CIO Viewpoint: The RCEP - Asia's Fight Against Anti-Globalization

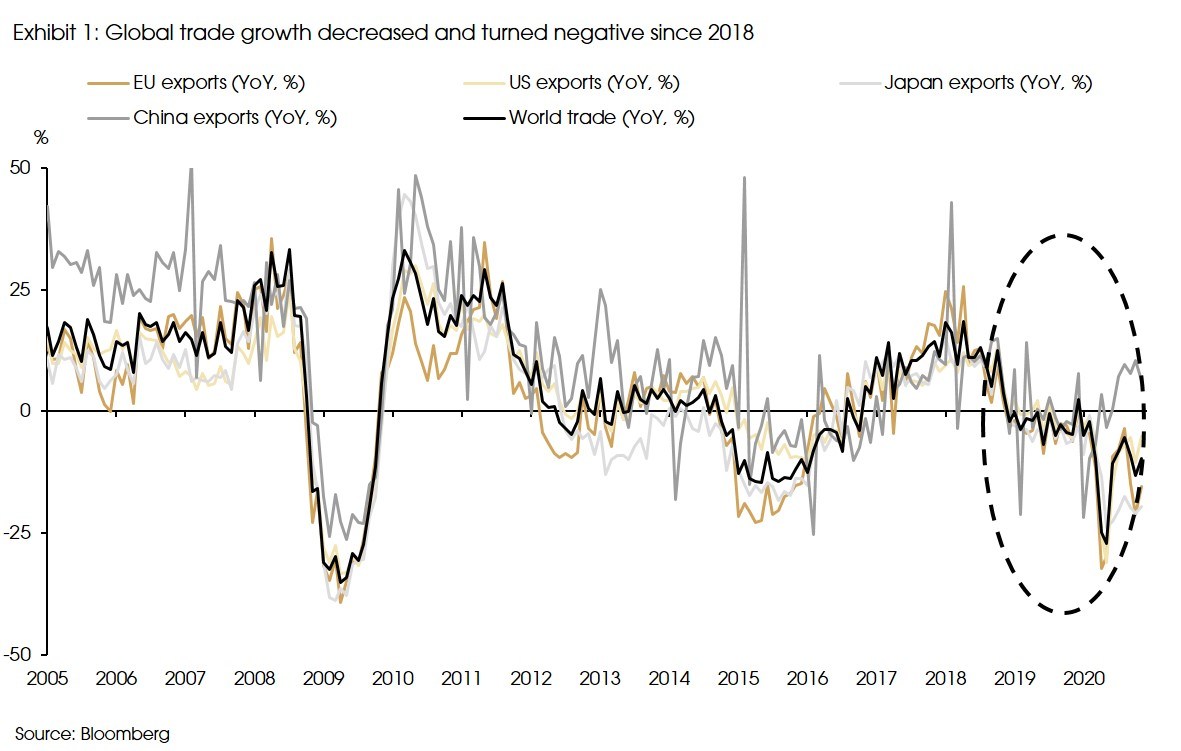

Global trade is depressed by the US-China trade war since 2018, and trade growth has turned negative since then (Exhibit 1). The outbreak of the pandemic has added further downward pressures on the already deteriorated free trade condition due to the doubtful premise that domestic supply chains are safer than the cross-border ones.

The rising popularity of nationalism and protectionism was demonstrated by the 2016 Brexit vote and Trump’s election. It reflects the fact that globalization not only brings economic benefits but also raises challenges and risks, such as increased income inequality as well as the social and environmental risks regarding cross-border supply chains.

In the post-COVID era, regional economic linkages will be essential, as governments, corporations, and individuals will balance the costs and benefits resulting from globalization and will have to choose between more isolation or further integration.

The recently signed Regional Comprehensive Economic Partnership (RCEP) clearly demonstrated the 15 Asian countries’ choices of further integration.

