CIO Viewpoint: Why We See a Weakening Dollar

The dollar strength is decided by a number of factors such as technical, valuation, and risk appetite in the market. However, for the medium-long run trend, the determinants narrow down to fundamentals.

1. Disappearing interest rate advantage: the turn of the monetary policy

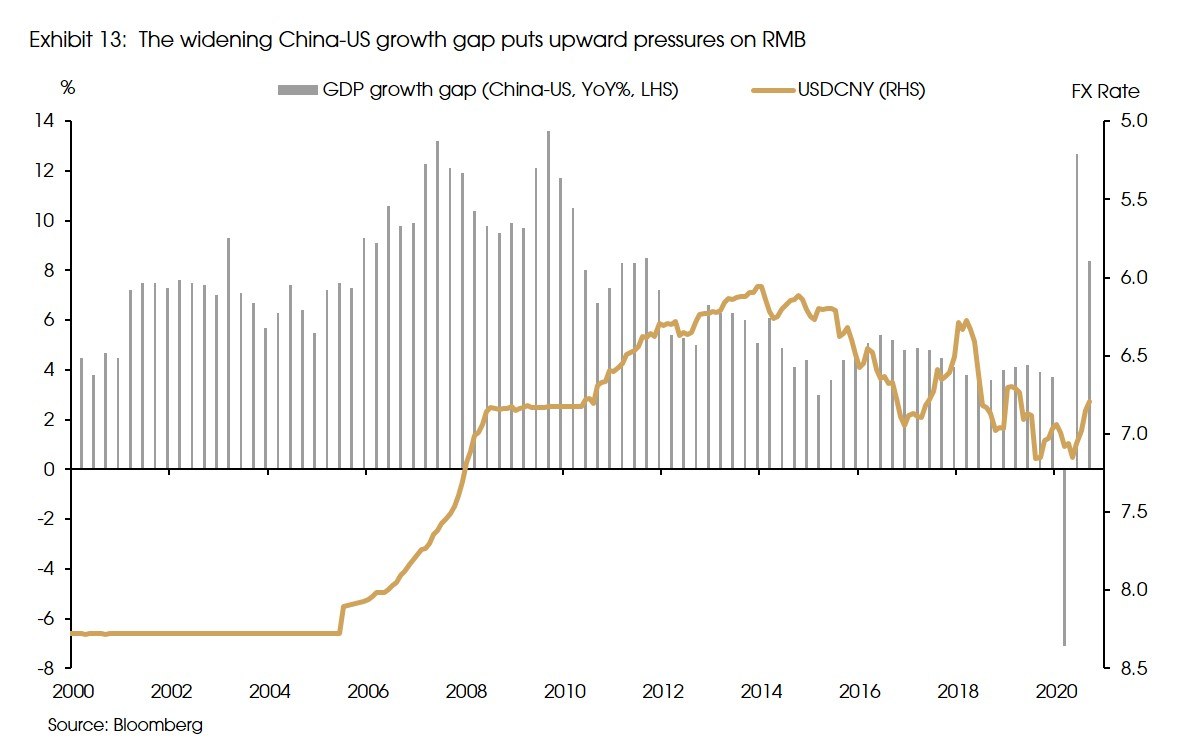

Currencies are driven by relative growth differentials. Stronger economies should have stronger currencies. But the link between growth differentials and currencies is not so direct. The mechanism is mainly through interest rates (Exhibit 1). Generally, higher economic growth offers higher interest rates, leading to stronger capital inflows and driving up the currency.

The interest rate advantage of the US dollar peaked at the end of 2018, as the Fed hiked the rate four times during the year, while the ECB, the BoJ, and the BoE generally maintained their loose monetary policies. But such yield advantages are decreasing since last year, as the Fed decided to stop hiking the rates at the beginning of 2019 and instead started to cut the rates in July.

Note: US-G3 nominal yield gap was calculated as the 10-year US treasury yield minus the weighted 10-year government bond yield for Germany, Japan and UK (weights equal the relative weights in the DXY dollar index, i.e. 70% for Germany, 16% for Japan and 14% for UK).

