Focus: Evolution of Payment Methods

Guillaume Page

Over the last few years, the world has experienced significant changes in the way people and businesses conduct transactions. Payment options have been evolving with existing solutions improving and new technologies replacing progressively standard payments. Following the year 2020 and the pandemic, some of these changes and new payment trends have accelerated due to the urgent need for companies and consumers to adapt to new methods. It has mostly benefited to e-commerce businesses and digital payment solutions, proving their strengths in increasingly connected economies.

E-commerce driving digital payment

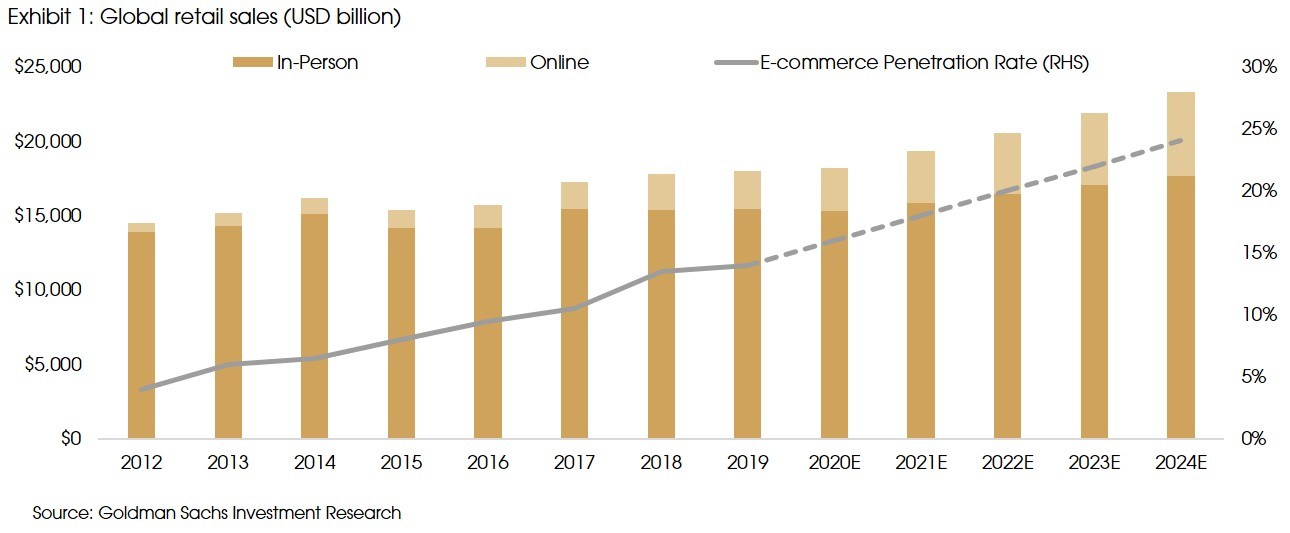

Global e-commerce has continued its growth in 2020 with a total of USD 4.6 trillion in transactions, an increase of 19% compared to 2019. Based on the last few years’ growth, it is estimated that e-commerce penetration has accelerated by almost three years. E-commerce is directly linked to digital payment solutions, hence e-commerce growth has driven the increase in use of digital payments.

E-commerce transactions are nowadays originated from three main ways/categories:

Desktop browser-based

Desktop browser-based commerce is the largest and most mature category. In the browser channel, there are three primary ways for consumers to pay:

- Manual entry or guest checkout, where consumers enter their payment and shipping information for one-time use.

- Card-on-file, where consumers save their payment credentials and shipping preferences at a trusted retailer website for quick direct checkout via login/password.

- Third-party digital/mobile wallet or button services (e.g., PayPal, Pay with Amazon, Apple Pay, Google Pay, Alipay, etc.), which auto populate billing and shipping information.

Mobile Browser-based

Demand for mobile browser-based transactions has been bolstered by the proliferation of tablet computers and smart phones, and the availability of high-speed data. However, transaction abandonment rates are typically higher on a mobile devices (relative to desktops) given the tediousness of keying in payment card data and shipping information on smaller screens. To that end, many online merchants have simplified the check-out process by allowing consumers to save their payment card and shipping information under a profile, dramatically reducing the number of key strokes needed to complete a transaction, or by offering third-party payment wallet checkout options (e.g., PayPal, Apple Pay, Pay with Amazon, etc.).

Mobile In-App

Mobile in-app commerce is similar to desktop browser-based commerce, except browsing and payment occur within the retailers’ own mobile apps. Demand for mobile in-app commerce is also helped by the proliferation of smart phones/tablets, retailer apps and the availability of high-speed data.