1. A broad trade deal but with less aggressive terms

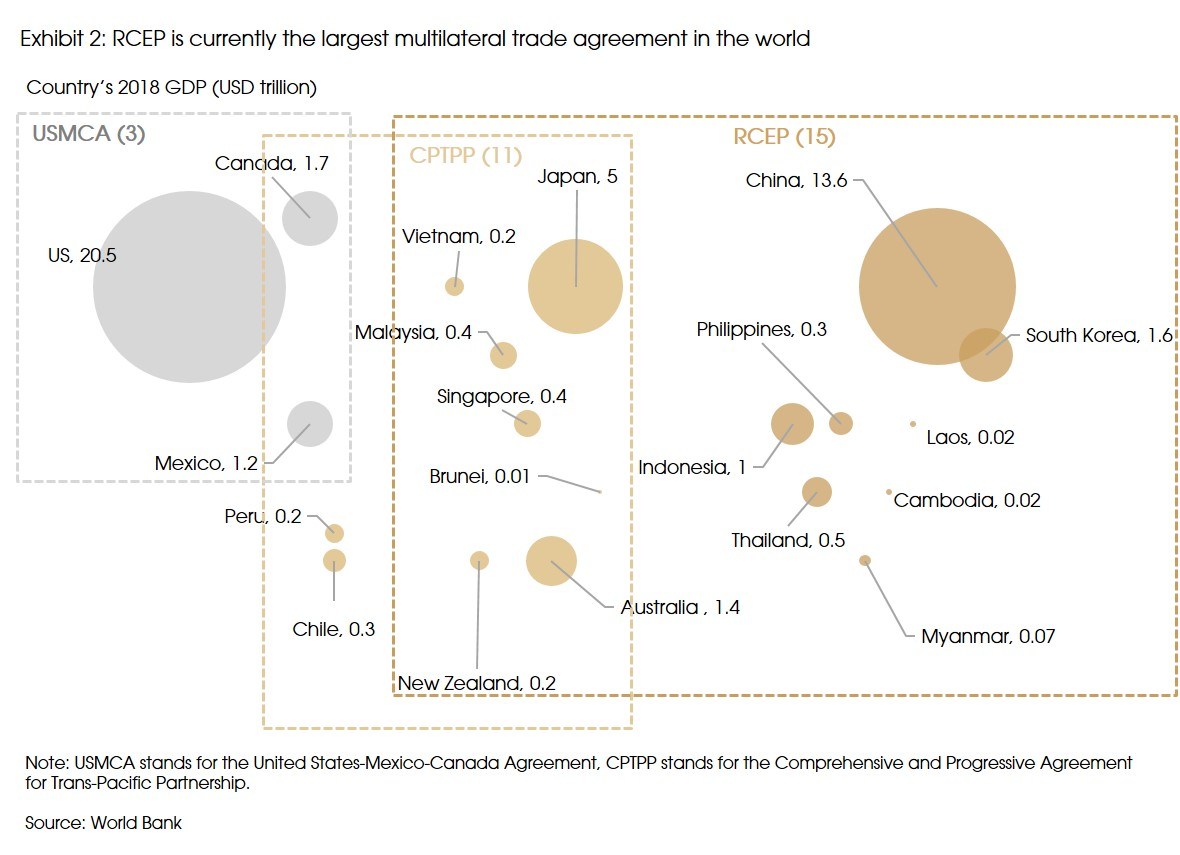

The RCEP involves almost all major Asian economies, i.e., China, Japan, South Korea, Australia, New Zealand, and the ten member countries of the Association of Southeast Asian Nations (ASEAN), creating the largest trade bloc in the world. It covers about 30% of the world’s GDP, population, and trade.

However, as the member countries covered in the agreement are in an enormously diverse region, large and small, high income and low income (Exhibit 2), the terms of the trade agreement are reasonably less aggressive.

Unlike the other Asia-focus free trade deal, the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), the RCEP sets less rigorous requirements in trade liberalization and allows extensive flexibilities to protect specific sectors in member countries from the immediate competition.

Specifically, the CPTPP immediately eliminates 86.6% tariffs on industrial goods traded among member countries, aims to eventually remove 99% tariffs, and applies the same rules for both developed and developing countries. However, the RCEP has a smaller immediate impact on tariff reduction, which only tends to eliminate 90% tariffs over time, and allows different treatment to member countries.

For example, under RCEP, Japan will remove most of its tariffs on imported vehicles and auto parts from other member countries. Meanwhile, South Korea and China are more conservative on slashing vehicle tariffs but will remove most tariffs on imported auto parts. ASEAN countries offer more limited tariff reductions on both cars and auto parts.

Moreover, in general, tariff cuts for many industries have a long transition period of 10 years or more (e.g., agricultural goods) to protect less developed members, such as Laos and Cambodia. Therefore, the impact of the RCEP will not be fully reflected until at least 2030.

Besides, the RCEP achieved less liberalization in services trade and cross-border direct investments. It allows eight member countries to follow positive-list (less open) approaches for market access in services and foreign direct investments. Meanwhile, the CPTPP requires all member countries to adopt negative lists.

Moreover, unlike the CPTPP, the RCEP does not set high standards in protecting labor rights, the environment, and intellectual property. The e-commerce chapter achieved little as it does not reduce customs duties on electronic transmissions nor reach an agreement regarding cross-border data flows.