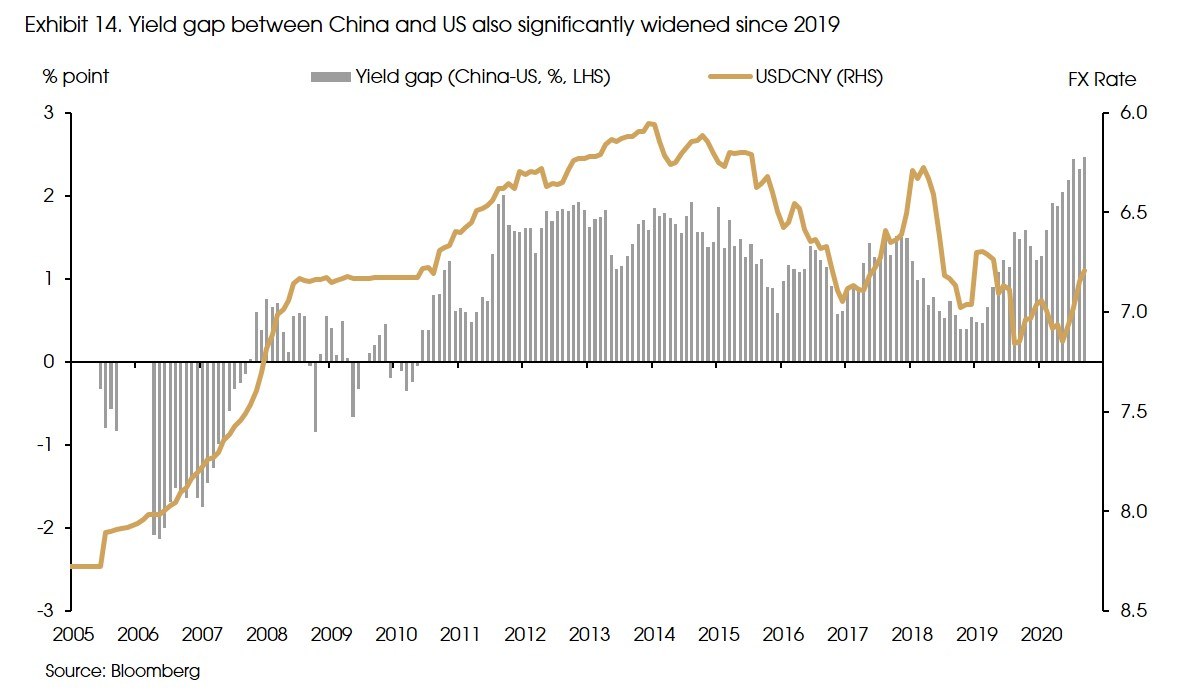

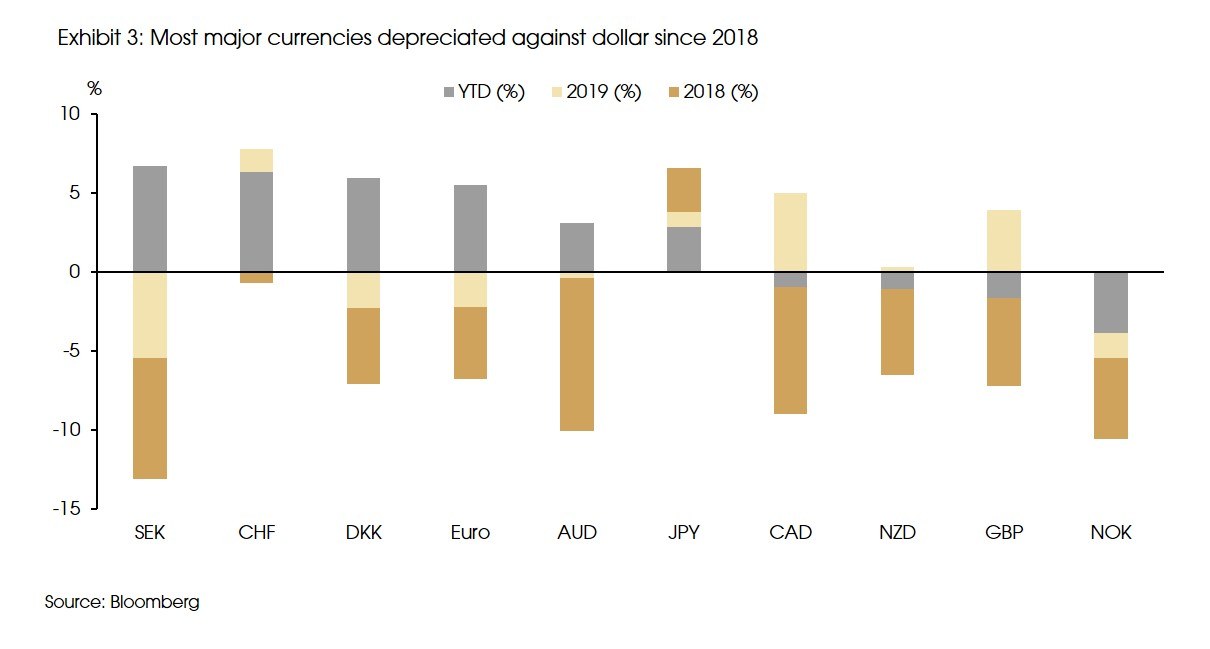

As a result, at the end of last year, both nominal and real interest gap between the USD and other major currencies have narrowed and returned to (fallen or below) their end-2017 levels; however, the dollar was still stronger than its end-2017 levels in most cases (Exhibit 3).

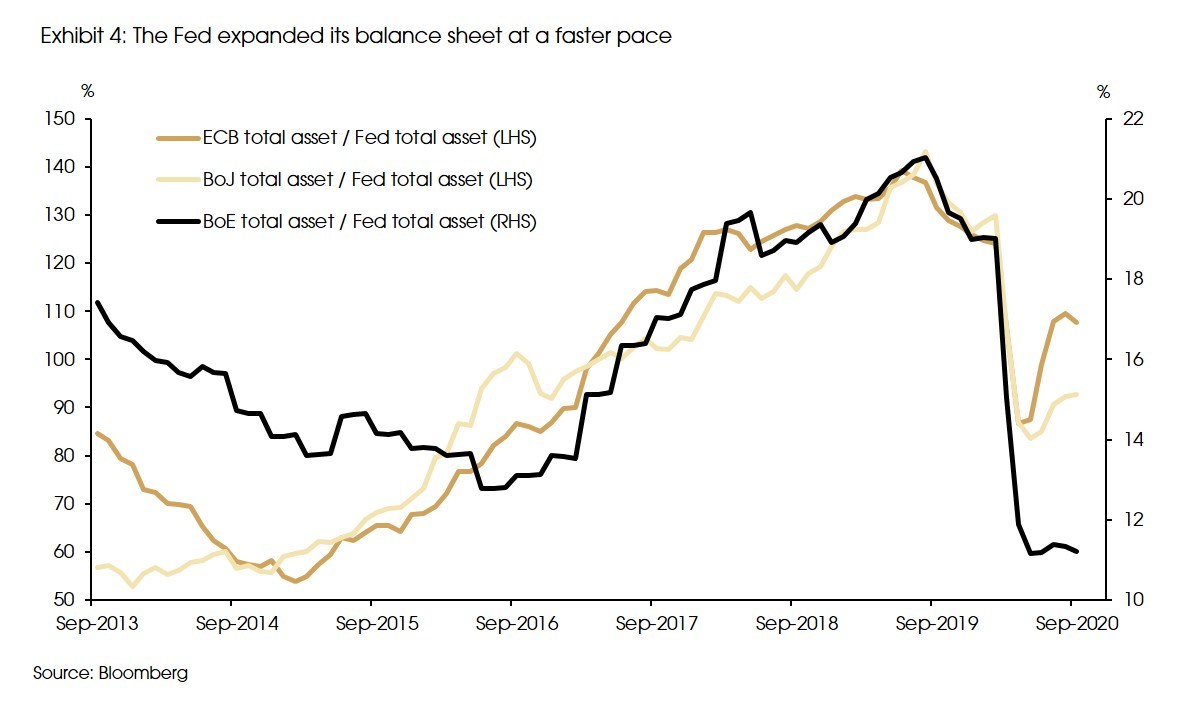

Moreover, after the pandemic, the Fed not only cut the policy rates to zero but also expanded its balance sheet at a faster pace compared with other central banks (Exhibit 4). As a result, money supply grew faster in the US: US M2 growth increased from 6.8% in February to 23.3% in August, while the Eurozone money supply growth only increased from 5.5% to 9.5%, and Japan increased from 2.7% to 7.1%, during the same period.

