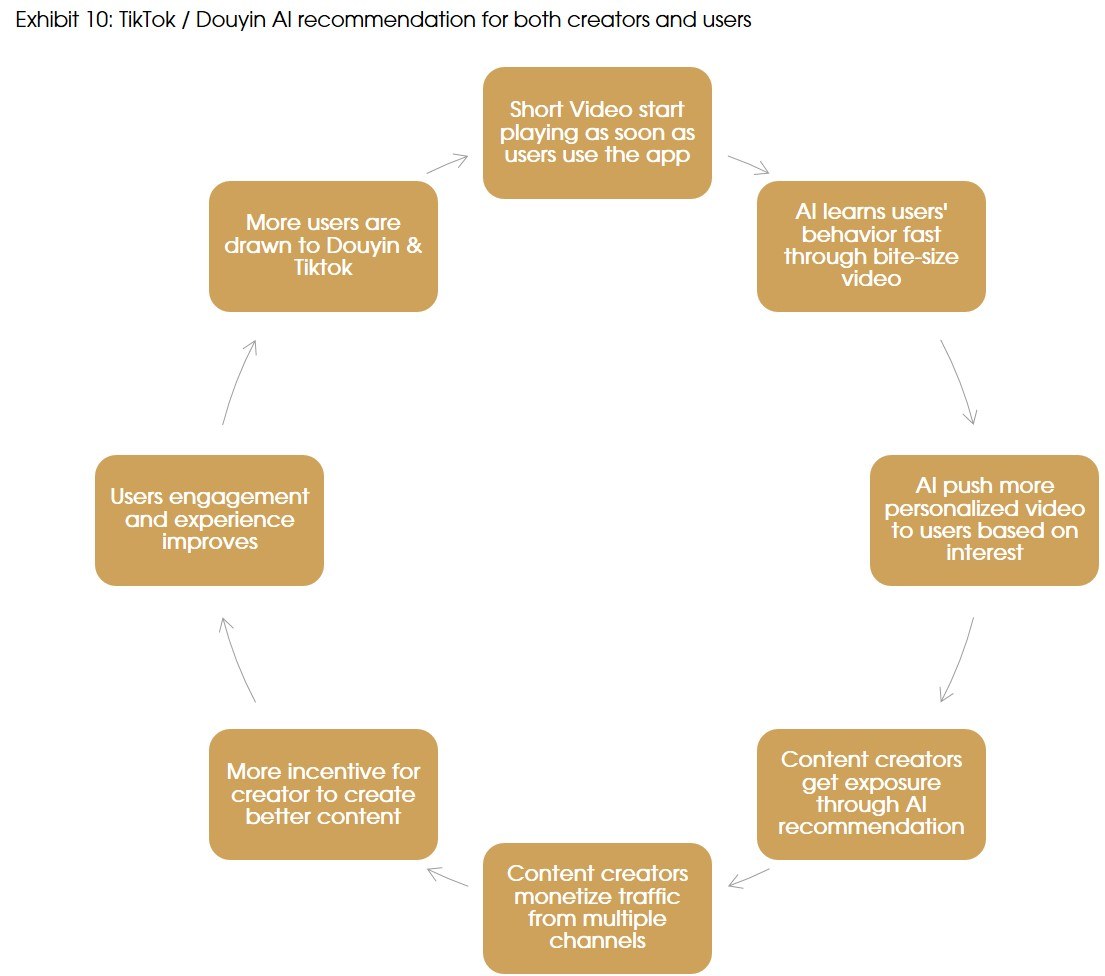

Bytedance believes that “choosing” is an act that takes time and effort. Bytedance’s flagship products TikTok / Douyin are also reliant on AI, minimizing the need for users to choose the content they want to consume. The AI algorithm automatically chooses and displays video that suits one’s interest once the app is opened, and the search function is supplementary in TikTok. The AI keeps building on users’ reactions to each video (e.g. positive: a like / watching till the end, negative: swipe away), which increases the accuracy of personalized video over time. Eventually, TikTok not only learns about what you like, but also attends to your unarticulated interests by serving never-ending streams of videos that are aimed at capturing your attention. With over 2 billion downloads worldwide, TikTok is the most downloaded app in 2020, and it has reached 1 billion MAU since launch, faster than any competitor in history.