In sum, the RCEP’s focuses are more on traditional aspects of free trade agreements, i.e., trade in goods, especially manufactured goods, aiming mostly to reduce tariffs and harmonize rules of origin. That said, the broad geographical coverage, significant tariff reductions, and favorable rules of origin are already more than enough to make the RCEP a meaningful deal for the region’s economic growth.

2. A diverse region that has a heavy tilt on the manufacturing sector

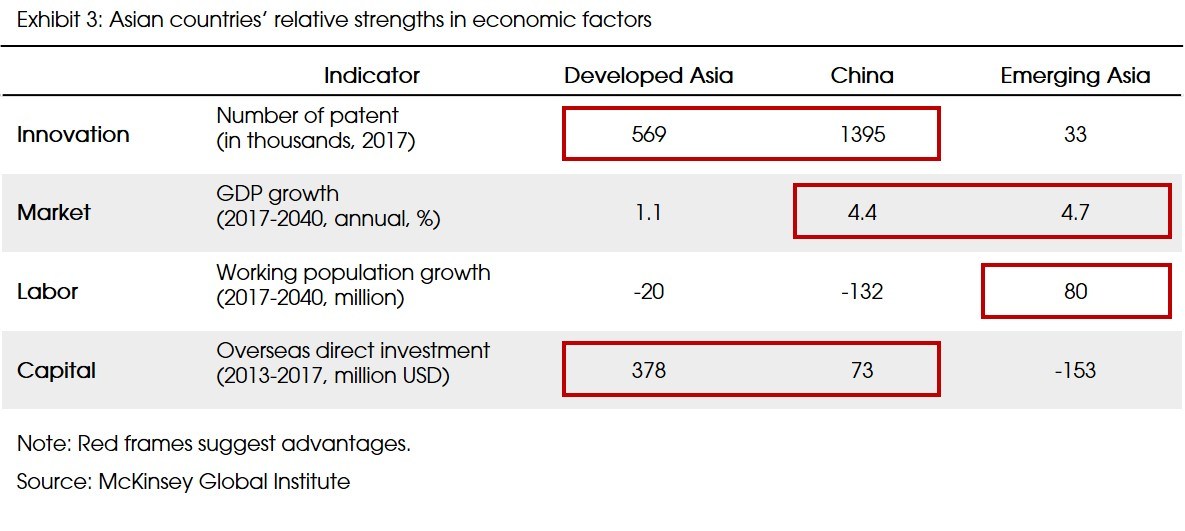

The 15 member countries have distinct comparative advantages in innovation, capital, labor, and consumer market (Exhibit 3).

Specifically, Australia and New Zealand are rich in natural resources and are the key providers of raw materials. Japan and South Korea have higher capital accumulation and substantial technological and innovative advantages in high-end manufacturing sectors, such as the electronic and automobile sectors. Therefore, they are the main providers of capital and technology.

China is the world’s largest manufacturer and a crucial supply chain hub in Asia that connects the productions of other countries. Almost everything, from labor-intensive to capital and technology-intensive high-end manufacturing goods, can be produced in China. According to the Chinese government, it is the only country with industrial and manufacturing supply chains covering all categories included in the United Nation’s industry classification.

ASEAN countries have a fast-growing manufacturing sector, significant labor cost advantage, and have become increasingly attractive for multinational enterprises, especially those in labor-intensive industries, to rebalance their supply chains.

Moreover, the RCEP member countries represent one of the world’s largest consumer markets with a 2.3 billion population. China’s domestic consumption is expected to surpass the US and become the world’s largest. Also, as one of the world’s most populous regions with growing wealth, ASEAN has a huge potential to be a promising consumer market.

A key feature of the region is its heavy tilt towards manufacturing sectors. With three of the world’s manufacturing superpowers (i.e., China, Japan, and South Korea), RCEP member countries comprise roughly 50% of the global manufacturing output.

