CIO Viewpoint: What to Expect after the US Election

More than two weeks after the election, Pennsylvania, Michigan, and Georgia finally finished their vote count or recount, and officially certified the respective states’ electoral votes to President-elect Joe Biden, blowing Trump's long-shot attempt to overturn the result.

Trump's continuing denial of his election defeat is inflicting enormous damage on the foundation of American democracy and recklessly inflaming destructive passions. Going forward, we expect that pressures against Trump’s “fraud and stolen” rhetoric would arise within the Republican party.

Therefore, despite the remaining recount in Wisconsin and the ongoing legal claims, Trump’s arguments are supported by little evidence, and the Biden presidency seems unchallengeable.

For the election, one last thing to watch is the two run-offs for the Senate seats in Georgia, scheduled on January 5th. Republicans already secured 50 seats in the Senate and only need one more seat to win. Given Republican Senator David Perdue’s notable lead during the first round, a split Congress, i.e., Republican Senate - Democratic House, is highly likely.

1. First things first: deal with the pandemic and pass the stimulus package

After the election, the focus has switched to Biden’s ability to push his agenda through Congress. Given the continuously rising number of new COVID-19 cases and Biden’s own campaign agenda, measures to contain the virus and repair America should be the priority.

Biden has already announced a COVID-19 advisory board with infectious-disease experts and updated the seven-point plan to beat the pandemic. Specific actions include providing nationwide free testing, implementing mask mandates and clear guidance, and rejoining the WHO to coordinate with the global response and obtain more information. Opposing Trump’s passive dealing of the pandemic, we expect Biden’s actions to be more effective and could limit the health and economic damage.

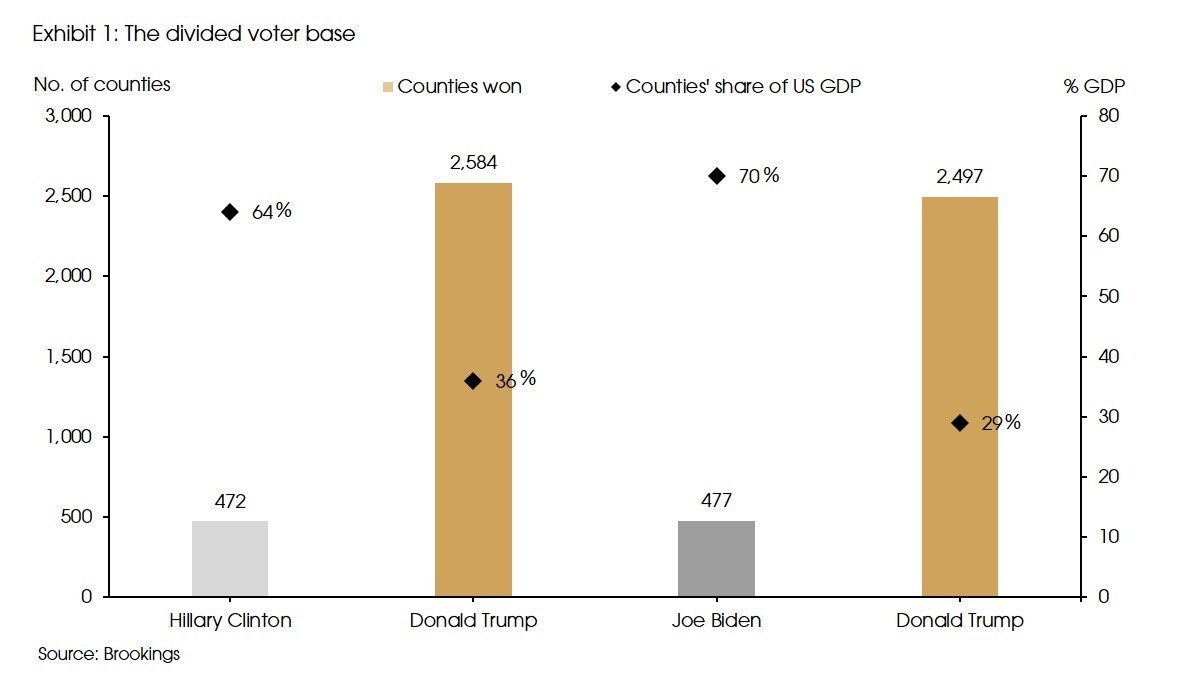

Education spending runs a close second. The election results, again, showed a deep divide between big cities and rural areas. Biden only won 477 counties, but mostly big cities with well-educated populations, accounting for 70% of the US GDP. On the other hand, Trump won 2,497 counties, mostly in rural areas, representing only 29% of GDP (Exhibit 1). To get anything done, Biden needs to appeal to those left behind.