Abandonment rates for mobile in-app transactions are lower than mobile browser based transactions because: (1) the consumer often has a stronger relationship with the retailer (evidenced by the fact they downloaded the retailer’s app in the first place), (2) it’s relatively easy for the retailer to re-engage the consumer who has abandoned their shopping cart by sending an alert or notification, and (3) consumers often save their payment card and shipping information to their profile in the app, which reduces the need for (and pricing power of) third-party payment wallet options.

Mobile in-app transactions are gaining share relative to mobile browser-based transactions and competition among third-party payment providers for acceptance and placement within in-app mobile applications is intensifying.

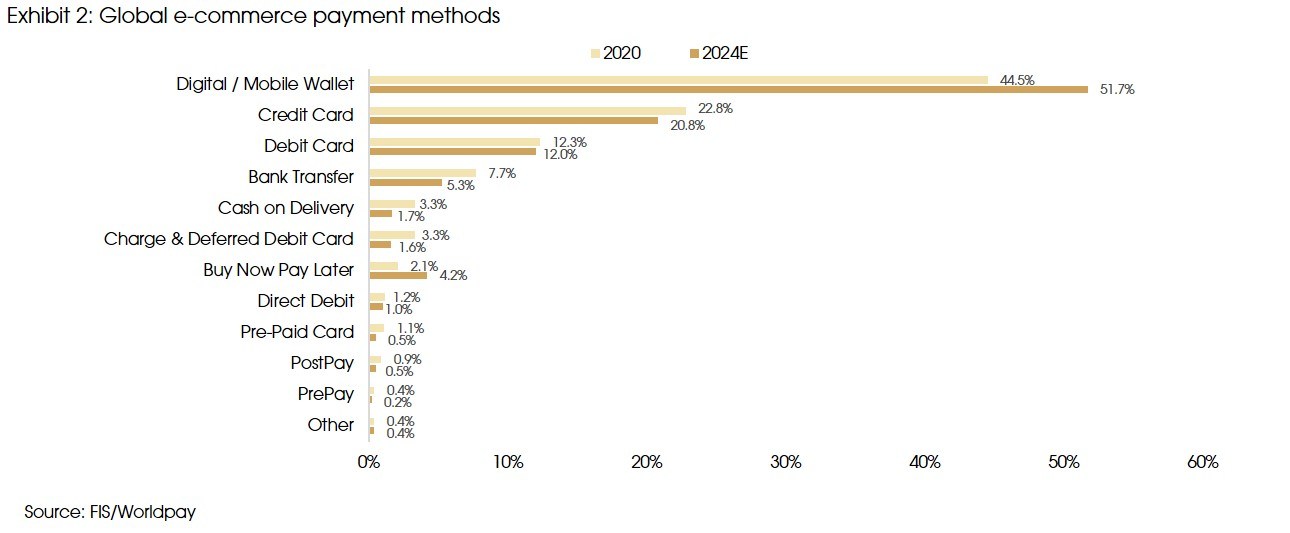

Digital wallets were the main payment method used in e-commerce in 2020, with 44.5% of transactions.

- In China, 72.1% of consumers are using digital wallets for their e-commerce purchase.

- In the US, this numbers is growing but is less significant for now with 29.8% of online transactions being related to digital/mobile wallets.

Use of digital/mobile wallets is at the expense of credit cards, bank transfers and cash on delivery (COD). According to WorldPay, digital wallet will account for 51.7% of e-commerce transaction volumes by 2024. One method that should also continue its expansion is “Buy now, pay later (BNPL)” solution, which gained importance during the pandemic. Debit and credit card use for online transactions should decline over time.

