CIO Viewpoint: Are Higher Taxes Really Disastrous?

The Biden-Harris Administration's first 100 days have been productive. The government passed the USD 1.9 trillion American Rescue Plan to fight against the pandemic and proposed two additional multi-trillion-dollar plans to rebuild the US economy. These three plans entail nearly USD 6 trillion of government spending in total.

To fund such large spending, the Biden administration proposed to increase taxes on corporations and higher-income individuals. However, such tax hikes have provoked strong opposition from the Republican Party and triggered notable concerns in the market.

We are well aware of these concerns and fears. Indeed, higher taxes will eat into companies' profits and set higher bars for companies' capital investment decisions. No one is happy to give an increased portion of their income to the government. However, from a more macro perspective, there is no convincing evidence showing that lower taxes will encourage capital investment or lead to higher growth. Tax is only one of the many factors that affect business decisions and individual behaviors.

We try to take a more detailed look at Biden's tax plan and address its possible impacts on the economy and the market.

Biden's tax plan: the first major hike in 30 years

Biden's economic plans reflect a significant policy shift among major economies during the pandemic-led recession, from more prudent fiscal stances seen in the previous recessions to a more aggressive response this time.

The main components in Biden's economic plans include: 1) large income redistribution through tax and government transfer system, 2) increased government spending to address the pandemic, climate change, and infrastructure, 3) stronger monetary and fiscal policy actions against underemployment, low growth, and low inflation.

Based on a more Keynesian stance, whereby governments should play an active role and adopt expansionary policies to drive up aggregate demand and economic growth, Biden proposed two additional proposals to boost the US economy after signing the American Rescue Plan into law.

Specifically, the American Jobs Plan is to make a historic investment in the US's infrastructure and create millions of jobs, and the American Families Plan aims to rebuild the American middle class. These two plans will be requiring a total of USD 3.5 trillion government spending.

However, such large-scale spending cannot be solely funded by issuing debt. The US government debt has already reached USD 26 trillion (107% of GDP) by the end of 2020, far exceeding the existing 22 trillion debt ceiling. Although the debt ceiling will probably be adjusted upwards, considering the pandemic impact, further significant debt increases could deteriorate disputes between the two parties and create funding gaps. Significant funding gaps would lead to government shutdown, increase sovereign risks, trigger turmoils in the financial market, and drag down GDP growth. For example, according to data from the US government, the 2013 and 2018 government shutdowns led to 0.6% and 0.1% decline of GDP, respectively.