One way to address this issue is through education, which is especially important after the pandemic, as the US is now a country where nearly half the voters are deeply suspicious of scientists and public-health experts. Moreover, according to McKinsey’s estimates, the divide of access to online education resources may lead to a learning gap between children from high-income and low-income families during the pandemic. 15-16 million K-12 public school students would be affected and could lose USD 61,000 - USD 82,000 in lifetime earnings on average, which may further widen the inequality gap.

Therefore, Biden may take quick actions on education spending after taking office. Possible measures include student-debt forgiveness and aids to public schools to provide adequate device for distance-learning at home.

A new fiscal package is needed to fund such spending, which could be challenging given the likely Republican-controlled Senate. However, the previous negotiations showed that major disagreements between the two parties were mainly on the total scale of the package and the funding to local governments. Meanwhile, pandemic related funds (such as providing USD 1,200 subsidy to individuals, financial aids to airline companies, etc.) should not face notable headwinds. Therefore, a smaller stimulus package of USD 0.5-1 trillion should be able to pass the new Congress early next year.

However, except for the above measures that are directly related to the pandemic and those that have already been discussed by the two parties before the election, there is little hope for a progressive agenda on a “green new deal”, healthcare reform, and tax hike.

2. Energy sector: a “green” transition is still possible, but mainly through regulations

Republicans have a history of ignoring fiscal deficits when the president is one of their own, for example, Trump’s USD 1.5 trillion tax cut in 2017, but will restore fiscal discipline when there is a Democrat in the White House. Therefore, the odds of having a large fiscal stimulus that funds Biden’s clean energy ambitions will significantly decrease under a Republican-controlled Senate.

However, Biden’s government may reverse Trump’s soft regulations towards CO2 emissions and oil and gas exploration.

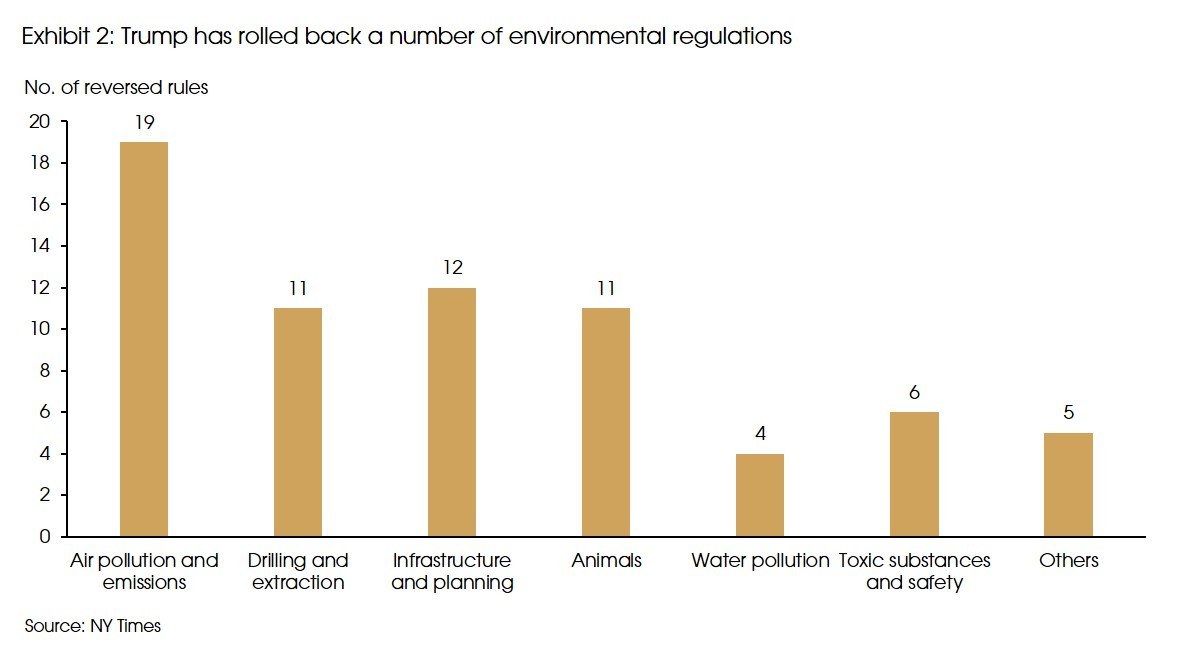

Specifically, Trump has repeatedly emphasized “freeing” the US energy industry from regulation since his campaign in 2016. During the past three years, the Trump administration has reversed around 70 major environmental rules (with 30 still in process) that is deemed burdensome to the fossil fuel industry, even as climate change accelerates (Exhibit 2). For example, Trump relaxed the Obama-era emissions rules for power plants and vehicles, and now both China and India plan to have stricter passenger car emission standards in 2025 than the US.