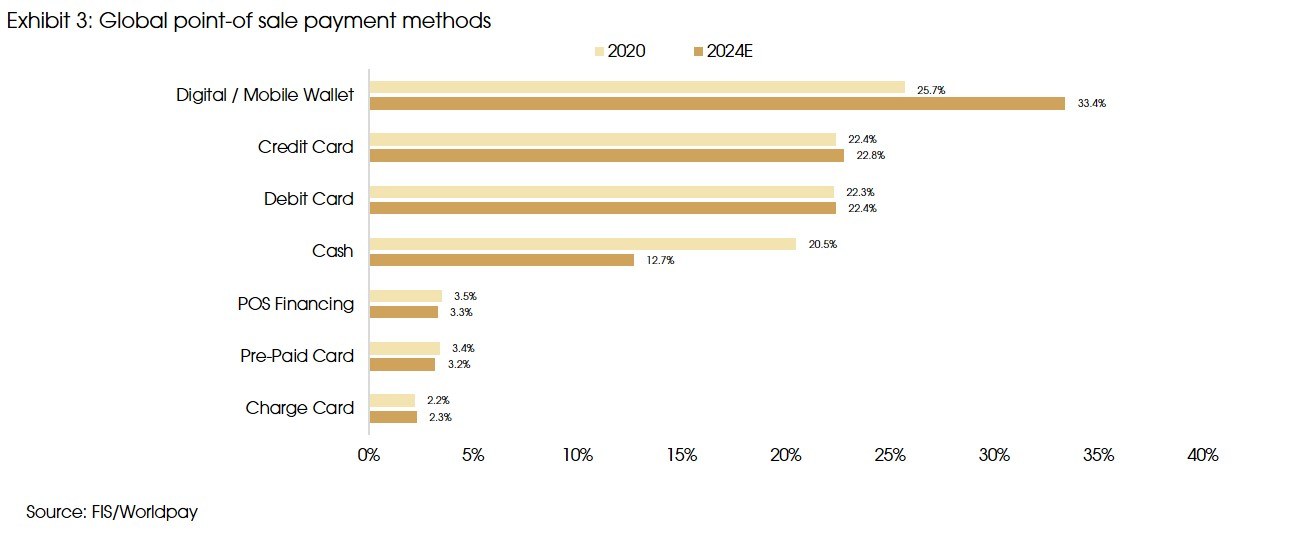

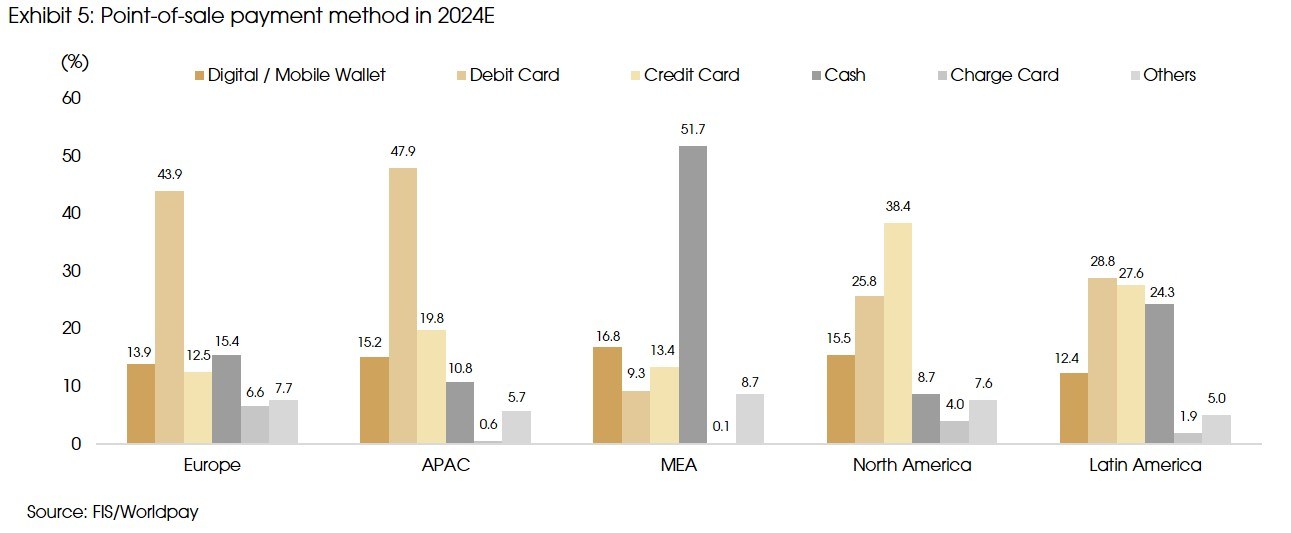

On the other hand, point-of-sale (POS) volumes were logically impacted by -4.4% in global transaction volume compared to 2019 due to Covid-19. Lockdowns and business restrictions all led to the decline of cash usage. In addition, the pandemic increased the use of contactless payment methods at POS. In the coming years, we should expect this trend to continue, as consumers will move their preferences to more convenient payment methods.