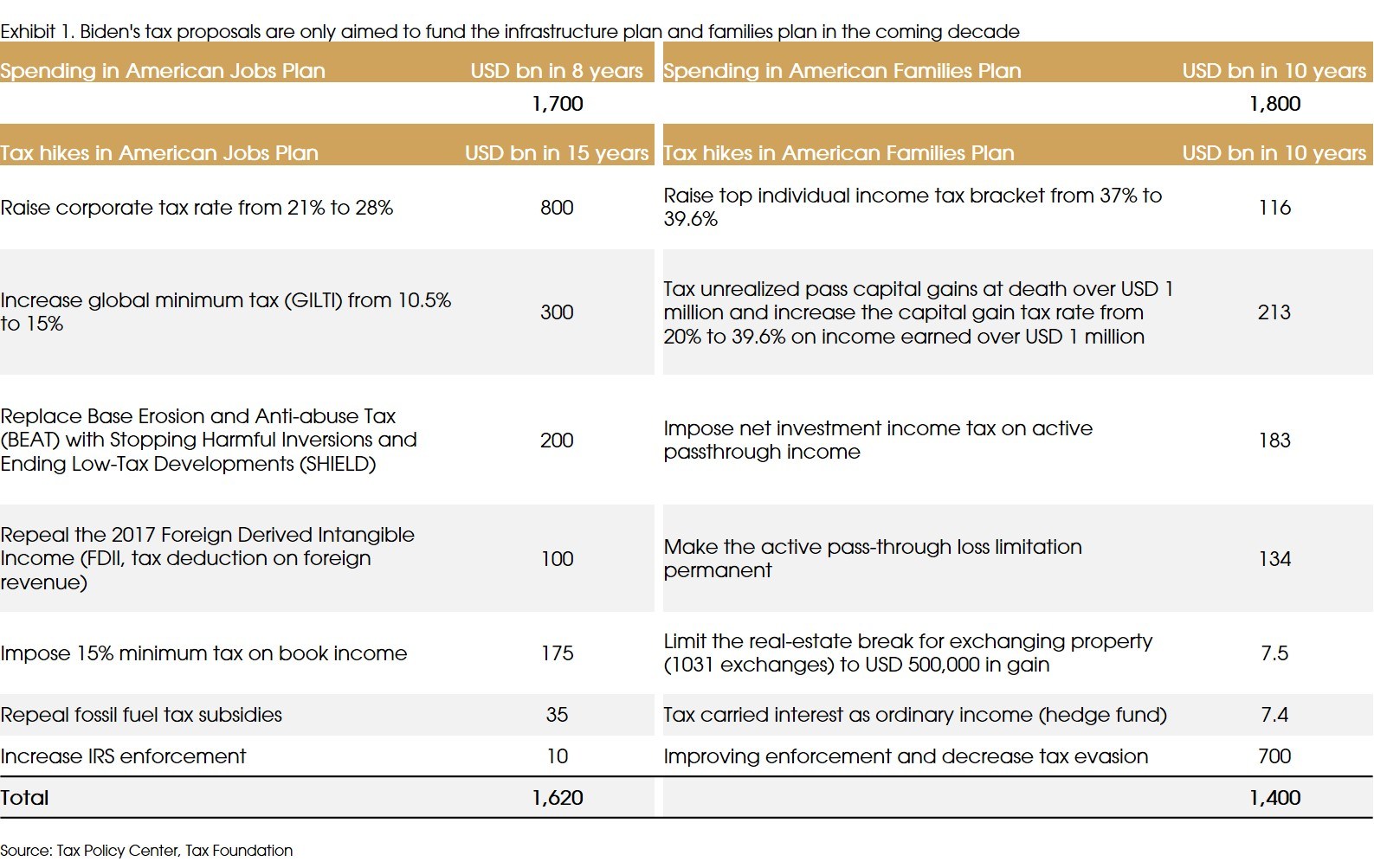

Therefore, the Biden-Harris government proposed more than a dozen significant changes to the US tax code, raising around USD 3 trillion to partially fund the increased spending (Exhibit 1). Among all the tax measures, the corporate tax hike (from 21% to 28%), the 15% global minimum tax, and the capital gain tax hike will be the major contributors of the increased revenue, thereby attracting more attention from the market.

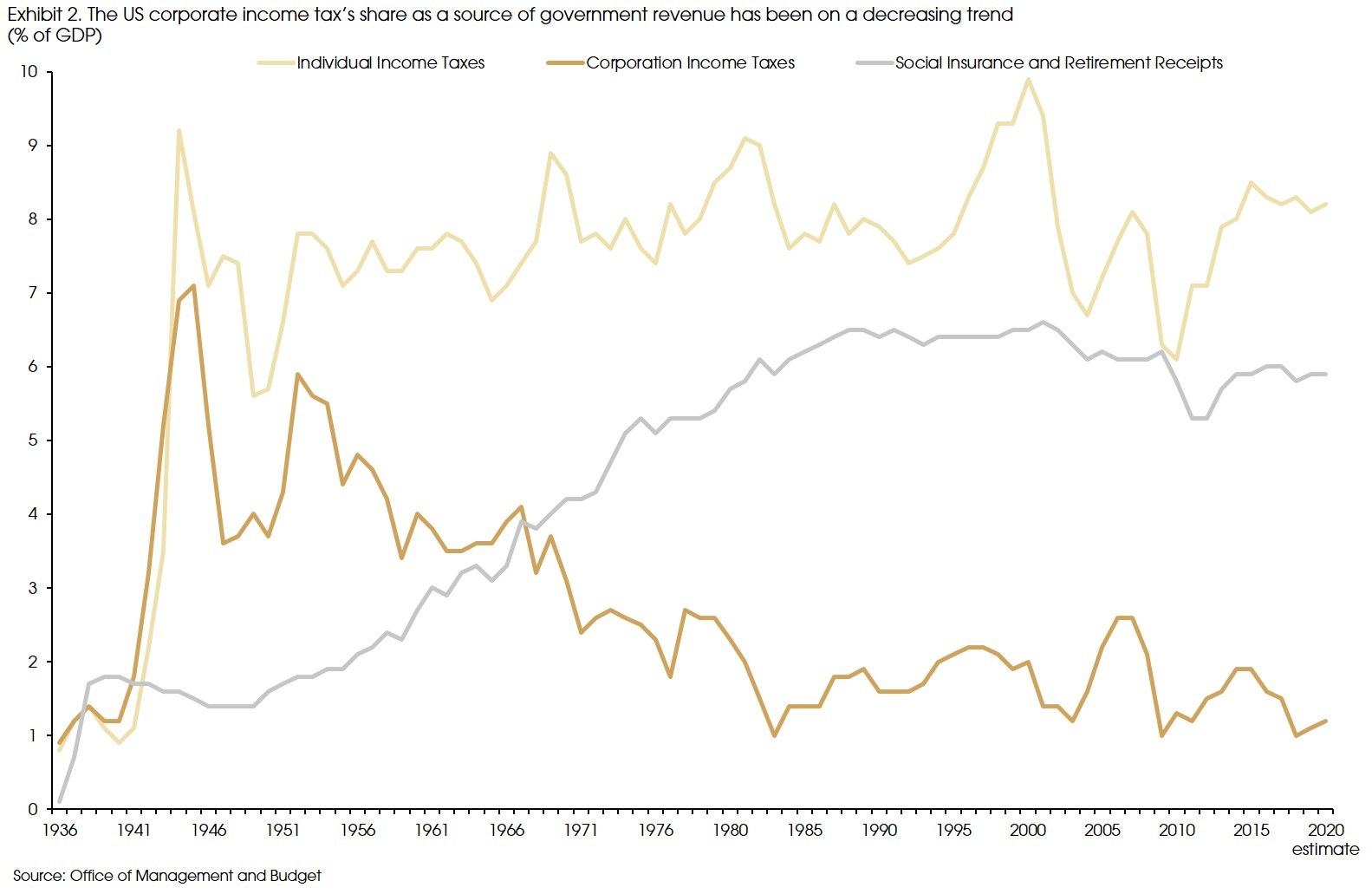

US Corporate tax revenue has been declining for decades (Exhibit 2). Corporate tax revenue as a share of GDP fell from 5% in the 1950s to 1.2% now, as corporates are taking advantage of lower tax regimes globally, such as Cayman Islands, Ireland, the Netherlands, Luxembourg, Singapore, and Switzerland. Especially, companies with less physical assets and more intangible assets (e.g., tech and pharmaceutical companies) find it easier to move profits/cash worldwide.