Biden would redirect regulations towards “zero-emission” of vehicles and power plants, ban fracking on public lands, hold on off-shore drilling, and stop giving out liquid natural gas (LNG) export permits. Talking about the renewable energy transition that does not threaten the community relying on these non-outsourceable high paying jobs is difficult.

However, globally, the “green transition” is already happening and will continue regardless of the US policy. According to EIA’s estimate, crude oil’s share of total global energy consumption will drop from 32% to 28% in 2030, while renewable energy’s share will rise from 17% to 21% (please refer to our Focus: Renewable Energy Revolution for more details).

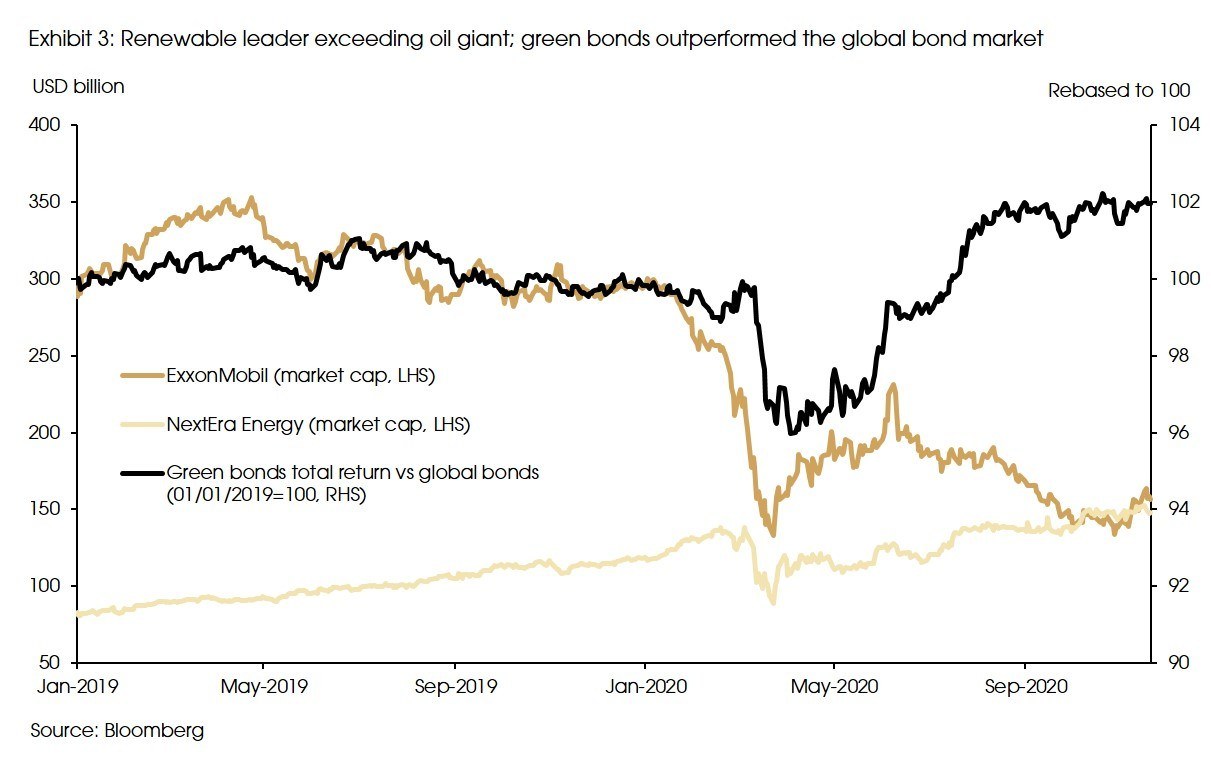

Boosted by such a secular change, investors are flocking into “green themes”, such as renewable companies and socially responsible (ESG) investments. ExxonMobil, once the biggest public company in the world’s oil and gas sector, has been bypassed by NextEra Energy, the world’s largest solar and wind power generator in terms of market capitalization. ExxonMobil lost more than a half of its market cap during the past two years and was recently removed from the Dow Jones Industrial Average Index. Meanwhile, NextEra Energy gained more than two-thirds in market capitalization.