The Advantage of Short Video and Algorithm over Choice

Since TikTok has control over what users will see (both information flow & distribution), this gives content creators who would not otherwise succeed on YouTube, a chance to be rewarded through “exposures” on TikTok. Videos do not have to rely solely on “popularity” ranking in the search engine to be discovered. Instead, each video will be matched with different niche interest in TikTok’s massive user base. TikTok is a social media that does not need a “social network” to begin with as AI will do the matching. Reducing the need to choose from viewers gives new content creators chances to build viewership, which encourages creativity. Furthermore, the majority of the videos last for about 15 seconds, TikTok’s algorithm can build user profiles much faster than YouTube by having users to go through 40 different 15-second videos rather than a single 10-minute YouTube video.

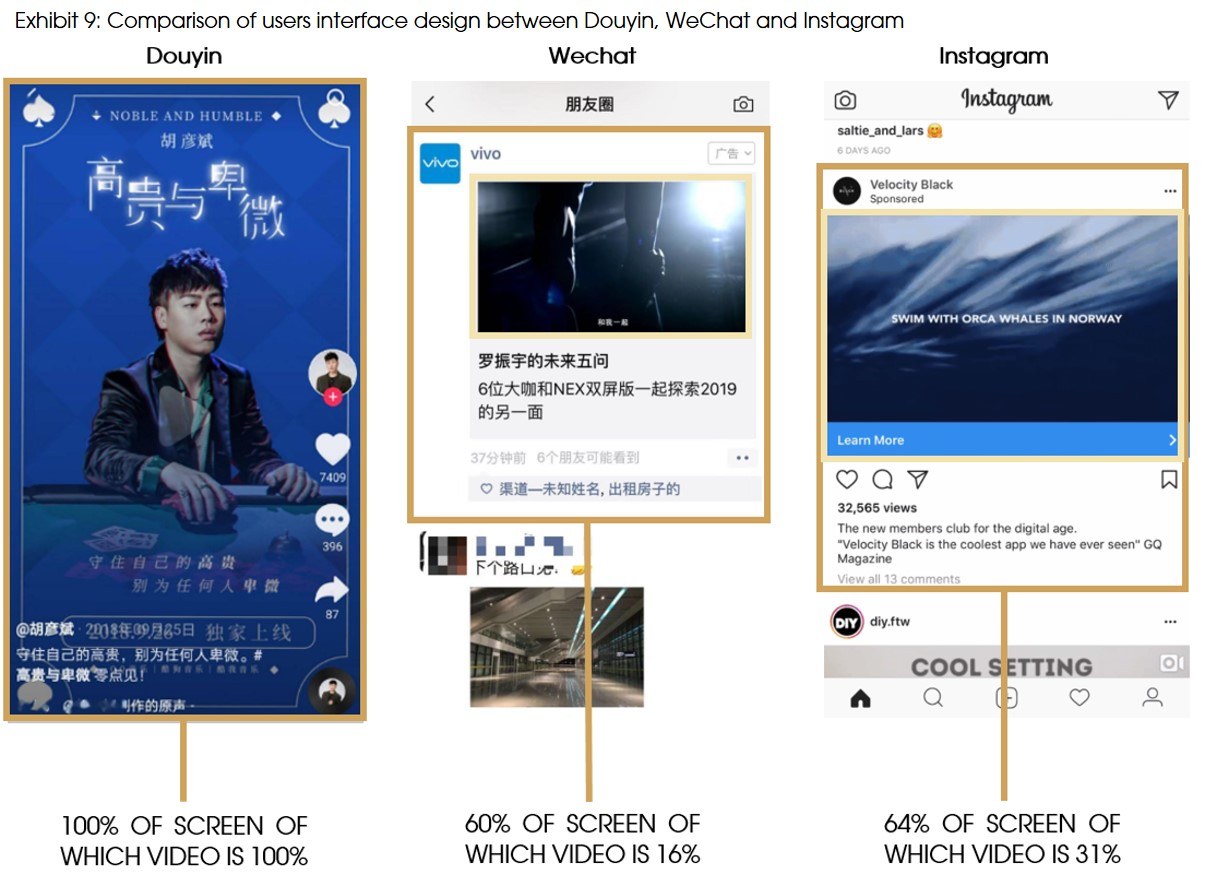

Full screen video user interface to optimize both ads performance and user experience on mobile devices

YouTubers cannot edit their video on mobile, but TikTok was designed with built-in tools for creators to film and edit their videos on mobile. This significantly lowered the threshold for content creation in the mobile internet era. Existing social media platforms like Instagram / Wechat still carries design legacy from desktop, while TikTok innovated by utilizing 100% of the mobile screen as the main user interface for playing the video. Advertisements become more engaging and lead to better conversion when shown on 100% of the mobile screen, rather than 60%.

Beyond advertising: Short video and live streaming as the future of e-commerce

For YouTube, the major monetization model for its 2 billion traffic is still largely limited to advertisements. For most YouTubers other than the most popular ones, advertisement revenue sharing only account for meager livings. In China, Douyin has another monetization model linked to e-commerce. In many cases, if a picture is worth a thousand words, then a video is worth a million. Douyin videos allow merchants / Key Opinion Leaders (KOLs) to show an authentic story behind a product / brand. There are “Farm to Table” videos showing how fresh fruit was cut at the farm or product testing in action showing the effectiveness of a protective phone case from a drop test. Better yet, Douyin’s live streaming allows models to try on clothes, shoes, or cosmetics in real-time as requested by audiences, providing an interactive and entertaining shopping experience. With the help of various mobile payment channels, users can buy products directly featured in the videos, book the rooms at hotels after watching the virtual tours, or get coupons on restaurants after checking out the video reviews. Douyin turns video into a shopping experience, which is convenient and fun for users while providing additional revenues / incentives for content creators.

Bytedance's Virtuous Circles and the Flywheels

Why it matters?

Prejudice and biases blind people to investment opportunities and the real competitions.