Such policy changes led to further decreases in interest gaps, most of which fell to, or even below, their end-2014 levels (before the Fed’s rate hike cycle). However, the dollar’s exchange rates are still stronger than or equal to that of the end-2017 levels in most cases (except the Swiss franc and Japanese yen, Exhibit 3). Thus, from the interest gap’s perspective, we see downward pressures for the dollar.

Looking forward, given the Fed’s “lower for longer” and the average inflation target policy, it’s hard to see monetary tightening from the US in the coming years. Therefore, the “fading yield advantage” scenario should persist in the foreseeable future and remain the key reason for the weakening dollar.

2. Relative economic strength: the US’s lead has also weakened

After the 2008 financial crisis, the US did have a stronger and faster recovery than other economies, especially the Eurozone.

A key reason for the difference in recovery is that after the 2008 crisis, sovereign risks dominated the headlines of the Eurozone economy. Countries like Greece were on the edge of economic collapse. Such risks only declined after multi-year and multiple bailouts. After the 2014 deal, it seemed like Europe was finally getting back on track, but then the UK erupted in chaos with the Brexit vote.

On the other hand, the US’s recovery did not encounter significant disturbance, and the 2018 tax cut further lifted economic growth prospects.

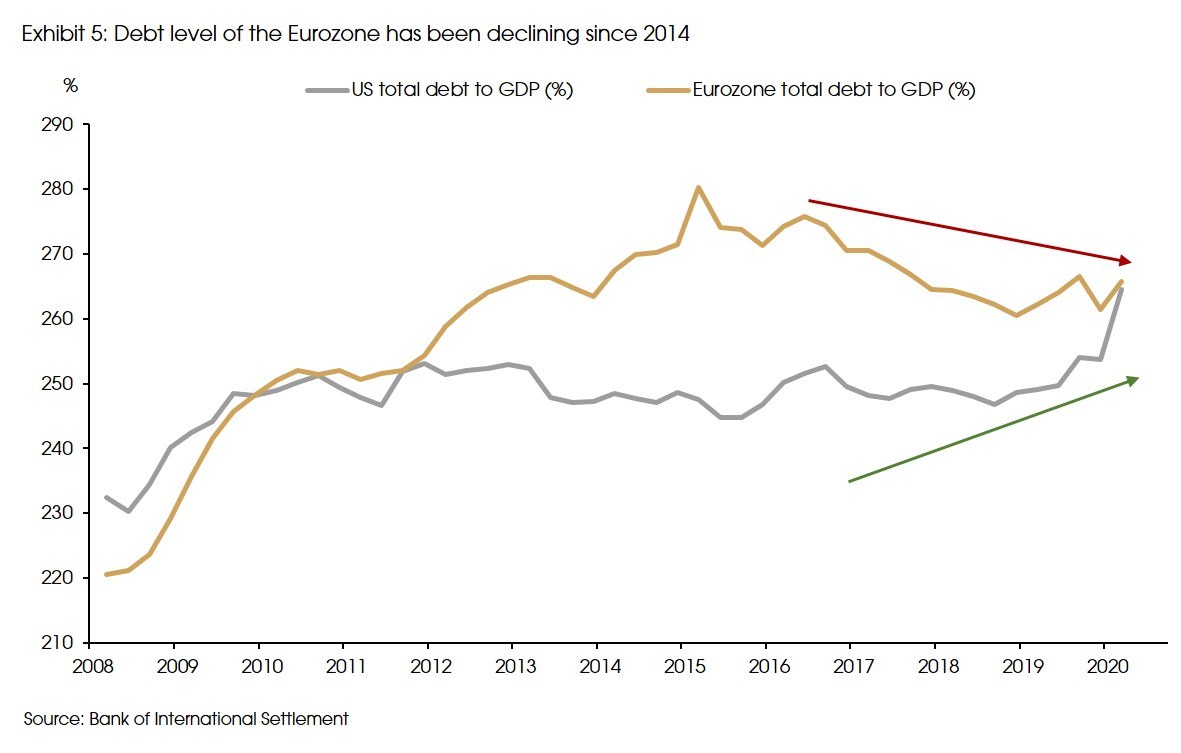

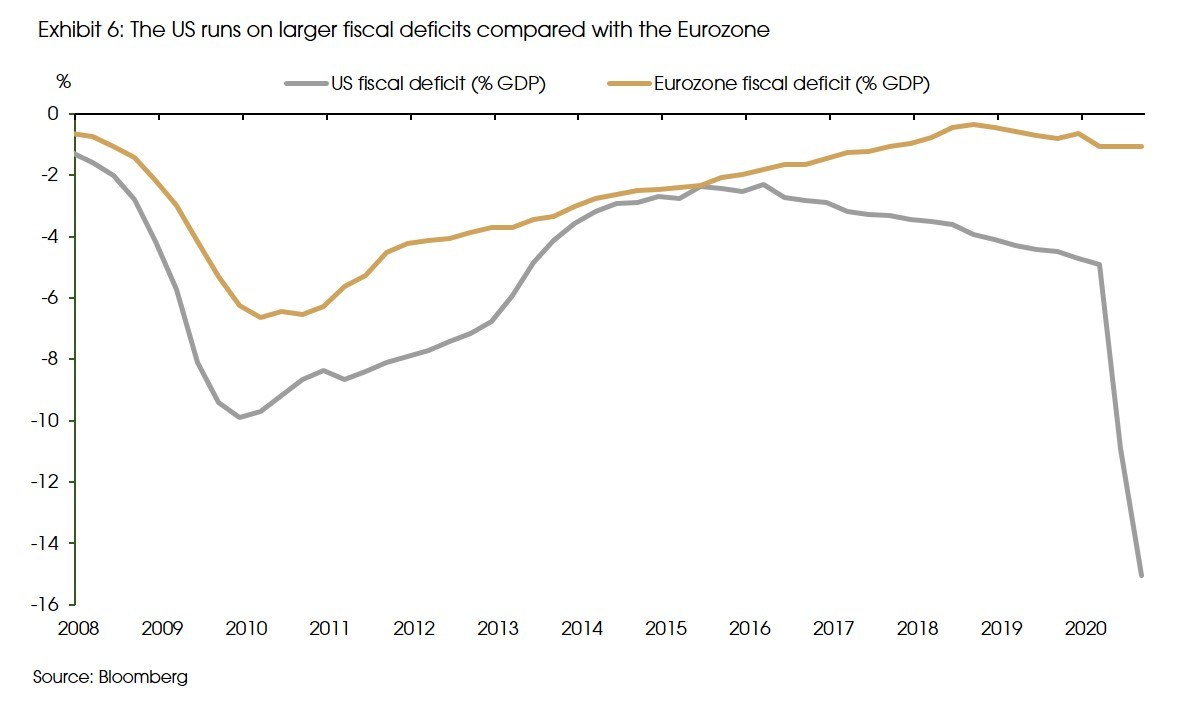

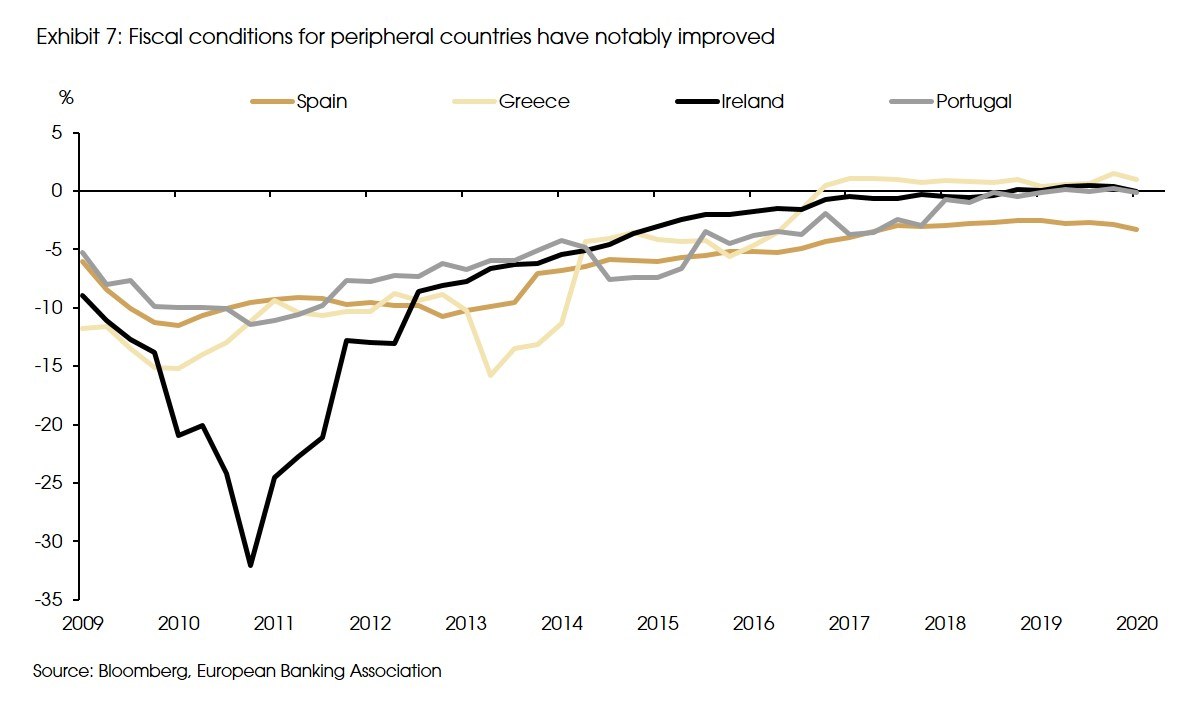

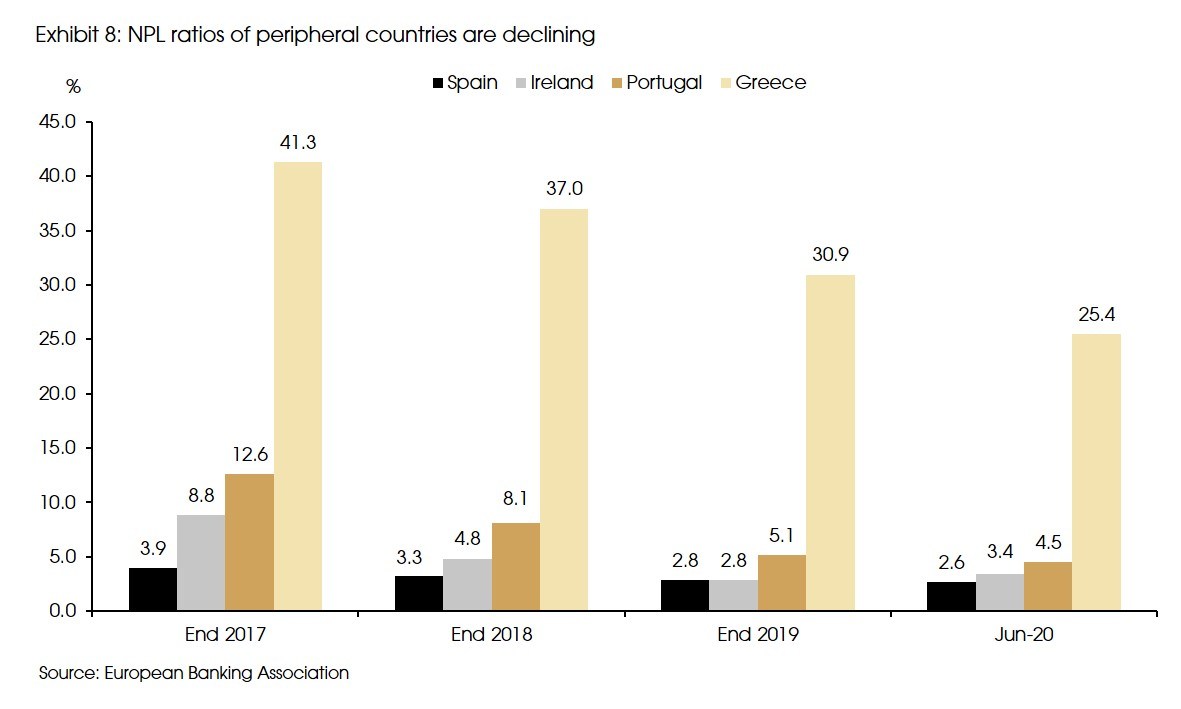

However, potential risks that widened the growth gap between the US and the Eurozone remain muted this time. Specifically, debt levels and fiscal deficits have been declining for the Eurozone, while both have been rising in the US (Exhibit 5, 6). Fiscal deficit to GDP ratios in peripheral countries (Portugal, Ireland, Greece, and Spain) have dropped below that of the US (Exhibit 7). Similarly, non-performing loan ratios for peripheral countries also kept declining after the launch of the EU bank stress test in 2016 (Exhibit 8), suggesting that the tail risk for the region remains limited for now.

Therefore, even though the eurozone economy may not be as solid as the US, improvements are notable. Moreover, with the launch of the recovery fund and the issuance of the Eurozone bonds, the