The rise of renewable investment not only reflects the decrease in oil consumption but also suggests strong investor desires for steady yields at a time of low interest rates. We are positive on the energy transformation even if there is no “green new deal” under a split government.

3. Big tech firms could be relieved in the short run, but long term risks still exist

A Republican-controlled Senate may prevent any talks of tax hikes, as it is a red line for Senate majority leader Mitch McConnell, which will provide relief for the general corporate sector, including big tech firms.

Moreover, unlike other progressive party members such as Elizabeth Warren and Bernie Sanders, as a moderate Democrat, Biden has never made the argument of breaking up big tech firms and has been relatively quiet on the tech giants. Therefore, we do not expect to see much heat on big tech firms at least for the short run.

However, it is a bi-partisan agreement to launch the antitrust investigations against the four leading tech companies, and both Trump and Biden have mentioned to revoke Section 230 of the Communications Decency Act (CDA).

Section 230 shields online platforms from legal liability of content generated by third-party users. This immunity enabled tech firms to utilize the creativity of hundreds of millions of individual users and achieved far more than traditional producers of content (e.g. the online versions of newspapers).

Over the course of the last year, Trump has threatened to revoke Section 230 because he believes the tech companies use their moderating authority to suppress conservative views. Biden has also mentioned to repeal Section 230, but his focus is on harmful content rather than censorship.

Therefore, even with similar conclusions, the reasons and purposes of removing Section 230 are quite different between the two parties, which may be politically challenging in a divided government. However, in the long run, lawsuits against big tech firms are still possible. The Justice Department (DoJ) has already filed an antitrust lawsuit against Google, and the Federal Trade Commission (FTC) is moving closer to a lawsuit against Facebook, and such antitrust lawsuits can last for years.

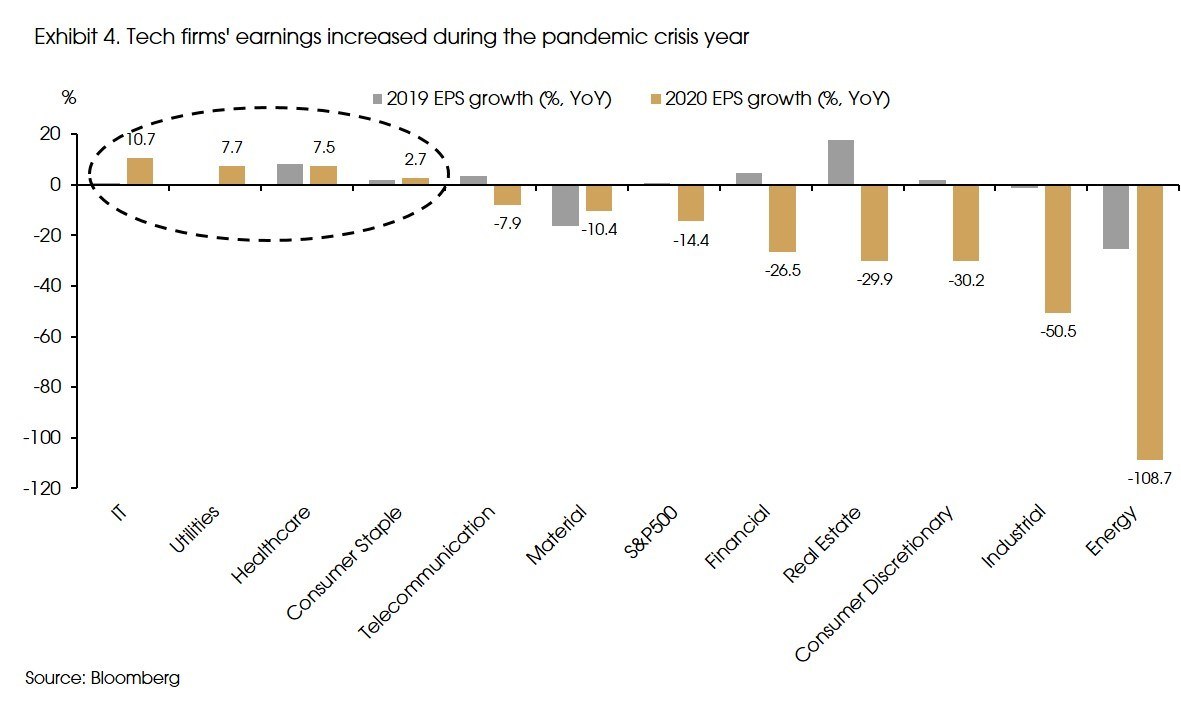

That said, given the 1998-2001 Microsoft case, which ended up with a mild settlement, we do not expect to see real severe impacts from the antitrust investigations. As a clear winner (in terms of earnings) during the pandemic era (Exhibit 4) and with the reduced legal risks under a split Congress, we remain positive on this sector.