Moreover, governments have been cutting corporate tax rates over time, known as a global "race to the bottom" tax competition to attract more capital and investment. Therefore, raising corporate tax has become increasingly difficult. Consequently, we have been witnessing growing profit margins of companies (e.g., the S&P 500 companies' profit margin increased from 5% in 1990 to more than 10% in 2019) and lower revenue for governments.

However, surging government debt and deficits during the pandemic have prompted more discussions on higher tax, suggesting a possible end of the "race to the bottom" game. Specifically, Biden's tax proposal (if passed) will be American’s first major tax hike in 30 years. The UK government is also preparing to raise the corporate tax rate from 19% to 25%. Meanwhile, the increasingly popular Green Party in Germany (according to opinion polls) is also advocating their corporate tax hike plan (from the current 16% to 25%).

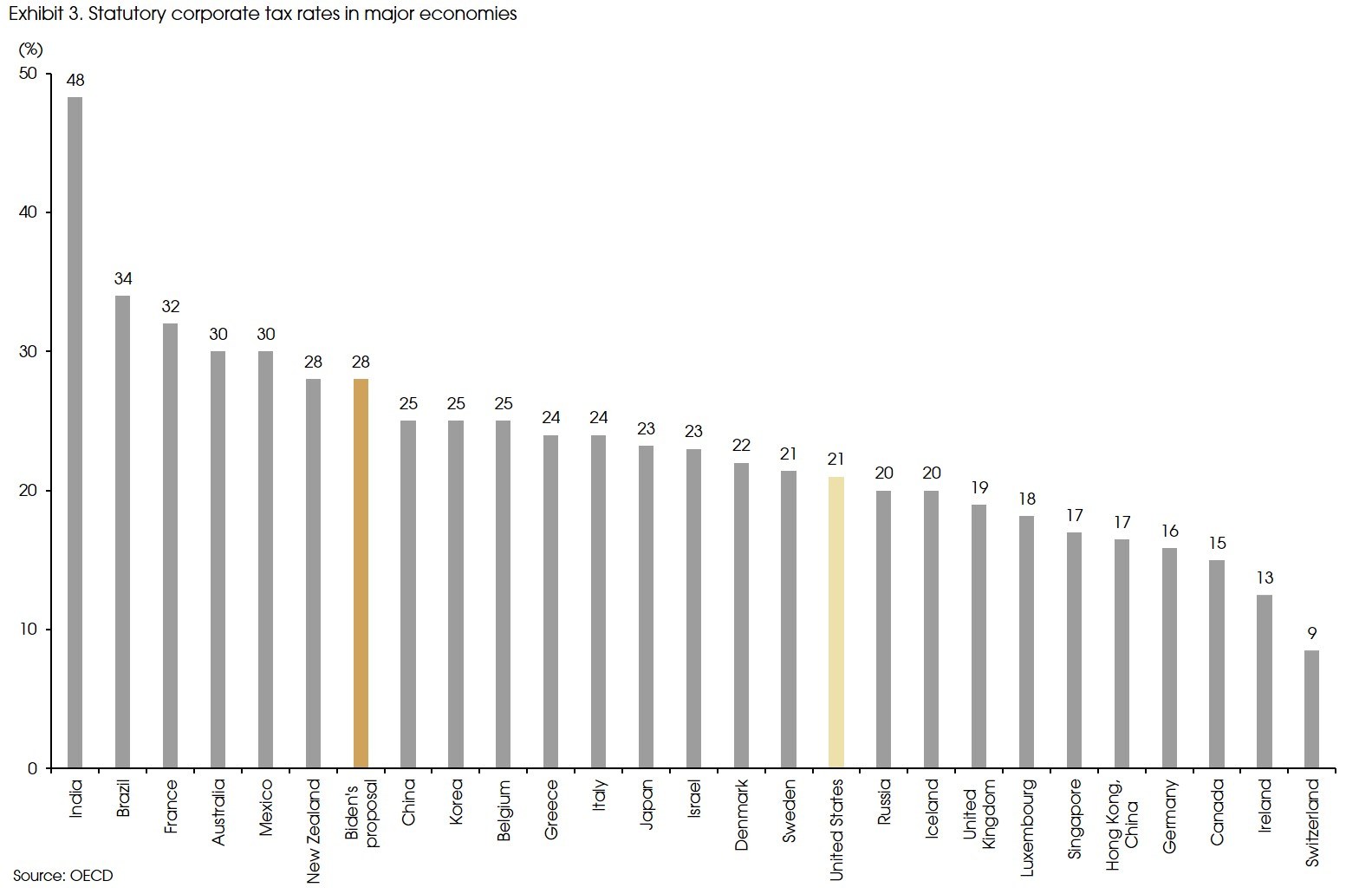

That said, Biden's proposed 28% corporate tax rate would lift the US's statutory corporate tax rate to the higher end of the global spectrum (Exhibit 3). To prevent companies from shifting revenues abroad due to this widened gap, the Biden-Harris Administration also proposed to set a global minimum tax rate at 15% (previously proposed at 21%).