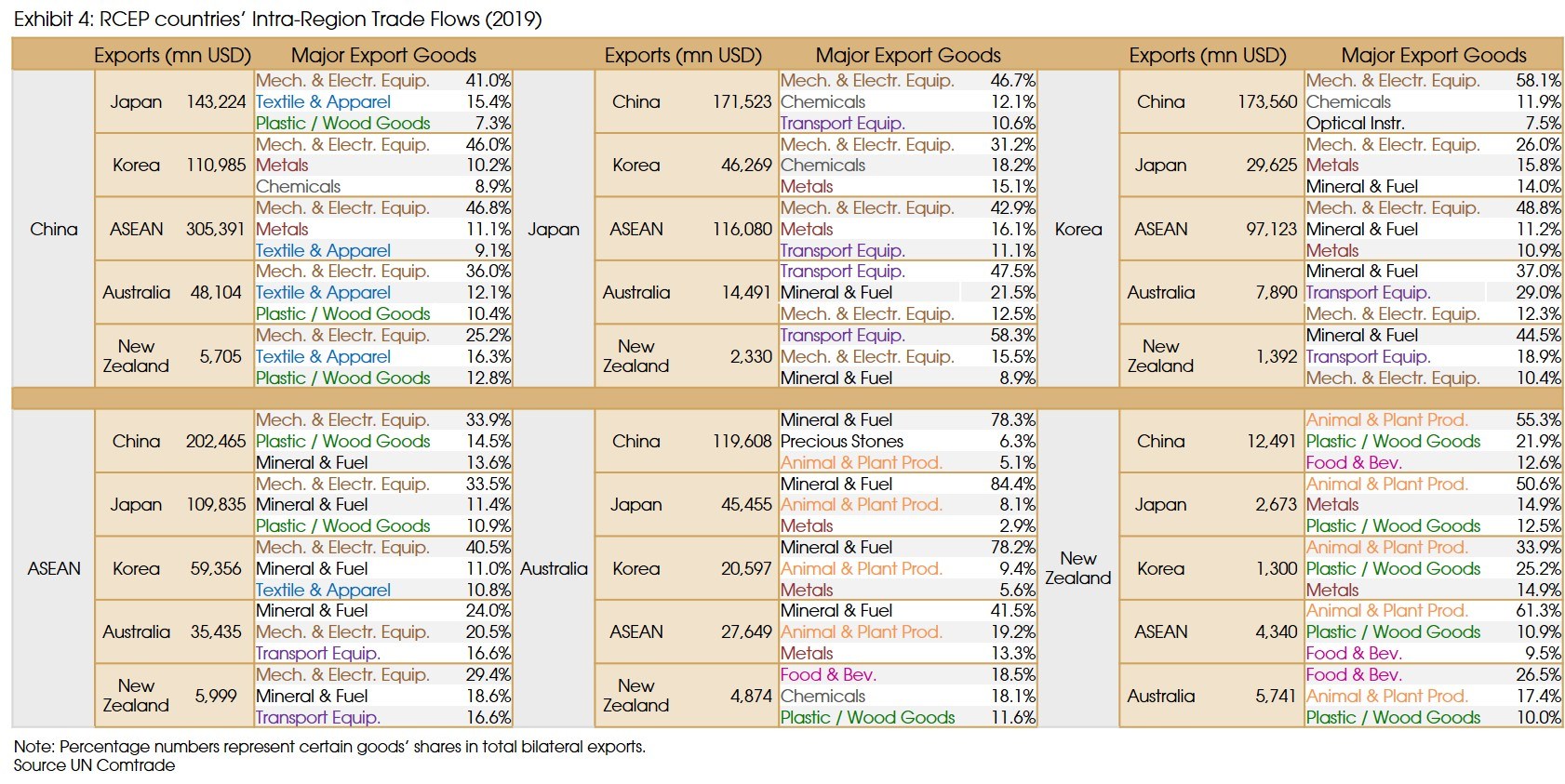

Intra-regional trade data shows that the RCEP members have the highest trade volume in mechanical, electronic, and transportation equipment, comprising around 40% of total intra-regional trade, suggesting an active supply chain in advanced manufacturing sectors. Trade volume in upstream materials (minerals, fuels, and metal goods) also accounts for a notable portion at around 17%, followed by textile and apparel (3.3%) and plastic, leather, and wood goods (3.2%) (Exhibit 4).

Moreover, trade flows of mechanical and electronic equipment have a high concentration in China, Japan, South Korea, and ASEAN. Exports of transportation equipment mainly concentrate on Japan and South Korea, while China has a dominant role in regional textile and apparel exports. Trade flows in other sectors are generally less concentrated.

3. RCEP benefits: more pronounced for China, Japan, and South Korea

Given the RCEP’s main focus on reducing tariffs for most manufactured goods and reinforcing market-driven economic integration in member countries, it will lower the costs for the region’s large manufacturing sector. The reduced costs may lead to lower prices of final goods and more profits for enterprises, which would increase demand and production.

