CIO Viewpoint: Anti-Trust or Anti-Tech?

The markets tend to be influenced, in part, by social movements, fads, trends of the day or the year. Right now information technology (IT) companies are being hounded by the media, consumers, liberals and conservatives alike in the United States. Ideologically, cyberspace has been transnational, largely unregulated and free, with no one country or body as overseer, thus it was allowed to multiply. It was only three years ago when the Obama administration embraced the promise of what IT could do for global society, but now politicians won’t touch it; the space is almost radioactive for regulators. Catalytically, President Trump’s questionable, in more ways than one, usage of Twitter elucidates yet another powerful use case for social media and tech overall: disintermediation and as such questions of responsible overseer. This was exacerbated by the multitude of investigations into Russia’s influence in US elections and how technology was used to execute such infiltration. The tech sector is accused of being a co-conspirator in nefarious activity in a country that values freedom and success and abhors foreign influence in such a prized political system: democracy.

Similarly, another case is being made for controlling the behemoth that technology companies now represent: the influence and control that Alphabet (Google), Amazon, Apple, Facebook and others have on our everyday lives. Consumers now engage with these platforms more than they ever have and these companies are reaping the profits of such success with growing revenues and earnings and ever higher stock prices. Yet again, Americans and political interest groups are lobbying to regulate such unchecked excess just as they did with the banks in the global financial crisis, and essentially breakup “Big Tech” all in the name of achieving equality.

So, is the US government anti-tech or anti-trust?

For investors this warrants caution for the future. Well understood mega trends are supporting investment in the space which has put IT on a bull run, due to its exponential innovation capabilities and growing progress in robots, big data, artificial intelligence, social local mobile, cyber warfare and more. Yet, we expect a recalibration of technology’s tonnage in society whether by society voting with their clicks or by the FTC (Federal Trade Commission) or DOJ (Department of Justice) via specific performance anti-trust rulings. All the while the companies themselves are trying to get ahead of this and initiate their own reform. Headline overhangs are never good for investors; this additional dynamic confounds markets making the efficacy of predictability even lower than usual.

If under the condition that the sector cannot resolve this on their own, and if legislation advances to US Congress rather than fines and specific performance rulings by the FTC/DOJ, we would expect a watered-down bill to be proposed that targets sector’s stalwarts: Alphabet, Amazon, Apple, Facebook. Alternatively, a true antitrust ruling, outlining fines and instructing a change in behavior, much in the realms of what Europe has pressed onto Google and Microsoft in the last two decades could be in the offing. Recall Microsoft already was under anti-trust investigation in 2001 in the US and 2004 in Europe for which it paid fines, largely over the bundling of Internet Explorer in Windows, which was claimed to limit consumer web browser options. It’s notable that Microsoft is not tied up in the current headline rhetoric. As a side, we might think that the Bill & Melinda Gates Foundation which promotes many global social good initiatives is helping to ease sentiment, and while the likes of Mark Zuckerberg and Priscilla Chan too have committed to The Giving Pledge, it may be too little too late to appease the everyday consumer.

We think there are likely to be fines if the sector doesn’t self-regulate, which tech leaders are attempting now, quickly or vigorously enough. Society is looking for a fall-man. We think this has the highest probability of satisfying the public in the near-term. However, as investors, we still believe in the long term prospects of the sector, not only due to the disruptive nature that creates unicorns and solves some of the world’s most challenging problems, but by its infallible integration into society helping us live longer and enjoy life more.

Current Landscape

Recently, the US has taken tact to “prosecute” mega cap tech. The DOJ has assigned itself Google and Apple under their jurisdiction, and the FTC has taken Amazon and Facebook. Even presidential candidate and senator, Elizabeth Warren, has plans to “beak-up big tech”.

The FTC is mandated:

“…to protect consumers and promote competition. The FTC protects consumers by stopping unfair, deceptive or fraudulent practices in the marketplace. We conduct investigations, sue companies and people that violate the law, develop rules to ensure a vibrant marketplace, and educate consumers and businesses about their rights and responsibilities.”

The DOJ is mandated:

“To enforce the law and defend the interests of the United States according to the law; to ensure public safety against threats foreign and domestic; to provide federal leadership in preventing and controlling crime; to seek just punishment for those guilty of unlawful behavior; and to ensure fair and impartial administration of justice for all Americans.”