The 15% global minimum tax rate seems much lower than the proposed 28% statutory domestic tax rate. However, the 15% is a minimum effective rate (the real tax paid after loopholes, deductions, credits, etc.) rather than the statutory rate. According to data from S&P Global, before the pandemic, the effective tax rate for large US companies (proxied by the S&P 500 companies) was around 16%, even slightly lower than their foreign effective tax rate, 16.9%. Therefore, the "real" gap in corporate tax rate between the domestic and foreign countries will be much smaller than the 13% (28% US statutory tax rate minus 15% global minimum tax rate). Setting a 15% minimum tax rate should help reduce companies' incentives of moving revenues abroad.

Finally, increasing the marginal capital gain tax rate will help close some tax loopholes among high-income individuals. Under the current tax rates, the capital gain tax rate (20%) is lower than the marginal personal income tax rate for high-income individuals (37%). According to the Tax Policy Center study, some income can be transferred as capital gains for tax avoidance through certain financial transactions or tax operations. 77% of such tax benefits are obtained by individuals with annual income higher than USD 1 million.

However, higher tax is a red line for not only the Republicans but also some of the Democrat lawmakers. To seek common ground with the Republicans, Biden's administration has already lowered the price tag for the infrastructure plan from more than USD 2.3 trillion to USD 1.7 trillion (trimming spending on roads, bridges, and other transportation infrastructure projects). However, that is still more than USD 1 trillion higher than the Republicans' offer.

Therefore, further compromises are likely, not only for spending but also for taxes. For example, the global minimum tax rate was originally set at 21% and reduced to 15%. The corporate income tax rate might also be reduced, and some market views predict a 24%-25% corporate tax rate rather than the proposed 28%.

Will higher taxes damage the economy?

Raising tax is never a nice or easy story to tell. Although there is no clear evidence showing that higher taxes will curb growth, this very logic is deeply rooted and widely assumed nontheless.

The most well-known argument advocating lower tax is the "trickle-down theory", suggesting that reducing tax on businesses and the wealthy will increase business investment in the short term and benefit the entire society in the long run.