Payment methods across the world

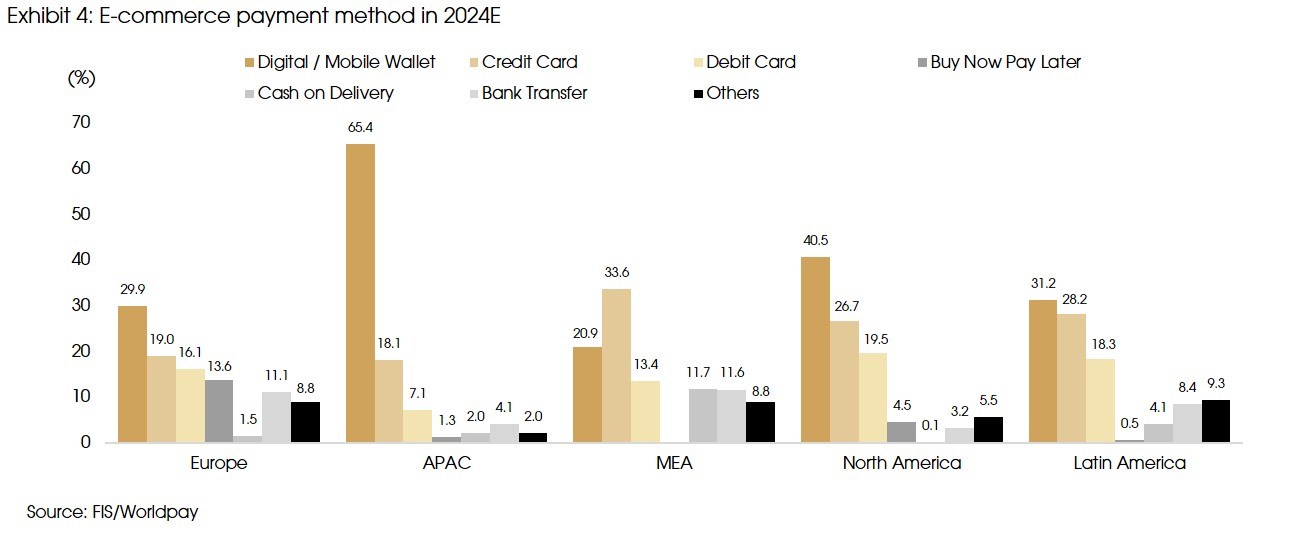

In developed markets, the card remains the primary funding mechanism for mobile payments. However, emerging markets rely heavily on alternative funding methods, including prepaid and direct debit card (ACH), with a heavier focus on QR-code tech (e.g., Alipay, Tenpay, Paytm).

Europe

- European consumers have continued to spend online. EU’s e-commerce market grew 14% on average between 2016 and 2020.

- Internet penetration and e-commerce penetration remain diverse across European countries.

- 26.4% of online payments are done through digital wallets. Digital/mobile wallet and BNPL are expected to be the two growing methods in the coming year. Other main methods are credit/debit cards and bank transfer.

- At POS, debit card (41%) is the leading method with cash use (27.4%). However, consumers’ cash use is expected to drop significantly. According to WorldPay, Scandinavian countries will be almost cashless within five years.

Asia Pacific

- Payment method moved toward digital solutions throughout APAC in 2020. Consumers shifted from POS to e-commerce, it also shifted payment preferences to digital methods.

- In 2020, digital wallet accounted for more than 60% of APAC e-commerce payment methods. China is the leader globally in digital wallet use as it was used for 72.1% of 2020 e-commerce payments.

- Payment methods at POS are moving from cash toward mobile wallets, also driven by some government initiatives. For example, the Japanese government offered discounts for retail purchases when non-cash payment methods were chosen.

- In China, mobile wallet will continue to grow as a method at POS, and the trend should accelerate even more in countries like Thailand, Philippines and Taiwan.

United States

- Digital payments and e-commerce benefited from the shift from travel and hospitality transactions to online groceries/services and delivery platforms.

- US consumers have had historical preferences for credit cards, but in 2020, it moved to higher use in debit cards, digital wallets and BNPL services. This was driven mainly by fear of recession and unemployment.

- Digital wallets and BNPL services appeared to be the growing payment methods.

- At POS, consumers paid more with mobile wallets and contactless payment method for safety concerns.

Middle East and Africa

- MEA consumers are turning to local e-commerce ecosystem. With Jumia (leading pan-African e-commerce platform) and Flutterwave (payment platform), Nigeria has become the driving market for digital payment.

- Credit cards and cash on delivery are the main payment method, showing the low digital penetration and underbanked populations. Credit cards should remain the major payment solution online, with digital wallets gaining more shares in the future.

- Cash use accounts for half of transactions at POS, and it shouldn’t change in the near future.

Latin America

- For many Latin Americans, 2020 was the first time they started using e-commerce as necessity during Covid-19. Latin America should have the highest growth in e-commerce over the next few years.

- Credit cards represent a third of online payment. Digital wallets accounts for a fifth nowadays, but should dethrone credit cards as the leading method in the future.

- Cash used to be the foundation of Latin American economies at POS but it is expected to be replaced progressively by credit/debit cards and mobile wallets.