While in fact government regulation in any industry can arguably be beneficial, such as has been seen with financials or utilities or energy, which are all key facets of functioning society, technology has also become a quasi “essential service” in a modern digitally connected society. While fines may help solidify pointing the finger of blame, they do little to change behaviors and in fact just enable unaffected platforms a green pasture to run free. It is a virtuous cycle.

There are three main areas of anti-trust concern:

A. Advertising Angst

Google’s acquisition of DoubleClick, an online advertisement placement company, in 2008 propelled it into the lucrative world of selling advertisement space. Advertisers follow eyeballs; they want the greatest reach in the most efficient way. More people going online purports less money being spent on radio ads, newspaper ads and billboards. It is undeniable that online and mobile ads have become the new medium to reach consumers. Because Google has acquired more and more platforms over the last two decades: DoubleClick, YouTube, AdSense, reCaptcha, Waze, Nest, some claim that its influence might be causing harm to consumers.

Furthermore, not only do eyeballs result in market share, but innovations in Google’s search results and rankings have lead it to become the leading platform for online and mobile ad placement. Companies such as Unilever, Diageo and Roche pay dearly for those eyeballs. Some claim that Google has forced out competitors because of this dominance and they, Google, set the market prices because of reduced competition. Thus the call is to not just issue monetary penalties to these companies for to-be-determined anti-trust violations, but to force them to sell off units/asset, thus the “break-up”.

B. Privacy Priority

Ever since it was revealed in 2017 that Cambridge Analytica, a data analytics firm, had access to user data of some 87 million Facebook users (only because they acquired data of 270,000 Facebook users), who had not expressly given permission for that data to be shared, lawmakers have been up-in-arms to refine “opt-in” laws.

Furthermore, various data breaches in the US at Target, an apparel and home good retailers, Equifax, a consumer credit rating agency, Marriot, a hospitality chain, and even the DNC (Democratic National Committee), are enticing regulatory agencies to make changes. While there are strong laws around how to manage data breaches, including obligations to announce within 30 days of its identification that it has occurred, consumers and lawmakers are demanding more stringent rules given recent concerns.

Social norms are shifting and some companies are on a public relations tour promoting self–regulation in lieu of new privacy laws. For example, Facebook has been on the road, prompting changes to its features to protect its user privacy and prevent hate speech and fake news infiltrating feeds. Apple too has long committed to privacy protections and even states they attempt to reduce fake news on their Apple News app by curating articles authored by trusted providers. Ultimately society is still finding the fine line between what constitutes free speech and what does not.

We do expect there to be revisions to the Unities State privacy laws. Perhaps not under the current administration but with some democratic presidential candidates offering plans on how to manage the tech sector, it could be a top agenda item in an ensuing administration in the medium term. Any legislation is likely to give more control to the user beyond the current “opt-in” parameter, than to restrict companies and organizations. After all, Europe has been a leader in revising and updating privacy laws for the digital age: a 2016 ruling and 2018 implementation of Europe’s GDPR (General Data Protection Regulation) or more generally known as the ‘right to be forgotten’ gave control to the user of his/her personal data.

Privacy regulation could be zero sum when it all works out. For investors, we do think that privacy will be a critically important attribute of survival of the sector and those that integrate it wisely to their advantage can reap rewards.

C. Consumer Competition

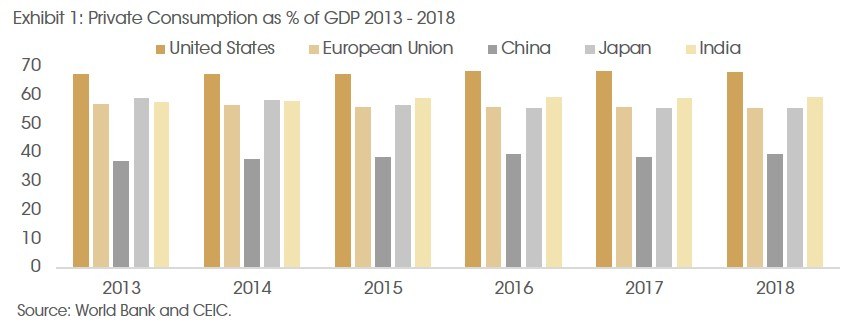

Private consumption contributes over 70% of GDP (gross domestic product) in the United States. America achieves this high level, in part, by regulating commerce to ensure fair competition and as level a playing field as realistically possible. Not only does the FTC mandate extend to retail (online and offline) but to suppliers, intermediaries, conglomerates and MNCs (multi-national companies).