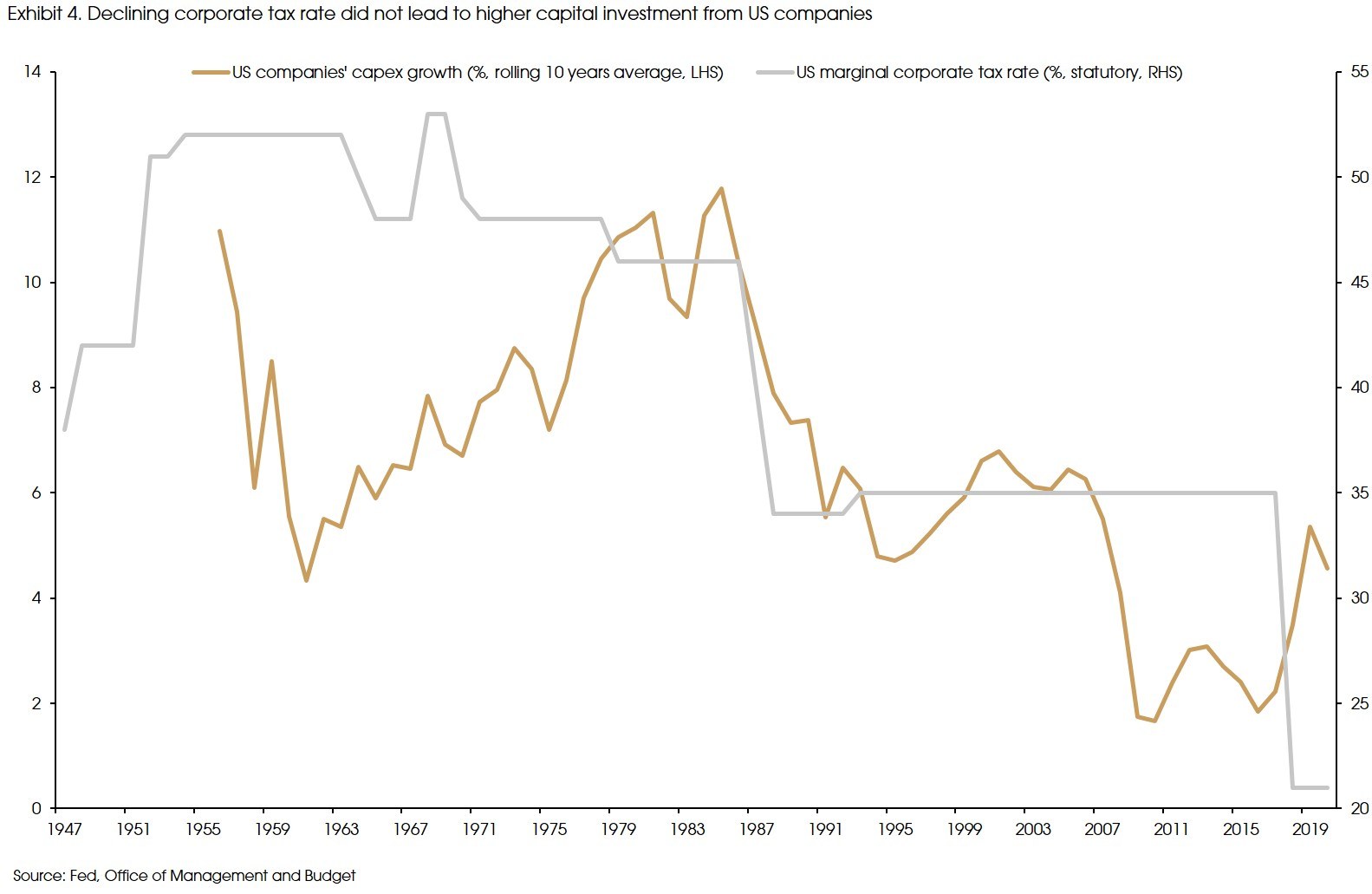

Nontheless, no data proves that low tax promotes capital investment or economic growth in the long run. The corporate tax rate decreased from around 50% in the 1970s to 21% now in the US. However, the growth of corporate capital expenditure decreased from around 12% to below 5% (Exhibit 4).

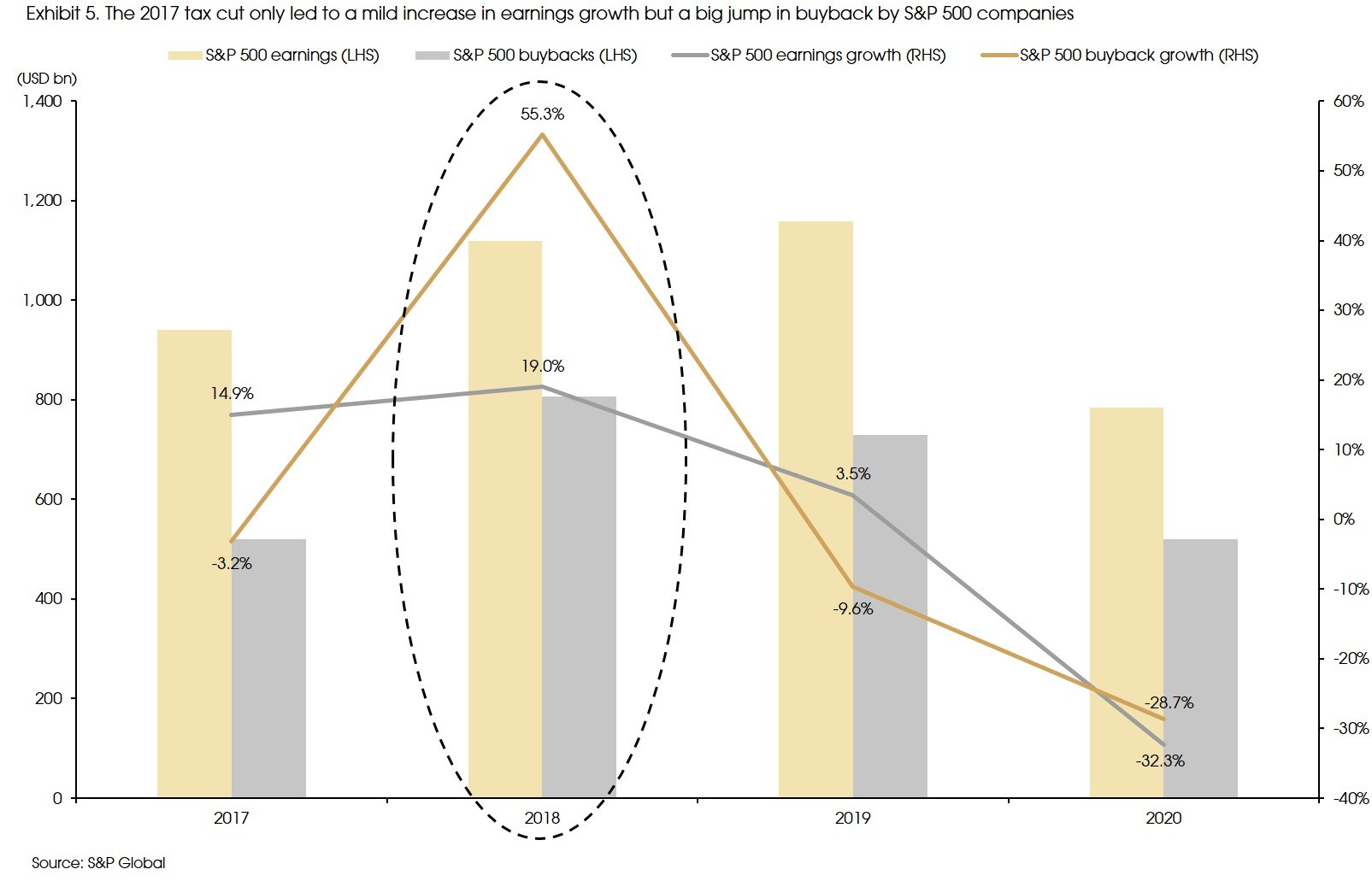

In addition, the short-term effect of tax cuts is also not convincing. Trump's 2017 tax cut did support the US economic growth to 2.9% in 2018, the highest level after the 2008 crisis. However, it only lasted for one year. Specifically, the S&P 500 earnings growth had a mild increase from 15% to 19%, with little change in capital expenditure but surging buyback activities (Exhibit 5).