improved risk-sharing and financial integration within the region will probably prevent a second crisis this time and put the Eurozone economy on a stronger foot compared with conditions after 2008.

One could expect that pressures from political risks would eventually fade and the Eurozone economic growth will catch up with their American counterparts. One example could be 2017, when major concerns regarding key elections receded, the Eurozone economy outperformed the US.

Therefore, as long as there are no tail risks among Eurozone countries, growth differences between the US and the Eurozone may not be as significant as the post-2008 period.

3. The rule of “twin deficits”: Fiscal and trade deficits are widening for the US

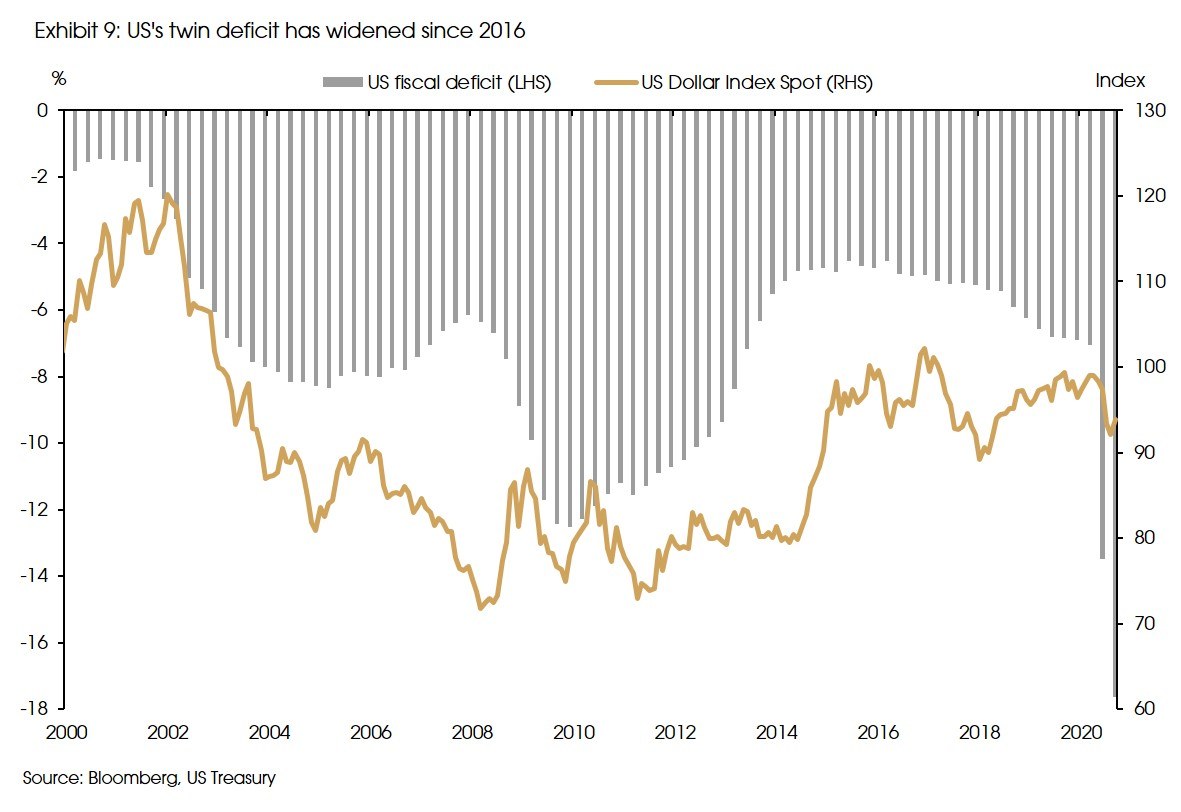

The US’s current account deficit widened from -2% at the end of 2016 to -2.6% now, while the fiscal deficit widened from -3% to -5% before the pandemic, and further to -15% after the large-scale stimulus.

In general, twin deficits (fiscal and trade deficit) conditions put downward pressures on currencies. For the US, the correlation between the dollar index and the twin deficit level is significant in the long run (Exhibit 9).