Evolution of payment solutions following 2020

As highlighted above, the decline of cash use will be at different paces across regions. It will depend on the development of local regulations/infrastructure and of course consumer preferences. Contactless payments will continue to be adopted as consumers realised their convenience in addition to the safety aspect and embrace the trend toward the future of faster-commerce.

- Based on a Mastercard study in April 2020, the company highlights that 79% of consumers worldwide and 91% in APAC are using contactless tap-and-go payments at POS. 74% of them globally will keep using such method in the future.

- Similarly, in Visa’s 2020 Back to Business study, 78% of global consumers said that they have switched to contactless payments to reduce contact. 67% of small businesses moved to new payment technologies to accommodate the demand from their customers.

Towards a cardless and contactless future

The contactless trend and technologies were already well present before Covid-19, which helped the fast adoption during the pandemic. Such a trend came along with the constant increase of smartphone ownership globally and the surging use of smartphone as financial management tool. In parallel, the trend was supported by years of investment in technological capacity for efficient contactless payments. More and more POS terminals have the capacity to accept “Near Field Communication” (NFC) payments, a technology allowing wireless data transfer in close proximity. Nowadays a majority of smartphones support mobile wallet (Apple Pay for Iphones, Android Pay, Samsung Pay) thanks to NFC chips.

Mobile wallets are usually linked to physical credit/debit cards, but card issuers have started to offer virtual cards. This additional solution improves the application process as the card could be issued immediately. Issuers can target new markets at a lower cost and new type of issuers (small banks, FinTechs) can also enter into the space.

While mobile wallets create a more level playing field and introduce more disruptors into the ecosystem, scale matters and incumbents remain vital to the mobile evolution.

Developers Needed to Make Mobile-Commerce Happen

- Looking beyond digital wallets, the convergence of e-commerce and m-commerce has created a second wave of niche integrators looking to simplify the payment stack, offering everything from gateway services to payment design.

- Vendors include Braintree (PayPal), Stripe, Shopify, Authorize.net, CyberSource (Visa), and Mastercard in addition to classic IT consultants like Accenture and Cognizant. Braintree, for instance, helped develop the payment application behind Uber (location-based car service), while Stripe powers Shopify.

End-to-End Players Emerging as Potential Power Brokers

- Certain players within the payment processing universe have become two-sided networks, whereby they own relationships with both merchants and consumers.

- Examples of two-sided networks include Alipay, Chase, PayPal and Square. Two-sided networks can pursue an “End-to-End” strategy and create unique opportunities including unique offers, economics and network growth effects that point providers can’t replicate.

Another digital tool for smarter checkout experiences is using loyalty points as a currency. Improving loyalty programs with simple payment experience can be a powerful vehicle. Intuitive loyalty programs can provide valuable business intelligence on customers, on their purchase and payment behaviours. In some platforms, loyalty points can be easily used for payments:

- Shell Fuel Rewards program members can redeem points at the pump in real time.

- Grabpay in Singapore is pushing customers to pay via QR code in order to earn points that can be redeemed also in other Grabpay merchants.

The velocity of payment has increased and represents great value for governments, businesses, consumers, banks and technology providers for faster payments and authentications.