Such facts suggest that tax changes are only one of the many factors that affect business decisions and may not necessarily be the determing one for economic growth.

Specifically, tax changes affect small businesses more than large ones. In general, small businesses have lower profit margins, weaker pricing power, and more capital constraints. The S&P 500 companies have an average net profit margin at around 10% during the past decade, while smaller companies covered in the Russel 2000 index only have about 2% during the same period, which decreased to around 0% after 2015. Tax hike will set higher bars of required returns for companies when making capital investment decisions, and that will have a more significant impact on the less profitable, smaller firms.

Although in terms of number, small businesses account for more than 90% of businesses in the US, it is the large companies that generate more revenues and contribute more to the GDP growth (around 60%), partially explaining the non-convincing impact on growth.

Moreover, Biden's tax proposals aim to achieve partial revenue-neutral for the increased spending in the two plans, not fiscal tightening, and the total fiscal pulse remains expansionary. According to the recently released budget plan for FY2023, the proposed spending and tax measures will increase the fiscal deficit-to-GDP ratio by 0.5% on average during 2022-2028. An expansionary fiscal stance should continue to provide support to the overall economic growth.

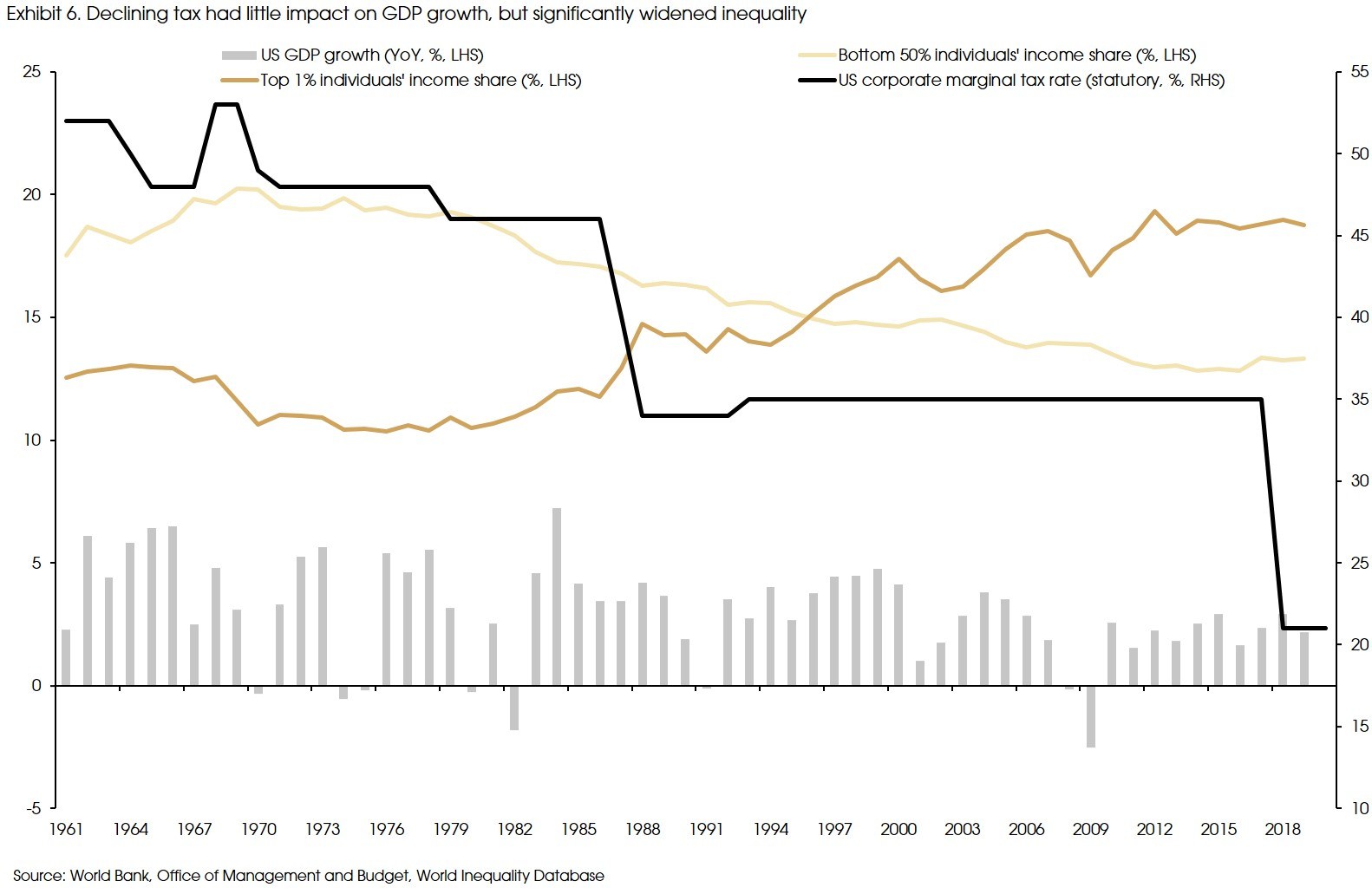

Despite the controversial impact on economic growth, inequality significantly increased along with the decreasing tax rate (Exhibit 6). The top 1% households' share of total income increased from 10% during the 1970s to nearly 20% now, while the bottom 50% households' share of total income decreased from 20% to 13% during the same period.