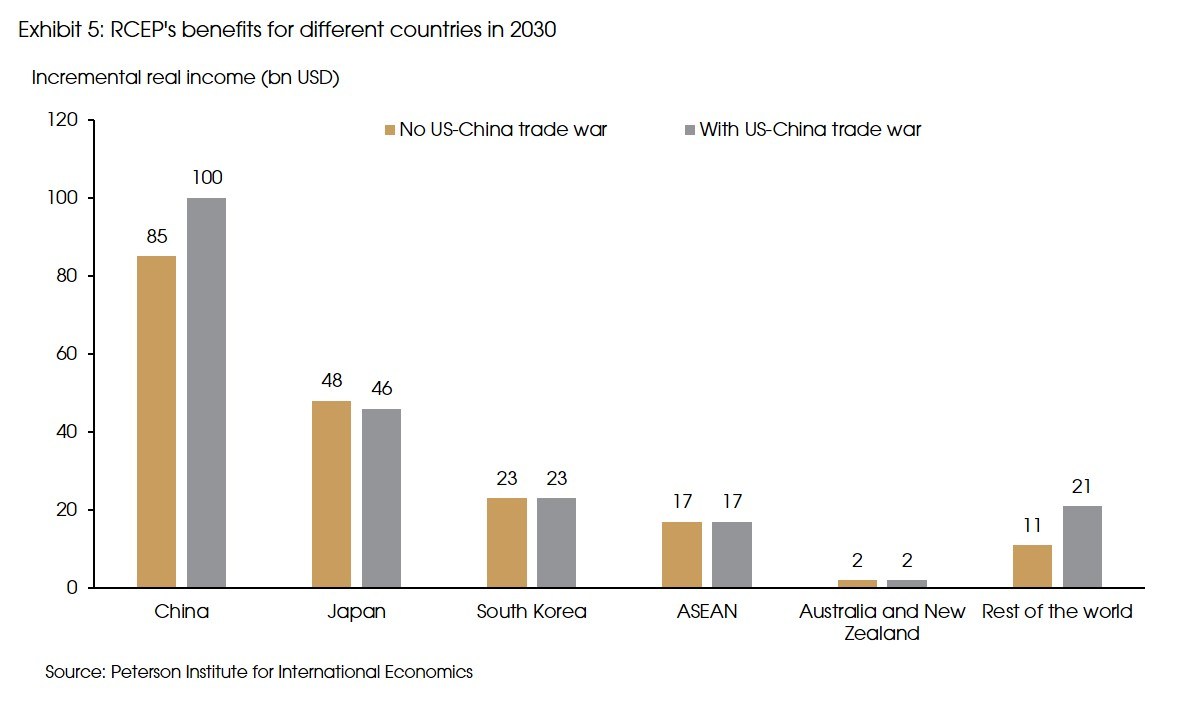

According to the Peterson Institute, in 2030, when most tariff cuts are reflected, the deal will increase the global GDP by USD 186 billion (0.2% of world GDP) (Exhibit 5). Most of the benefits will go to China (USD 85 billion, 0.3% of GDP), Japan (USD 48 billion, 1% of GDP), and Korea (USD 23 billion, 1% of GDP). Meanwhile, some ASEAN countries, such as Indonesia, Malaysia, Thailand, and Vietnam, will also have significant gains.

Two factors can explain the additional gains for China, Japan, and South Korea. First, these three countries have the largest manufacturing sectors, which tend to benefit the most from the RCEP deal. Second, before the RCEP, the three are never simultaneously included in any existing free trade deals. In contrast, trade among other countries is already covered under several free trade agreements, such as bilateral FTAs, CPTPP, and ASEAN+1. Therefore, trade liberalization among China, Japan, and South Korea will be more significant, bringing more benefits to the three.

Moreover, China would benefit more from the RCEP agreement if the US-China trade war persists. It is estimated that the current high tariffs on China’s export goods to the US will lead to about USD 300 billion loss in China’s national income in 2030. However, China will gain more from the reduced trade barriers among RCEP members and the more efficient Asian supply chains, which may mitigate 30% of the trade war loss.

India might be the biggest loser of the RCEP deal, as it abruptly left the negotiations just before the conclusion. India’s withdrawal is mainly due to political reasons.

Throughout the negotiation, the Indian government saw competition from China as a major potential threat to domestic manufacturing sectors. Moreover, India’s politically sensitive agriculture sector may face challenges on products such as spices from ASEAN countries and dairy from New Zealand and Australia. Finally, India has run a bilateral trade deficit with 11 of the other 15 RCEP countries, and like the United States today, India has become more concerned about this.

To mitigate these fears, India has asked for modifications of the RCEP terms, including changing tariff calculations, adding “auto-trigger” protection for import surges, and greater flexibility on tariff concessions. However, other members were unwilling to accommodate so many changes. That said, the door is still open for India to join the RCEP, but given India’s recently more protective development strategy, we are not very positive about this.