4. Healthcare: mind the drug prices

Policies related to healthcare see a notable divergence between the two parties. Biden wants to restore Obamacare, while Republicans think this as costly for both the government and individuals. Therefore, nothing radical is expected under the new government. However, something could be done to reduce drug prices, as it is a bi-partisan agreement.

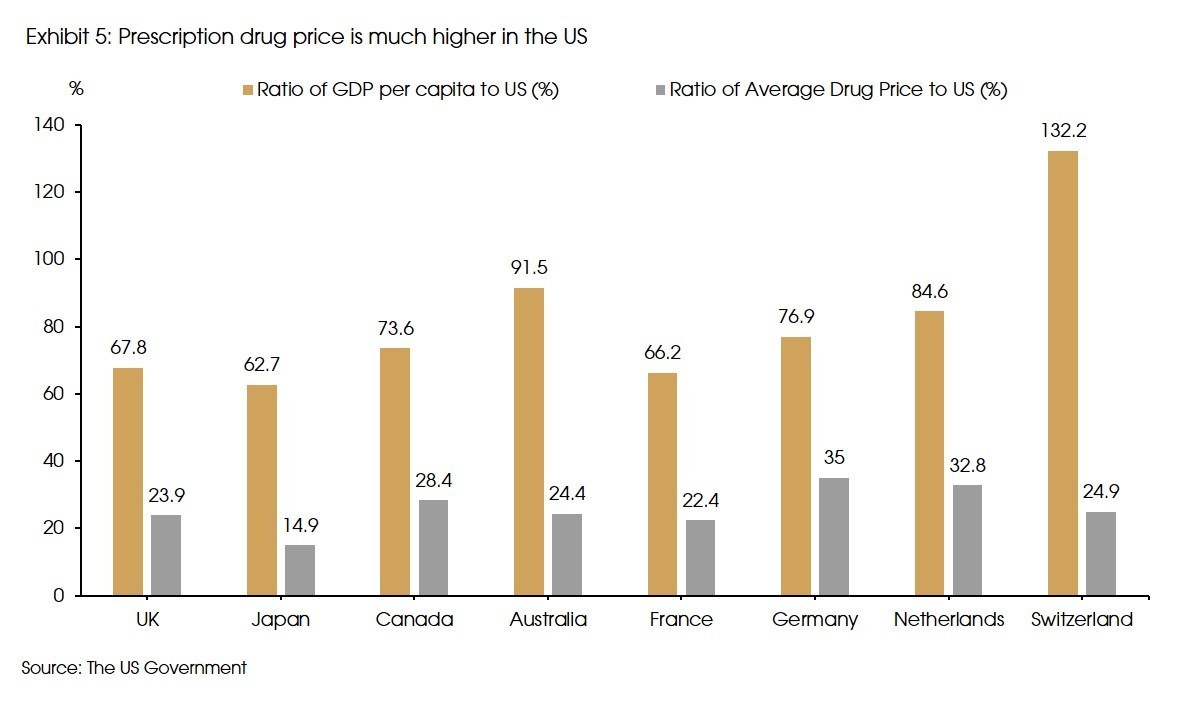

Specifically, according to a study by the US government, the US spends more on drugs than other comparable developed countries (Exhibit 5), which could have negative impacts on the US consumers and taxpayers.

In response to the rising cost of drugs, many experts and stakeholders have suggested that Medicare should leverage its massive purchasing power to negotiate prescription drug prices on behalf of beneficiaries.

According to another study by the Government Accountability Office, from 2006 to 2015, the top 25 pharmaceutical companies’ average sales revenues increased by USD 241 billion, but R&D funding only increased by USD 7 billion, which could well support the argument of negotiating a lower drag price.

Lower drug prices should create some downward pressures on big pharmaceutical companies. Still, we expect such policy to be mild, at least before the pandemic is well under control, as the government still needs to rely on these pharmaceutical firms to develop and handle the vaccines.