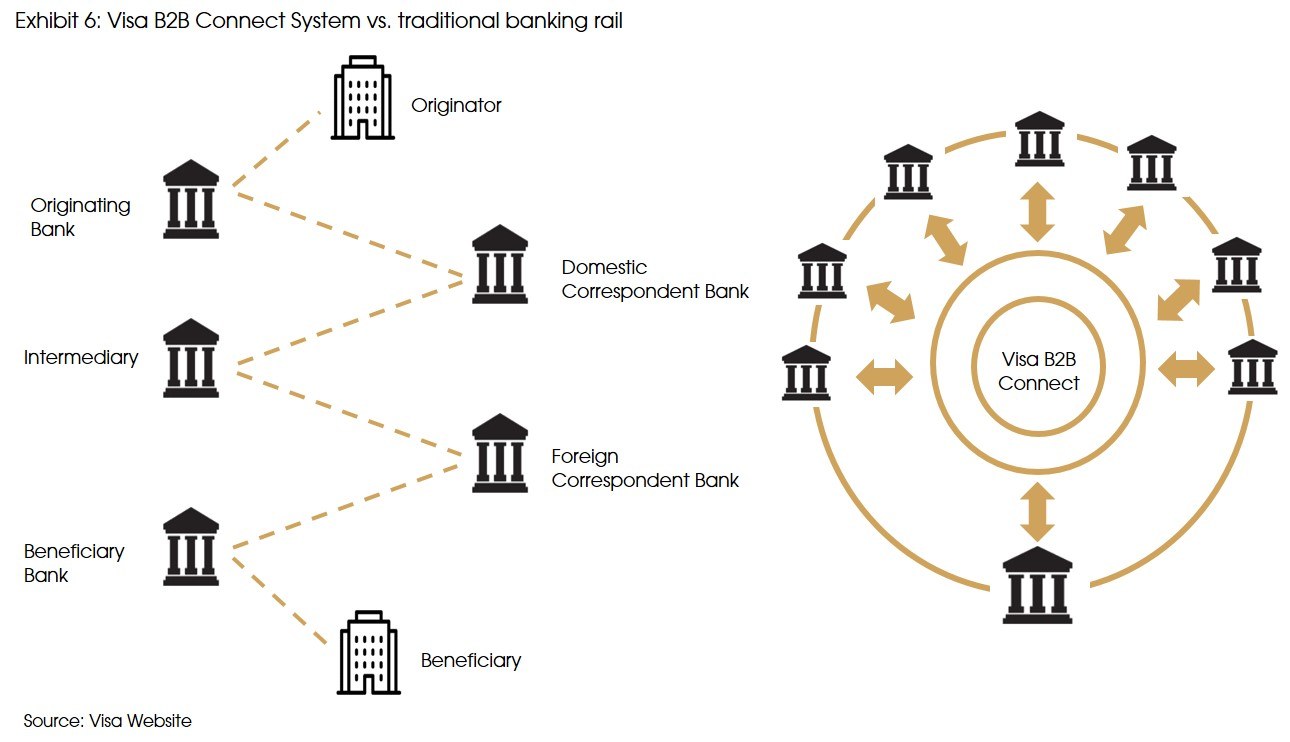

On businesses’ side, the need for efficient and convenient payment solutions became a survival tool, hence B2B payments solutions are playing more and more a vital role. It is a very competitive market between real-time payment rail/system providers as the market is estimated at USD 125 trillion globally.

- Example of Visa B2B strategy with two platforms:

- Earthport offers cross-border payment services to banks, money transfer service providers and other businesses through the largest independent “automated clearing house” (ACH) network.

- The combination of Visa and Earthport bring the ability to move money globally and efficiently. The scale of the network makes it simple for originators (treasury banks and service providers) to do all this through a single connection.

- Visa B2B Connect is a multilateral payment network designed to enable participating financial institutions and their business customers to make global business payments that are streamlined, secure, and predictable.

Digital transformation through e-commerce is also changing retail stores, as many businesses of any size become omni-channel experiences. As customers are increasingly exposed to digital platforms and payments, expectations will follow for retail experience once people will return to shops. Digital tools will also help stores in their overall shopping experience for making it convenient and efficient. Payment and checkout tools can make the payment part “invisible” and staff focus only on servicing customers. For example, Amazon is testing “just-walk-out” checkout technology and will introduce the digital technology to Whole Foods outlets in Q2 2021.

Real time payment and new modern payment in banking

There is demand for real-time payments. It became a key factor for consumers when selecting financial institutions. Consumers who are more prone to use such system are usually young consumers, and the ones with lower income as they have more tendency to look closely to their account. Overall, the interest in real-time payments mainly comes from the simplification of payment experiences and better visibility and management of accounts and cash flows in real time.

For financial institutions, most common and important features for client are trust and protection of personal data, but real-time payment services can add value to institutions service offerings. In the US, common payment rails/system have been put in place with services such as The Clearing House’s (TCH’s) Real-Time Payments (RTP) network. However, integration to such networks remains a challenge for smaller players who don’t have enough capital or technological tools to be linked to RTP networks.