Therefore, instead of the trickle-down effect, tax changes' impact on inequality is more evident, based on historical data.

Impact on the market: do we need to be worried?

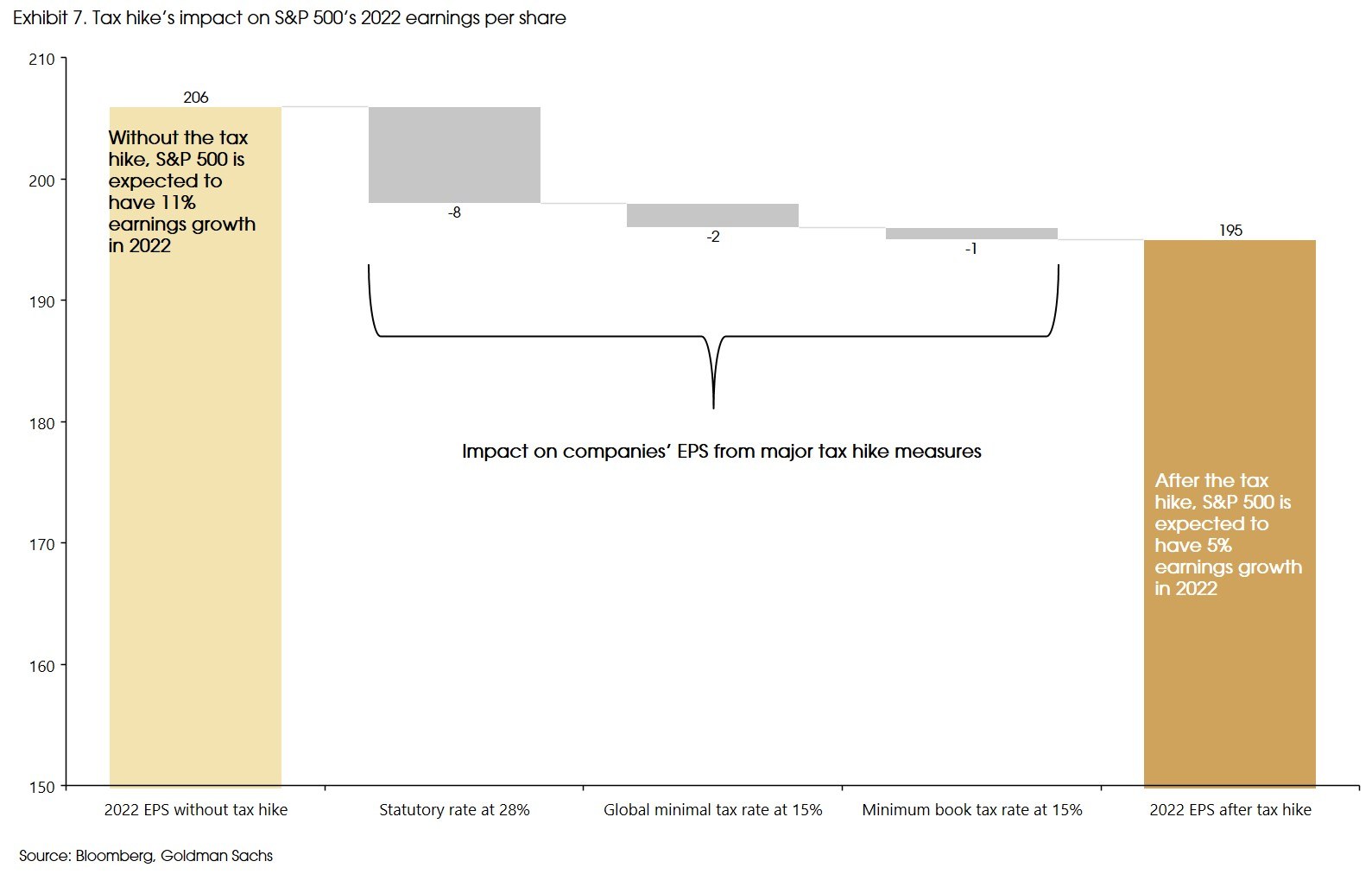

According to market estimates, tax changes on corporates (including statutory tax rate from 21% to 28%, imposing a 15% global minimum tax, and a 15% tax rate on minimum book revenue) will lead to a USD 10 earnings decline on S&P 500 EPS (earnings per share) in 2022, earnings growth will be decreasing from 11% to 5% (Exhibit 7).

However, historically, 5% of S&P 500 earnings growth is not high, but still acceptable compared to the average (5.8%) since 2008. Moreover, as we have mentioned, tax changes may not significantly affect business decisions, especially for big companies. The negative impact on earnings growth should be a one-off effect. In addition, although the 28% corporate tax rate will be a significant jump from the current 21%, it is still lower than the 35% before 2018.

We should also keep in mind that the increased tax revenue will be used to fund infrastructure spending. Such government spending may boost earnings of related sectors and companies (e.g., without the investment from NASA, SpaceX may not be as successful as it is today), which should ideally offset some of the drag in the market.