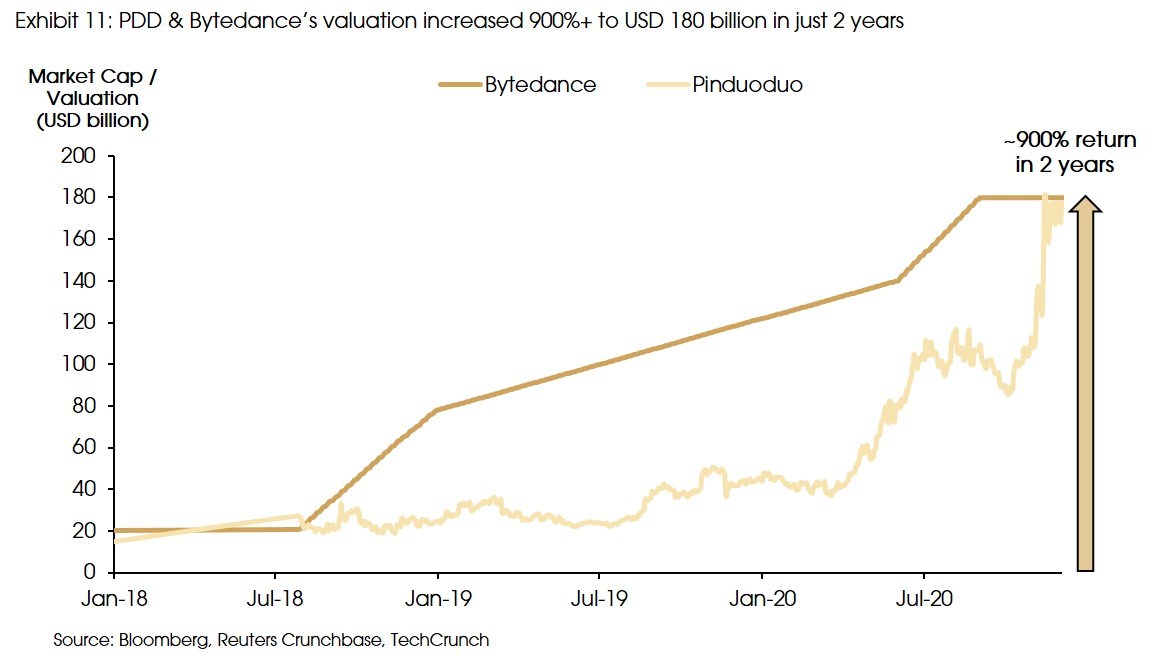

PDD was founded in 2015 after people already accepted the status quo of the oligopoly of JD.com and Alibaba in the Chinese e-commerce market. Bytedance was founded in 2012 when people had anticipated that Tencent & Facebook’s dominance in social media would continue. In their early days, Tiktok / Douyin were incorrectly labeled as a lip-sync app only for teenagers, while PDD was misunderstood as a platform that sells low-quality products only for low-income consumers in the rural area. Both views have been proven to be incorrect as the valuation of Bytedance and PDD rocketed to USD 180 billion from nowhere in just a few years. Early investors in both companies got enormous returns. As a response to the rise of PDD, Alibaba has re-invested in its own team purchase app “JuHuaSuan” that focuses on “Value for Money” products. Meanwhile, Facebook has released a TikTok clone called “Lasso”, while YouTube & Instagram have also rolled out e-commerce features within their apps. Both PDD and Bytedance have shown that the new generation of Chinese technology companies can be sources of innovation globally. Their investment cases and competitiveness are often underlooked.

Monopoly, innovation and competition

Bytedance did not try to create another Instagram nor YouTube when starting out. Likewise, PDD did not seek to become another Alibaba in the first place. Instead of copying what others are already good at, PDD & Bytedance chose to build new products that would have different appeals to the users. PDD & Bytedance succeeded because they were the first movers to have an innovative business model / product dedicated to the mobile internet era. Their forerunning insight on users allowed them to escape direct competition and compete from another dimension with new products. Bytedance captured the potential of short video as the future of entertainment when competitors were still focusing on picture sharing among contacts. PDD saw the need to help the underserved manufacturers and give better value to the consumers, while competitors are busy introducing premium products to cater the rising middle class.

“FAANGs” might seem out of reach now but monopolies do not last forever. Innovation is a process from 0 to 1, a beginning of a new trend, instead of trying to go from 1 to 10 and improve the existing products. Innovation is a way to develop an unexplored market (blue ocean) that is untainted by existing competition / monopoly. History has taught us that champions from yesterday will eventually be replaced by the disruptors of tomorrow. Just as those seemingly indestructible hardware champions in the 90s, namely IBM, Intel and Cisco in the PC era, were all replaced by today’s software giants known as the “FAANGs”. Therefore, the only way for the “FAANGs” to maintain their dominance is via continuous innovation. The real competition for the existing tech giants will always come from an unknown dimension, rather than the existing market that they already dominate. The emergence of “new species” is inevitable. While the US tech companies might continue to dominate in the years to come due to their continuous innovative effort, with China’s growing economy and a new generation of rising entrepreneurs, chances are higher that more disruptive innovation could come from the East. In fact, this is already happening in the changing world.