There are exceptions, though. The dollar did well during the early 1980s and 2018, even as the twin deficits widened. But it was mainly due to the Fed’s tightened policy stance and the increased attractiveness of the interest rates.

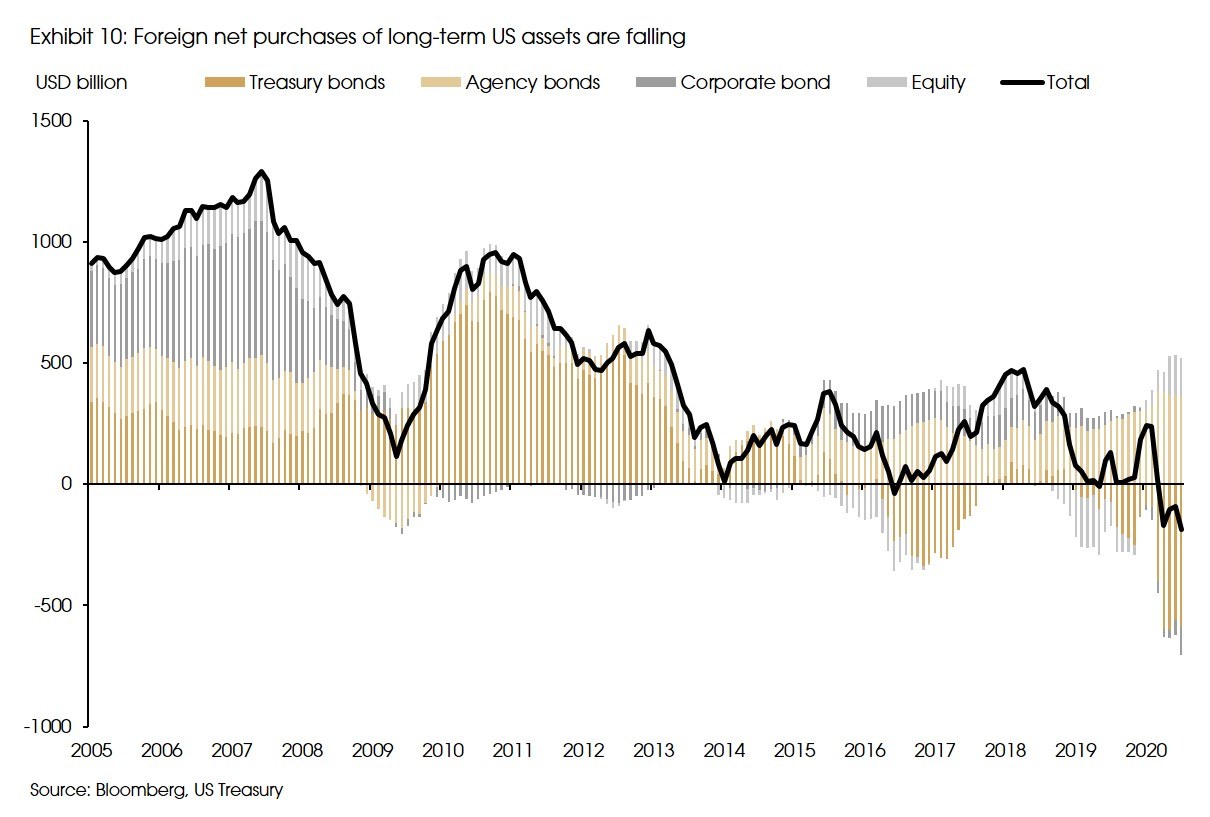

Another trend is that the net foreign purchases of long-term US assets have been falling in recent years, especially for treasury bonds (Exhibit 10). And from the perspective of the balance of payment, the annual current account deficit of USD 600 billion needs to be funded by capital inflows. However, with the long-term portfolio net inflows falling and turning negative recently, and the net FDI inflow stayed at around USD 300 billion in recent years, the US needs to rely heavily on short-term capital inflows as its external funding.

However, the “lower for longer” monetary stance and the large fiscal deficit suggests that the short-term interest rates should be held at around zero for quite a while, which would depress such short-term flows.

As a result, the widening current account deficit, the weak long-term capital inflows, and the low interest environment will all dampen the strength of the dollar.

4. Challenges arise for dollar demand in global trade and foreign reserves

As a dominant currency in trade settlement, the US dollar comprises more than 40% of global trade settlements. The demand for the dollar could increase after the pandemic, given a possible rebound in trade volume. However, such an impact should mainly be limited to the short-run. Regarding the long run, however, rounds of tariffs and sanctions between the US and China suggest that the global trade order could be vulnerable to inconsistent trade policies due to leadership succession.