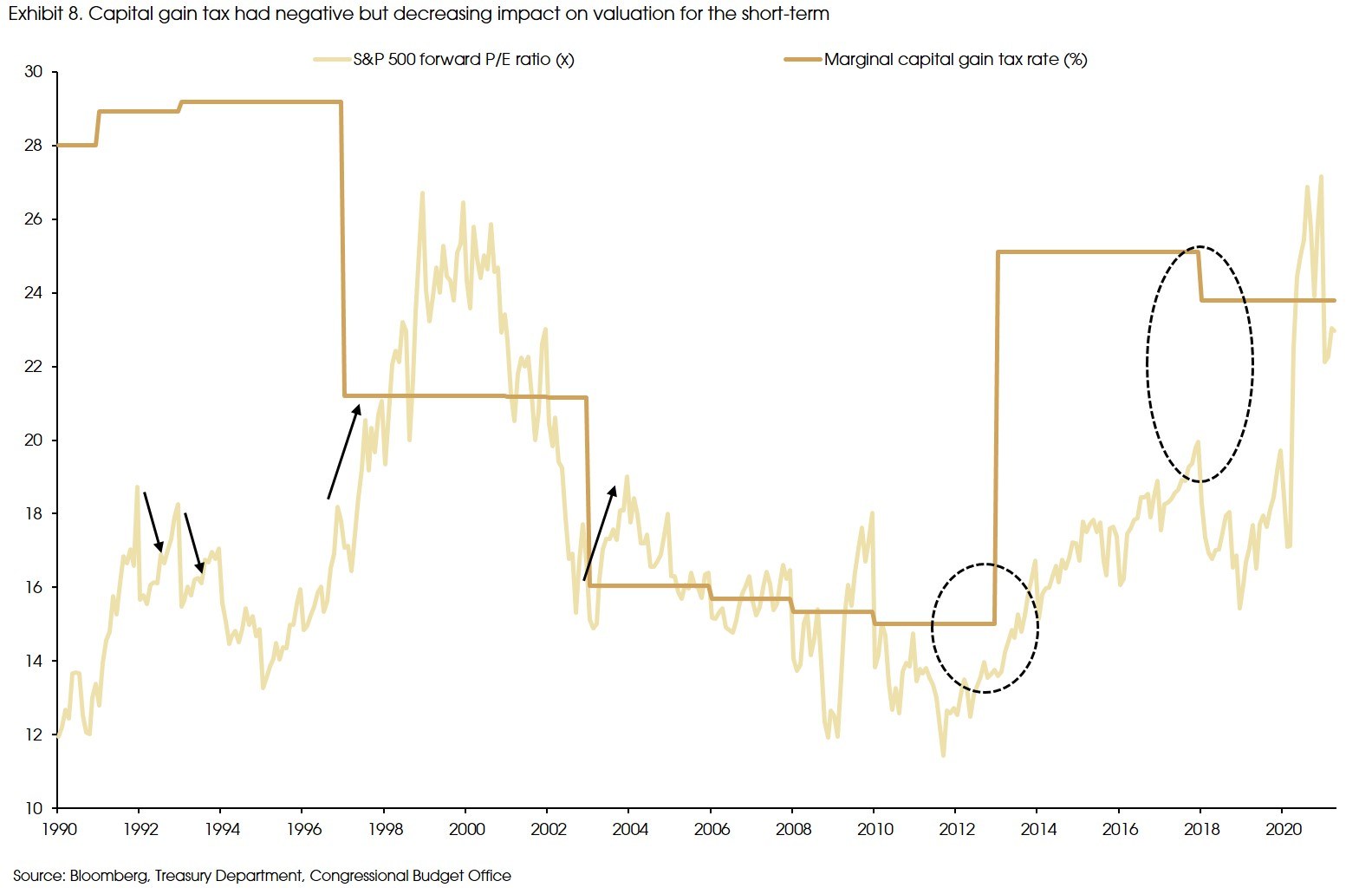

Moreover, there is a moderate negative relationship between the capital gain tax rate and the S&P 500 P/E ratio, suggesting that a higher capital gain tax may dampen valuation (Exhibit 8). However, historical data show that such impacts are mainly short-term focused and have weakened in the recent decade.

Sector-wise, the corporate statutory tax hike may have a bigger impact on stocks with high domestic exposure and high effective tax rates (low credits and deductions), such as financials, consumer, energy, and industrials. However, the tax hike on foreign income will affect sectors with more overseas income and lower effective tax rates, such as tech, communication services, and healthcare.

According to estimates by Goldman Sachs, the combined effect will put more pressure on the tech, communication services, and healthcare sectors. However, even for these "most affected sectors", the impact on earnings will be merely in the single-digit and might be offset by other favorable measures. For example, the Biden-Harris administration hopes that setting the global minimum tax will stop the proliferation of national digital taxes among European countries.

Moreover, companies based outside the US but that generate high earnings within the US would see their effective taxes rise. Specifically, the US is the largest single country for European companies' sales. Media, healthcare, and food are the most exposed sectors in Europe.

However, the eventual impacts on markets and sectors will depend on the details and how much of the tax proposals will be passed into law.

For now, we are not highly concerned about the tax hike. Market volatility may rise as we get more details of the tax plans in the coming months. However, companies should still make notable profits as long as the recovery continues, supporting the market performance.

Sources: Bloomberg, Congressional Budget Office, Federal Reserve, Financial Times, Goldman Sachs Research, Morgan Stanley, Office of Management and Budget, Organization for Economic Co-operation and Development, S&P Global, Tax Foundation, Tax Policy Center, US Treasury Department, World Bank, World Inequality Database and CIGP Estimates.