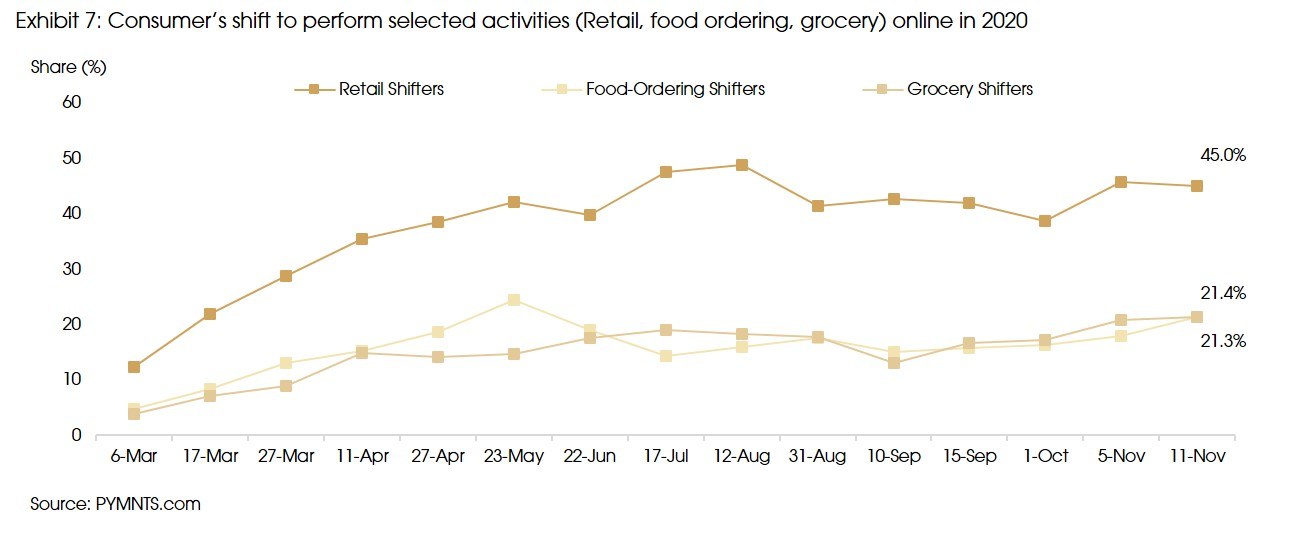

Financial institutions, namely banks, will inevitably need to take a new approach towards modern payments. Their services will need to be linked to the fast and connected economy. Demand for connected services has also driven the creation of digital banks, whose number has grown 200% globally since 2015. Such growth demonstrates the market potential for underbanked/unbanked consumers in developing markets. Financial institutions/banks and technology partners play a vital role to innovate and provide the infrastructure for the digital ecosystem. As commerce shifts rapidly to digital channels in a couple of weeks/months (see exhibit below), digital processing capabilities need to be delivered instantly by banks, with the access to new approaches and digital applications.

The rise of merchant services

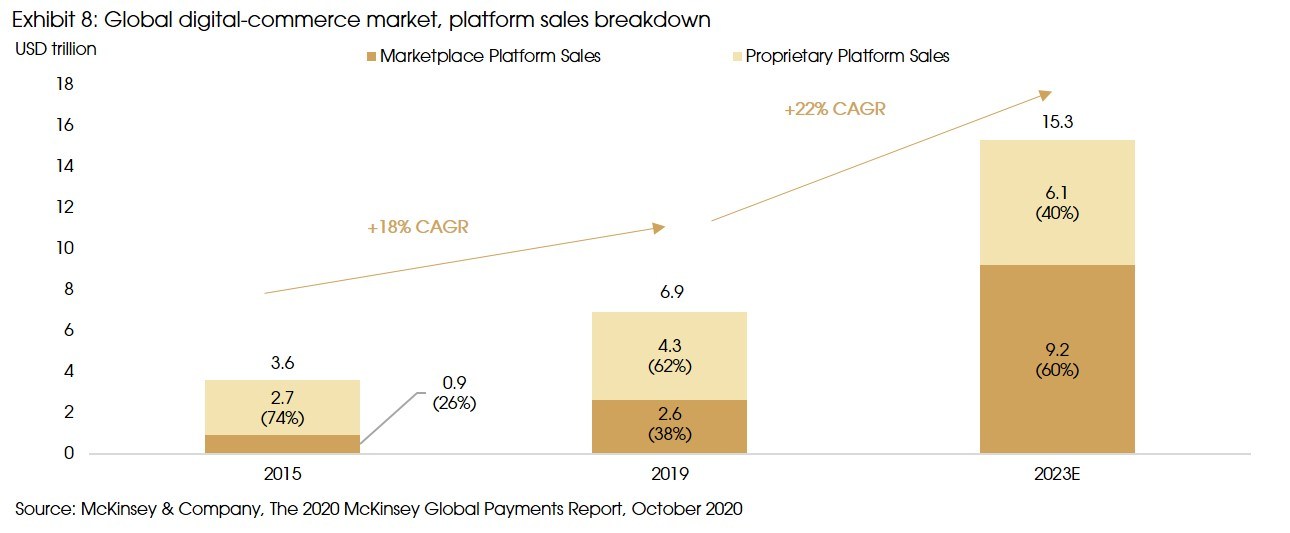

The popularity of e-commerce and digital payments expanded to different commerce, including segments such as healthcare, professional services and education. These businesses, small or large, were able to develop their digital channels through marketplace platforms. During the pandemic, platforms like Amazon, Shopify or Etsy registered 70 to 150 % more merchants. According to McKinsey, digital marketplaces could account for 60% of digital-commerce volume in 2023.