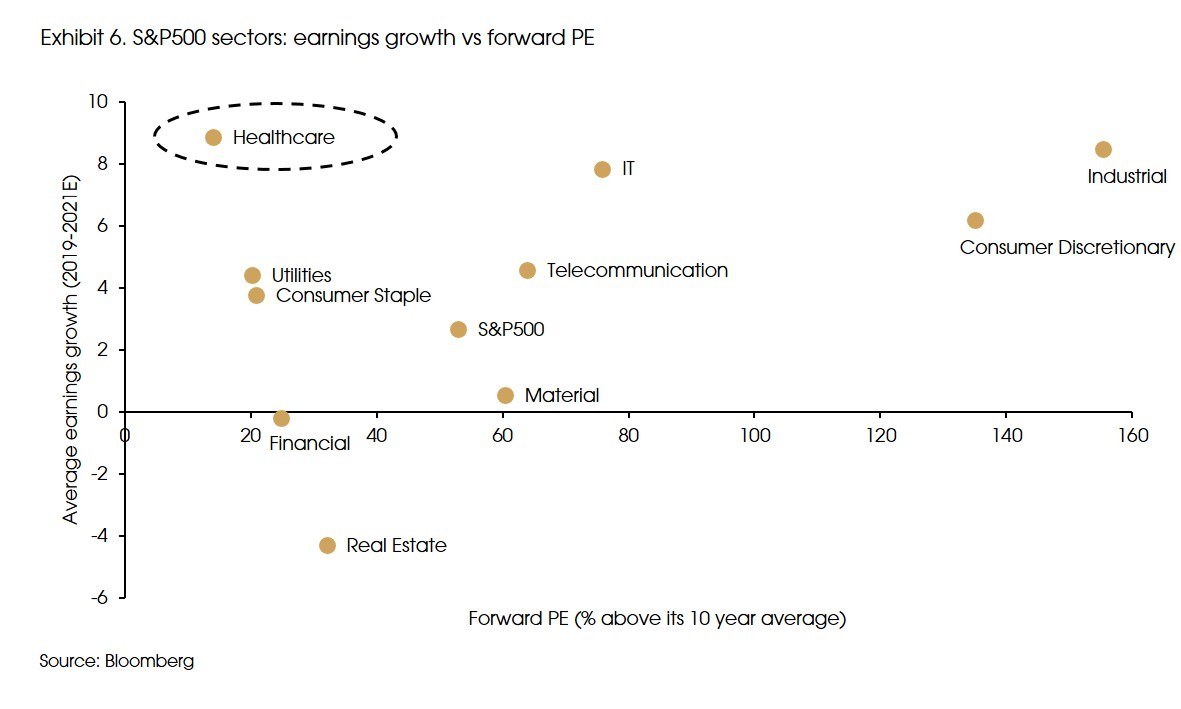

Moreover, the healthcare sector’s earnings growth remained stable during the pandemic, while its P/E ratio only increased moderately compared with other sectors (Exhibit 6). Thus, we still see the sector as attractive.

5. International relations: re-align with allies

Biden’s campaign of “build back better” prioritizes domestic policies, but there might be several quick actions regarding international relations, such as rejoining the World Health Organization and the Paris Agreement, bringing the US back to the Iran nuclear deal, and probably rejoining the Trans-Pacific Partnership (TPP).

However, such restoration in international relations should be limited to the US’s allies. Normalization in US-China trade relations may not happen, as the US’s hawkish stance towards China is one of the very few bi-partisan agreements in recent years. Moreover, a possible revival of TPP may put some pressure on China, as the TPP was part of the Obama administration’s “Pivot to Asia” strategy, designed to counter China’s growing clout. That said, the recently signed Regional Comprehensive Economic Partnership (RCEP) would mitigate such unfavorable impacts.