According to the Peterson Institute, India’s participation is estimated to bring another USD 53 billion economic gain to the world GDP in 2030. However, these gains will mostly accrue to India and have little impact on other countries, a small drop in gain for Japan and a small increase for China. Therefore, India’s withdrawal from the RCEP will mainly be its own loss.

4. Sector gains are comparable to intra-regional trade shares

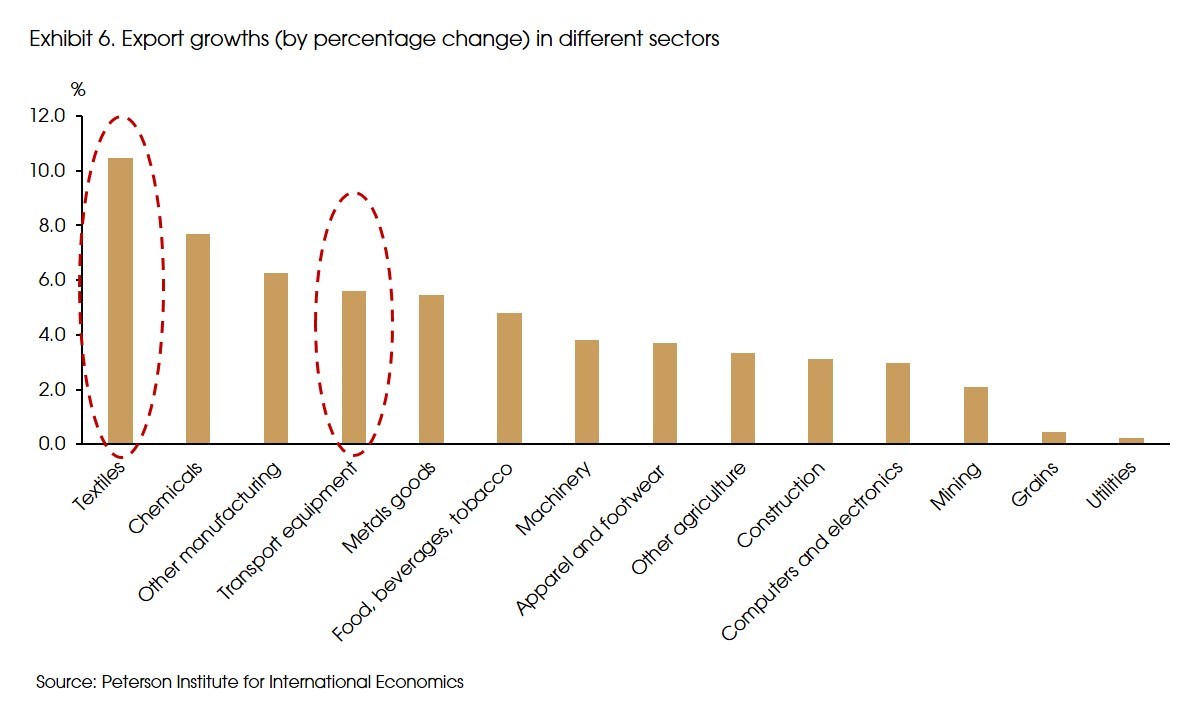

As trade barriers reduce, trade relationships among member countries intensify and will boost exports within and out of the region. According to the Peterson Institute, comparable to the intra-regional trade shares, exports in advanced manufacturing sectors will increase the most under RCEP (by value added) : two-thirds of the increased trade value under RCEP will consist of advanced manufactures, including electrical and electronic equipment, machinery, and vehicles.

A more detailed sector breakdown shows that textile, transport equipment, and various chemical goods will enjoy significant export growths within the region (Exhibit 6).

The 15 RCEP member countries together account for around half of the world’s textile and apparel exports. From a supply chain’s perspective, the RCEP trade bloc has an interdependent textile and apparel production network. China, Japan, and South Korea are major suppliers of textile inputs (such as fibers, fabrics, and yarn), while Australia is a major supplier of raw cotton and wool. China and some less developed ASEAN countries are leading producers of garments and home textiles. Most of the final products are shipped to the US and Europe, and some to regional consumer markets as well.

The RCEP trade pact will further lower the cost of trade within the bloc, boost intra-regional trade, and benefit its consumers. Therefore, brands and retailers will probably source more inputs and allocate more production within the region to benefit from the trade pact. According to the Peterson Institute, China is expected to benefit the most in terms of increased exports in textile and apparel, followed by Japan, South Korea, and Vietnam.