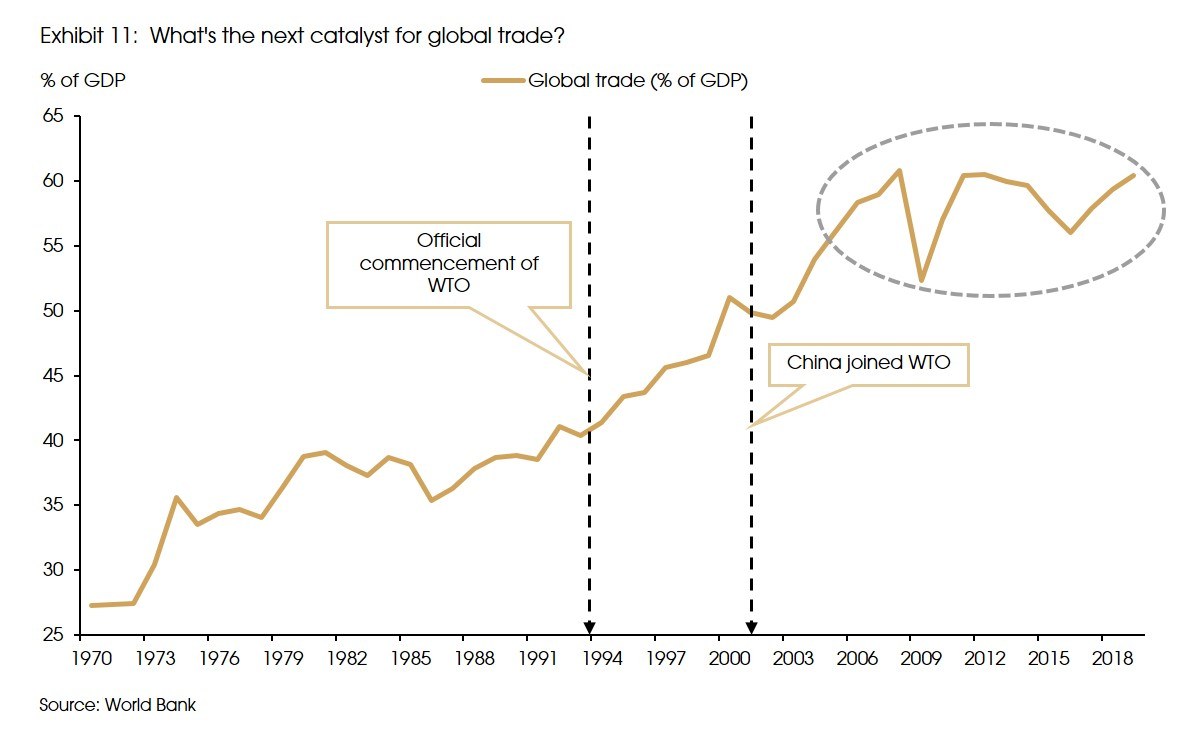

The share of global trade to GDP was significantly lifted by the establishment of the WTO in 1994 and China’s entrance in 2002 (Exhibit 11). However, looking forward, positive catalysts for global trade growth remain muted, as an anti-globalization trend could persist regardless of the potential mitigation of US-China relations.

Similarly, the increased policy uncertainty of the US has led to concern that American institutions might be too weak now for the world to rely on the dollar. Moreover, regardless of the election result, it is highly likely that, in four years, we will have another US president. Thus, whatever policies implemented after the election could still be short-lived. Political uncertainties will reduce the demand for the dollar as a reserve currency.

5. How weak can the dollar go?

In sum, most indicators suggest a continued dollar weakness. Meanwhile, it is hard to make a strong case for a strengthening dollar unless tail risks emerge in other major economies, or the Fed sends a clear signal for monetary tightening. It is hard to imagine scenarios for a rising dollar

However, it is also hard to imagine a sharp depreciation of the dollar against major currencies, especially given the negative interest rates in the Eurozone and in Japan.

We should also keep in mind that strong currencies could lead to unwanted headwinds for economies whose exports still play a significant part, such as the Eurozone, Japan, and China. The ECB has already expressed concerns about the rising euro and the Chinese government also reduced the foreign exchange risk reserve rate to stabilize the currency and to prevent it from a potential fast appreciation against the dollar.

Therefore, we expect to see only mild depreciation of the dollar.

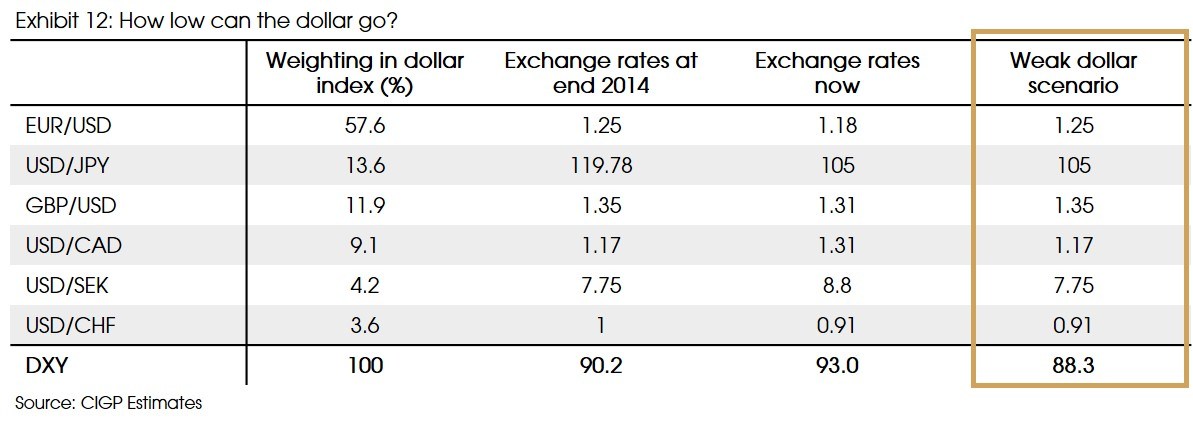

A rough estimation of the weak dollar index level can be calculated by choosing the weaker one between the current and 2014 levels (when the yield gaps were comparable to the current ones). Such calculation leads to the result of 88.3 for the dollar index.

6. Strong fundamentals boosted the RMB, but risks remain

China’s recovery outperformed most other economies so far, and according to IMF’s forecast, China will be the only major economy with positive GDP growth this year.

The pandemic was better controlled in China, with no major second or third waves, which helped support a relatively fast recovery compared with other major economies. After the -6.8% yoy fall in the first quarter, China’s GDP growth turned positive in the second quarter and further increased to 4.9% in the third quarter. However, negative growths in the US, Eurozone and Japan are expected to last for at least three quarters.