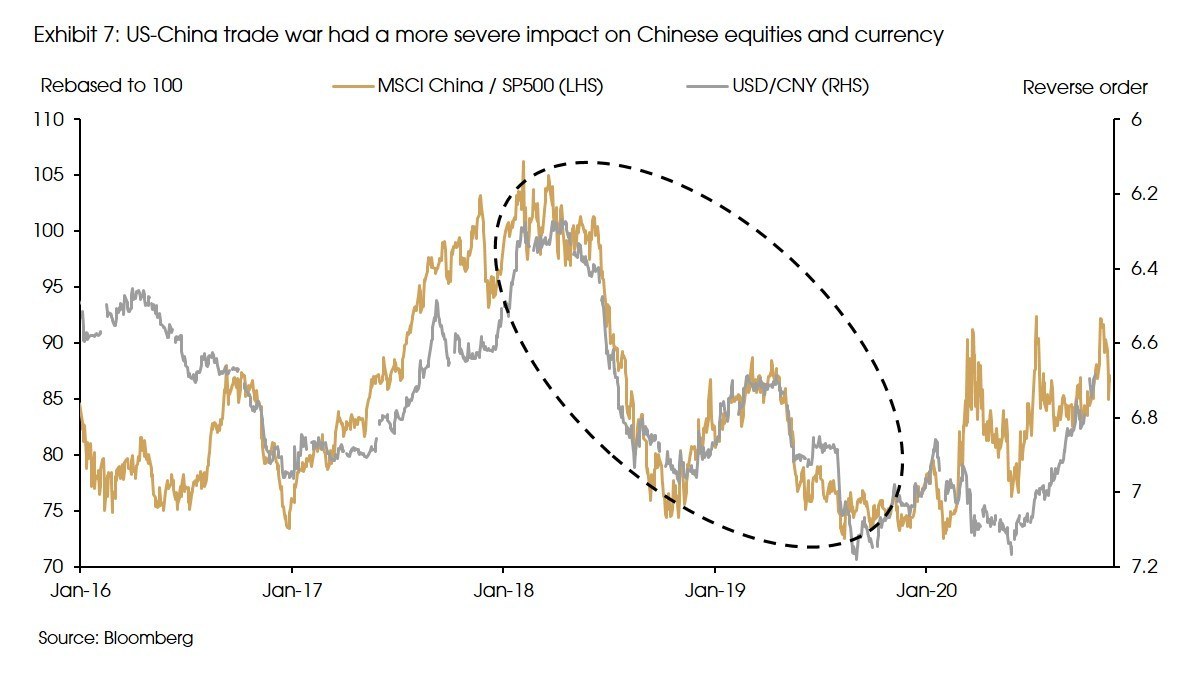

Meanwhile, we do not expect to see serious escalation of trade conflicts under the Biden government, given that the US’s foreign policy is turning from unilateral to multilateral. Even without repealing the tariffs, the potential tariff and sanction truce should benefit the Chinese economy and assets. The US-China trade war had a more negative impact on Chinese assets (Exhibit 7). During the past two years (2018 and 2019), the MSCI China index underperformed the S&P500 index by around 30%, while the Chinese yuan also depreciated against the US dollar by 12.5%.

A potential stable US-China relation may provide a stable external environment for the Chinese market, supporting Chinese assets in general. One caveat here is: back in 2016, the market was also optimistic on US-China relation after Trump got elected, believing that a US president with a business background is better than one aggressively promoting US democratic values abroad or bolstering US allies in Asia.