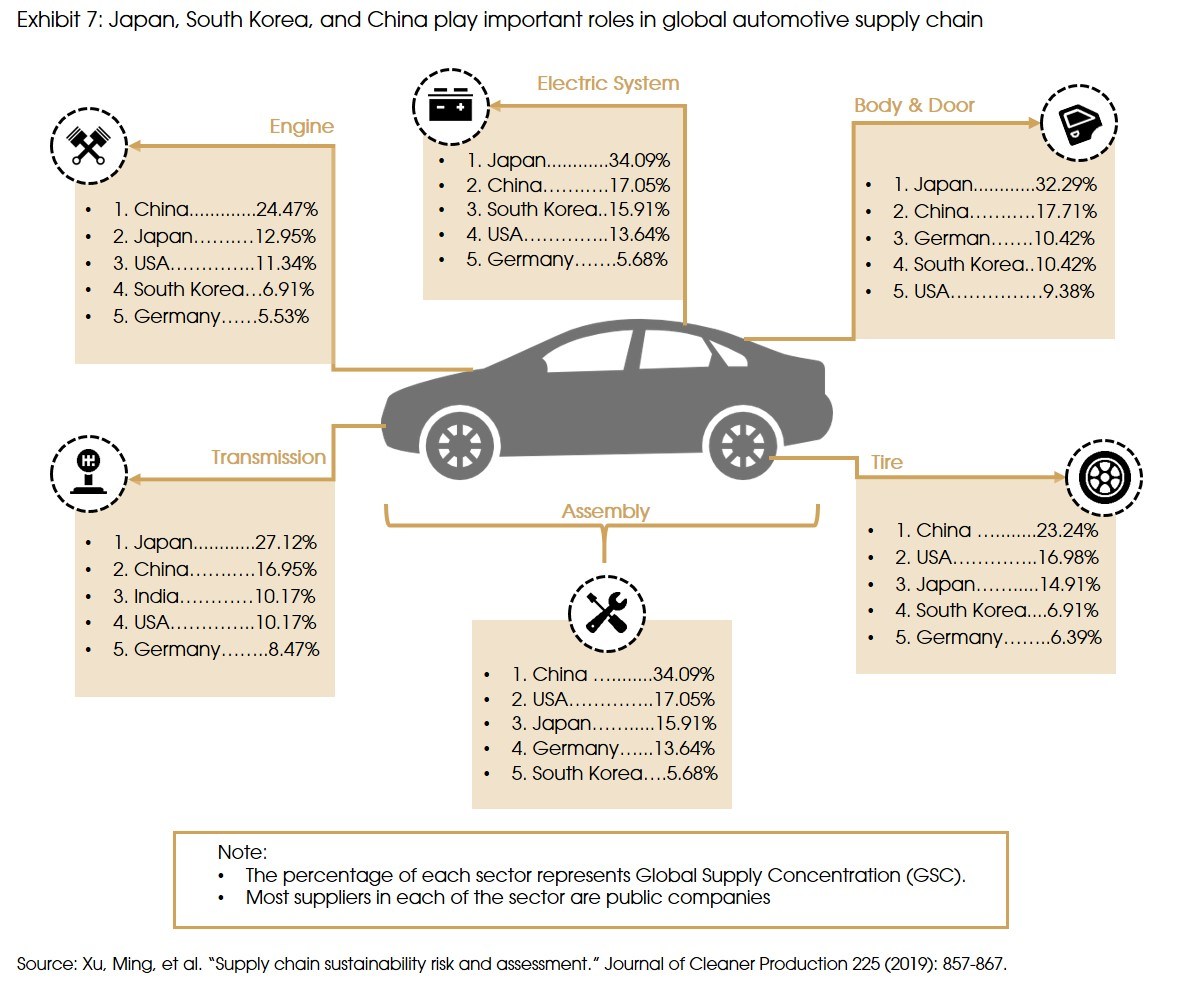

The RCEP countries also encompass nearly half of the world’s automotive industry. Japan and South Korea, as the primary providers of luxury cars and auto parts, and China, as the largest assembler, may all benefit from reduced tariffs (Exhibit 7). Under the RCEP, nearly 90% of tariffs will be reduced for auto parts shipped from Japan to China. However, as China and most other ASEAN countries retain the tariffs on most imported cars from Japan, Japan’s export gain in transportation equipment falls short of its presence in regional trade share. Moreover, ASEAN countries are expected to benefit from the RCEP deal by getting a wave of new assembly plants, thanks to their relatively low labor costs.