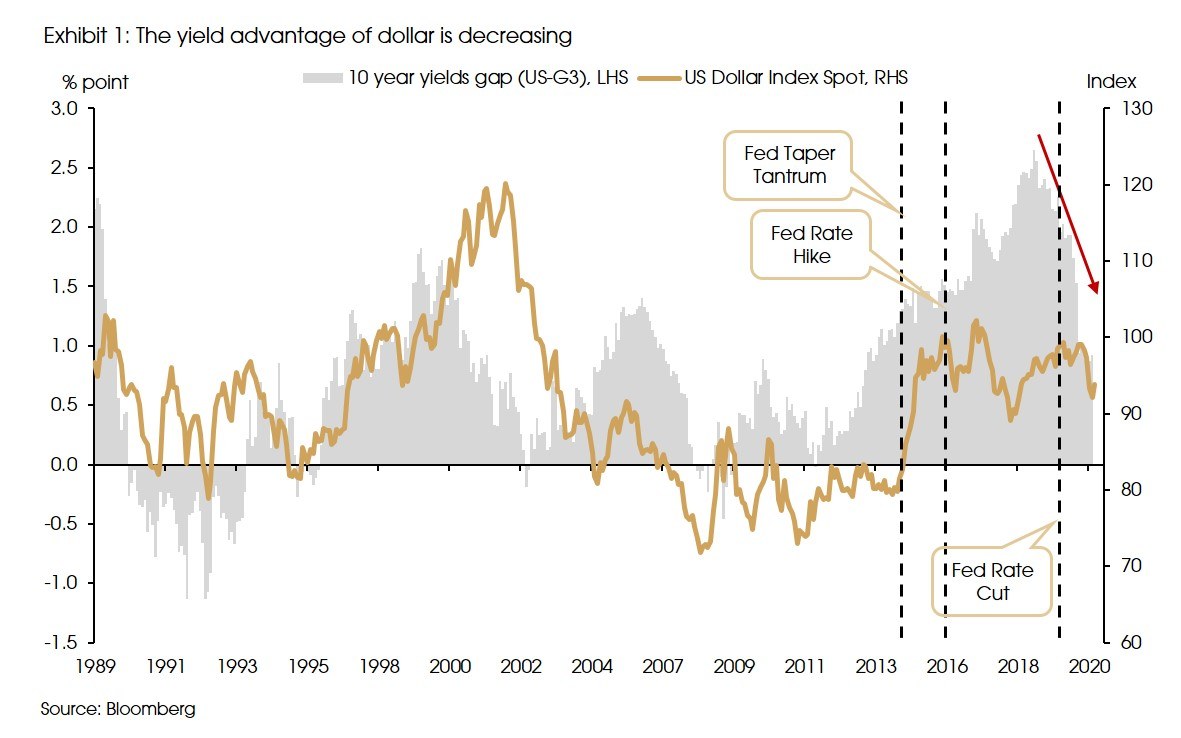

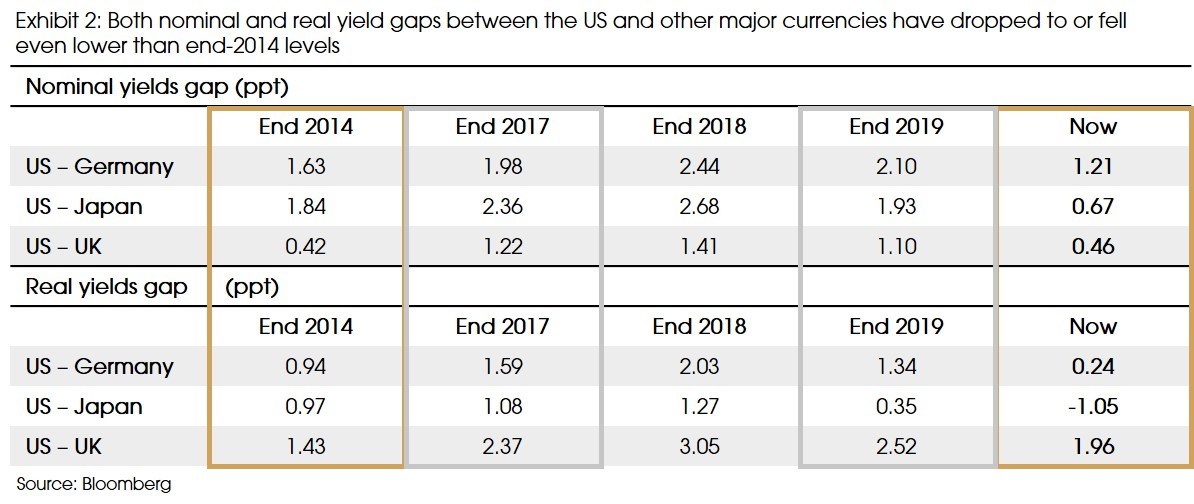

As a result, both growth and interest rate gaps between China and the US have widened (Exhibit 13, Exhibit 14), and the RMB has appreciated against the USD by more than 4% this year.

However, whether such momentum will continue merits further observation.

First, China’s recovery advantage was mainly from the production side, given its better control of the pandemic. Production activities in China recovered faster than the rest of the world, which leads to strong exports growths in recent months, especially for the pandemic-related ones, such as medical goods, home appliances, and decorations.

However, such strong growth may not be sustainable. The pandemic conditions in other economies will improve, and their production recovery should catch up, reducing the external demand for China and narrowing its growth advantage. Therefore, the growth gap between China and the US is expected to reach above 8% in the recent two quarters but will fall back to 5% in 2021.

Second, despite the recent liberalization and internationalization of the RMB, it is still managed by the central bank and subject to policy decisions. A fast appreciation will not only cause higher volatility in the foreign exchange market but could also hurt exports (contributing 20% of GDP and employment), and will do no good to the economy.

Finally, except for the fundamental strength, the market’s bullish call on RMB is also based on the hope of a potential Biden presidency. However, in our view, the US’s hawkish stance towards China is one of the very few bi-partisan agreements in recent years. Even with Biden’s presidency, the US’s foreign policy may turn from unilateral to multilateral. Improvements in relations should happen between the US and its allies instead of between the US and China.

Therefore, we do not expect to see substantial improvements regarding US-China relations, regardless of the election outcome. Under a potential Biden government, conflicts may only change from trade to other areas, such as geographical issues regarding the South China Sea, human rights issues in Hong Kong and Xinjiang, and intellectual property issues.

In 2019, the prolonged conflicts between the US and China has led to a 4% depreciation of the RMB during the first three quarters, despite China’s fundamental improvements in both growth and interest rate.

Therefore, given the above observations, we only expect to see mild appreciation of the RMB against the dollar in the future.