6. Implications on the market: low interest rate low growth scenario should persist

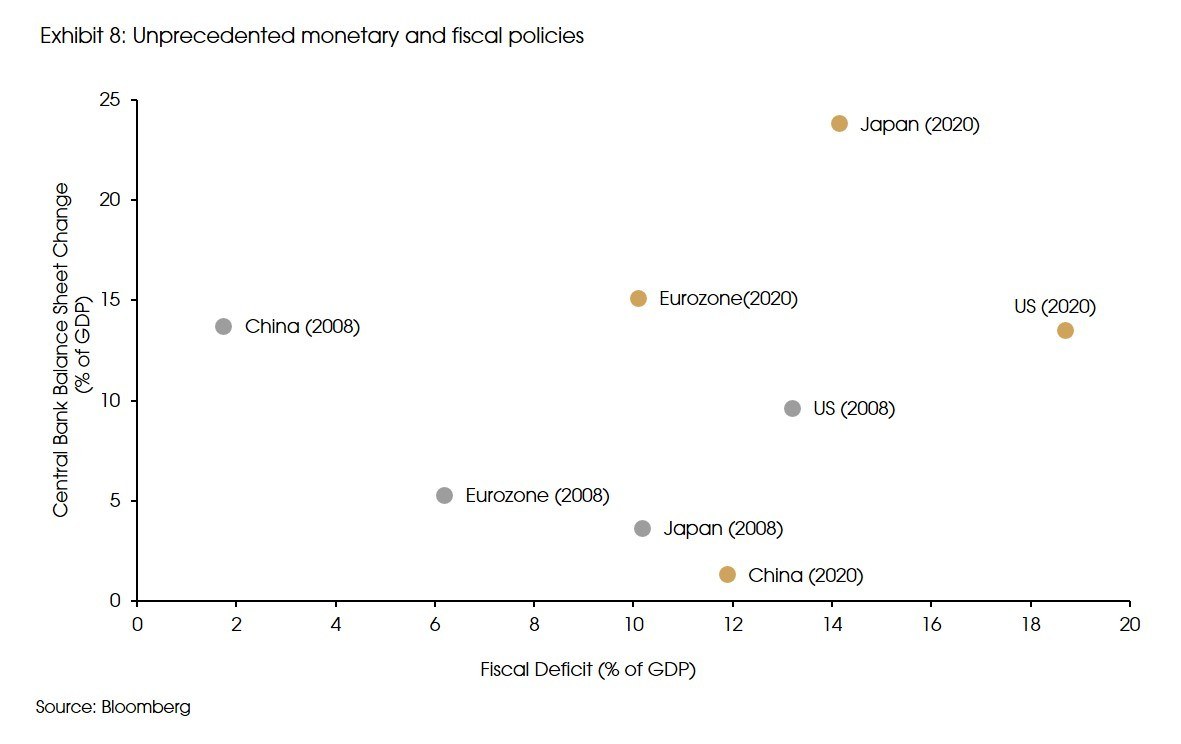

A possible split government will limit the scope and scale of fiscal policies. However, even with no further fiscal stimulus, the policy actions (monetary and fiscal) are unprecedented after the pandemic outbreak (Exhibit 8). Given the high debt levels, high unemployment rate, and weak inflation pressures, we see limited chances of unwinding these ultra-loose policies.

Moreover, uncertainties regarding the policy settings are balanced to the dovish side. Biden will probably name the former Fed Chair Janet Yellen as the new Treasury secretary, and Yellen is considered as the more dovish monetary policymaker. If the former Fed Chairman could build a closer relationship with the current one (Jay Powell), we may avoid the current situation that the US Treasury moved to wind down several emergency lending facilities at the central bank.

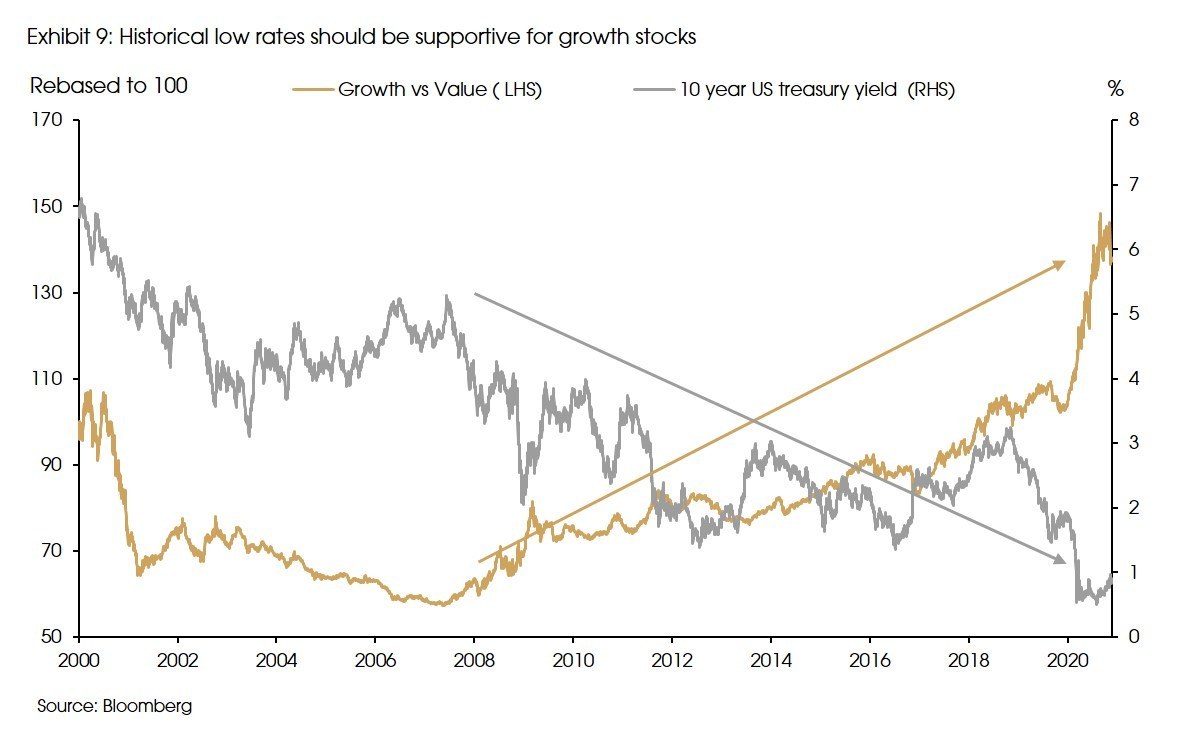

Thus, given the current favorable policy stance with some possible upside from a more collaborating Fed and US Treasury, low interest rates should continue in the foreseeable future, providing a favorable environment to risk assets and growth stocks (Exhibit 9).