Another sector of focus is the semiconductor sector, as it is notably affected by the US-China trade war, and supposedly, the RCEP agreement will alleviate pressures caused by the trade war. As the world's largest semiconductor market, China's semiconductor industry mainly depends on imports from the US, Japan and South Korea. However, China’s tariffs on imported semiconductor equipment and chips are already zero or near zero. Therefore, the RCEP tariff cut will have little impact on the sector. Moreover, the sector still faces risks from the US sanctions and bans.

5. What does this mean for investors?

The RCEP will be in effect 60 days after at last six ASEAN members and three non-ASEAN members have ratified the deal, which is expected sometime in 2021. However, even if the tariff cuts will be gradual, foreign direct investment may start increasing far before the zero tariffs are achieved.

The reduced trade barriers and the more integrated markets within the RCEP bloc will promote inter-regional trade, lower production costs, improve supply chain efficiency, and increase output as well as profitability for enterprises operating in the region. Such an improved outlook may attract more foreign investment and capacity allocated within the bloc, increase the region's share of global GDP over time.

The broad manufacturing supply chain among member countries is a clear winner in the RCEP deal. Sectors like electronics, industrial equipment, and autos will likely see the most benefits. Moreover, member countries such as China, Japan, and Korea are likely to benefit more from the deal given their heavyweight in the regional economy and the lack of prior bilateral trade deals.

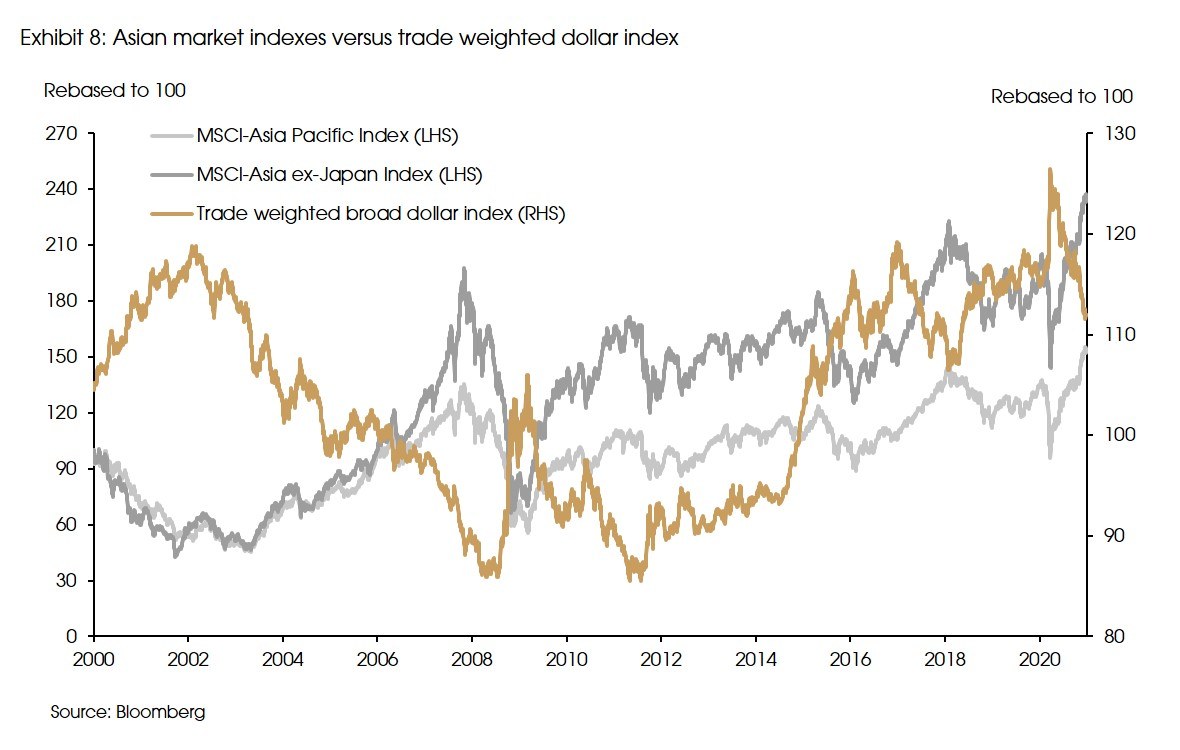

According to the IMF, the Asian Pacific and ASEAN region are expected to have a 6% GDP growth next year. The RCEP deal will make the outlook even brighter, benefiting the region’s cyclical sectors, such as industrials. Moreover, the region’s stronger foot on economic growth and the weak dollar trend may further strengthen the region’s currencies. Historically, the region’s stronger currencies against the dollar generally suggest better equity performance.