Merchants moving to marketplace platforms is a secular trend of businesses trying to follow consumer behaviour and demand, but also a way for any type of merchant to expand their business, customer base and enhance their overall operations. Most of these marketplace platforms offer integrated software vendors (ISVs) and built-in payment channels. SMEs investing in the integration of digital ISVs are looking to implement value-added services for their operations (SME financing, payment infrastructure), but also for their customers with rewards redemption at POS, POS financing. For many SMEs, e-commerce and digital operations is not anymore a nice tool to have, but a vital one.

Conclusion: Payment companies as solid bets on consumers and technology future

The 2020 pandemic has boosted the speed of changes in the payment ecosystem, even though such trends were already observed before Covid-19. Active players say that the transformation of the payment market has accelerated by four or five times faster than expected. All actors of this market should move forward and welcome innovation in order to gain or preserve their role.

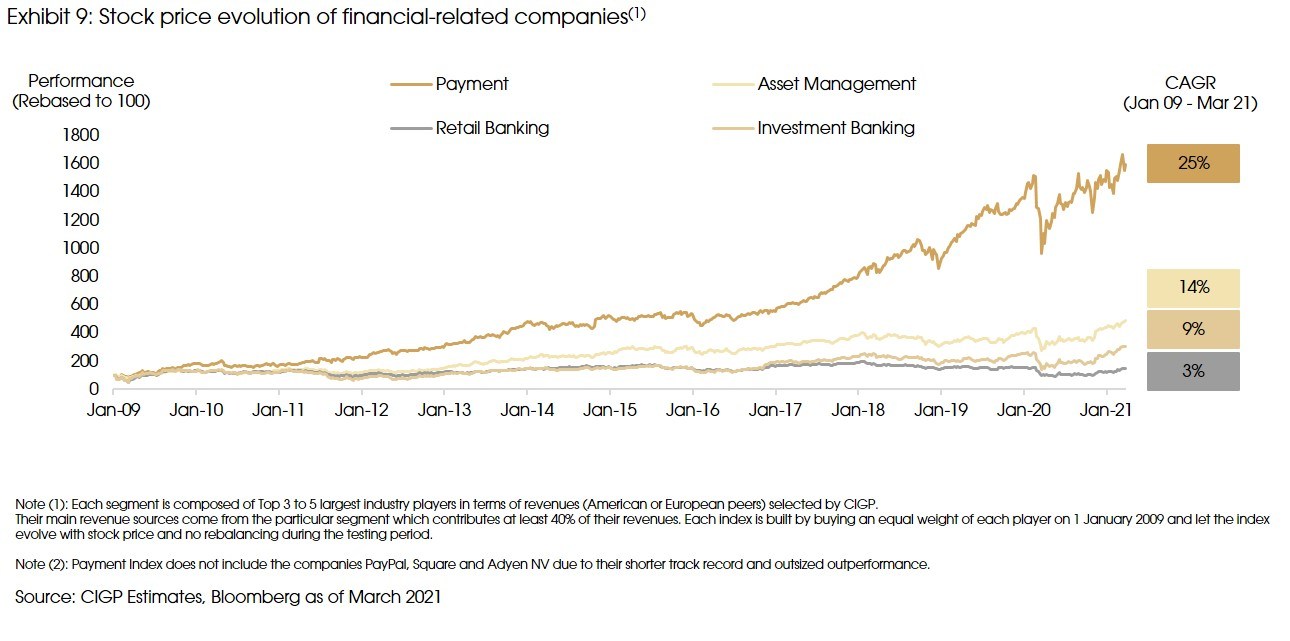

Within the payment market, companies that are providing new payment infrastructures and digital services should continue to grow and gain market shares as the future will lead to more applications and services around digital payment and e-commerce. In the last few years, we can observe that financial markets already perceived some of these changes and the importance of payment companies who were the best performers across financial services segment.

Banks have had less momentum in their payment business as they had to deal with a challenging environment for them with compressed net interest margins, pressure on interchange and cross-border fees by regulation and competition. With digital investments and technology costs, banks should continue to struggle in generating growth and profits in their payment segment. In addition, the competition will intensify as payment companies devote large investments to develop their capabilities. For investors, we believe the payment segment and its actors are important to observe in the context of the evolution of businesses’ operations and approach towards consumptions in the future.

Sources: Alacriti, Clark S. Berg Insight, FIS Global, Goldman Sachs Research, i2c Inc, Mckinsey & Co., MSCI, Pymnts, Company Press Releases and Investor Reports and CIGP Estimates.