“…shareholder value … will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model.”

How fortuitous Jeff Bezos’s words were 22 years ago in his annual shareholder letter. Today, the power of Amazon’s economic model is a result of growing its market share over the last two decades: first with physical books, then to music and ultimately nearly every store-bought good can be found on its website. Coincidently, Amazon’s business model was enabled by the simultaneous rise of the internet and access to instant product information. Today, its prowess in quantity of SKUs, warehouse footprint, and logistic capabilities also mark it as a target of struggling and bankrupt brick & mortar retail. But in fact Amazon’s approach and strengths have kept a lid on the rising prices of goods. The FTC is charged to “protect consumers against unfair or deceptive acts or practices in commerce”. It uses price as a measurement tool to evaluate whether regulations are broken. A key pre requisite of such investigation is usually complaints of higher prices without options for alternatives. However, with Amazon leading e-commerce prices are lower and thus the case by the FTC is weaker. It could be argued that in fact Amazon is not collecting monopoly profits, which is another key test for the success of an FTC investigation.

We think that in tech, scale wins and 'first-mover' wins.

Impact on Investing

For investors there is a value opportunity to be unlocked in companies who may be forced to spin-off units, “create new money” through an IPO (initial public offering) and consequently create value accretive core businesses.

Some results of a potential break-up of tech:

(1) Companies may not as actively seek acquisitions as they did in the past for fear of regulatory rejection.

(2) Companies may change shareholder class structure to eliminate activist shareholder maneuvers.

(3) Force analysts to value companies on sum-of-the-parts basis.

(4) Unlock value in buried or encumbered assets.

(5) Companies may employ more bankers and lawyers to explore sale, disposal or IPO options.

(6) Legislation may disrupt markets and enable medium size competitors to grab market share.

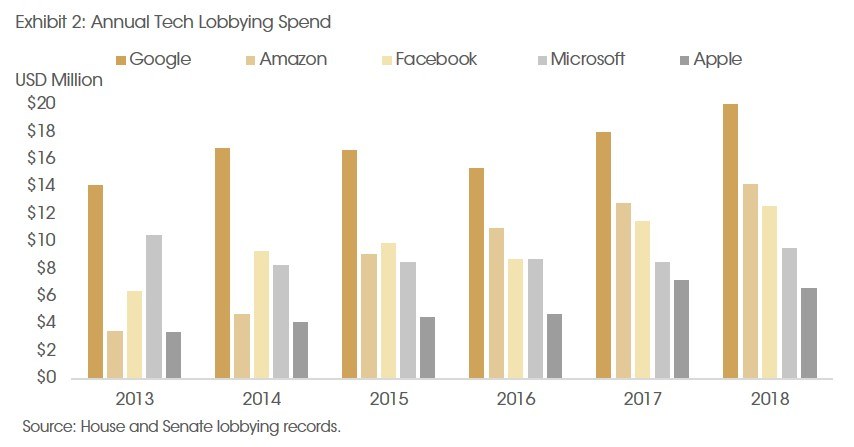

We think that any proposed legislation that makes it to Congress is likely to be watered down. Furthermore, it is not in the Trump administration’s agenda to pursue IT regulation. With the 2020 presidential campaign heating up it is unlikely he will take the same tact as his competitors but in fact differentiate and dictate the narrative: his. On the other side, the companies themselves are ramping up their lobbying activity in Washington, DC.

According to the US House and Senate lobbying records, Google, Amazon and Facebook spent a record amount on lobbying in 2018 – some USD 47mn in total.

Long-term, technology transcends market cycles. While there may be ups and downs in stock prices, information technology is revolutionizing society. The sector’s innovation, output, ideas, products, services, platforms, code, methods, and protocols, touches every part of the global economy, because to be a modern company one cannot avoid the ‘digital’. Every company wants to do their business better and make profits for shareholders using technology’s products and services to grow. If big tech is restricted and constrained from innovating, leading and being the best, we would be cautious about owning high flying names that catch the fancy of dramatic investors.

In the end social movements are headline risks to investors. No one can predict the outcome but we can reasonably rely on what we feel are more certain outcomes such as identifying investments that have strong intellectual property protection and portfolios, solve a unique problem or have public policy support.

Sources: Amazon 1997 shareholder letter, CEIC, DOJ website, FTC website, US House and Senate lobbying records, World Bank and CIGP estimates.