Investment Banking: Logistics Sector - the Highs and the Lows

Author: Carl-Alexander Van Tornout

2022 Highlights in Transport and Logistics – Boom & Bust

The Transport and Logistics (“T&L”) industry has seen an increased consolidation trend which has driven M&A activity and deal volume up from 2021 to H1 2022. Large logistics players have been looking for strategic growth opportunities to provide a more holistic service to clients, widening their distribution network and providing a larger share of service to the entire supply value chain.

Midmarket T&L players, who lack the investment capabilities to transition into a size benefiting larger network effects, chose to be either acquired or merged with a similar-sized player.

The consolidation is also due to new players entering the market including digital logistics players and private equity investors, who are looking to re-shape various areas of the supply chain. Private Equity investors, backed by cheap financing, have employed buy-and-build strategies to create large global players that are capable of expanding along the value chain and extracting higher margins in the process, with the support of digitalization infrastructure.

The COVID pandemic has accelerated the M&A activities in the T&L industry in 2020 and 2021. Many logistics players have achieved historically high revenues and margins from strong end-consumer demands amid supply chain disruptions. In turn, strategic buyers, supported by strong financials and growth prospects, accelerated their M&A activities to gain market share, enter new geographies and expand services for clients.

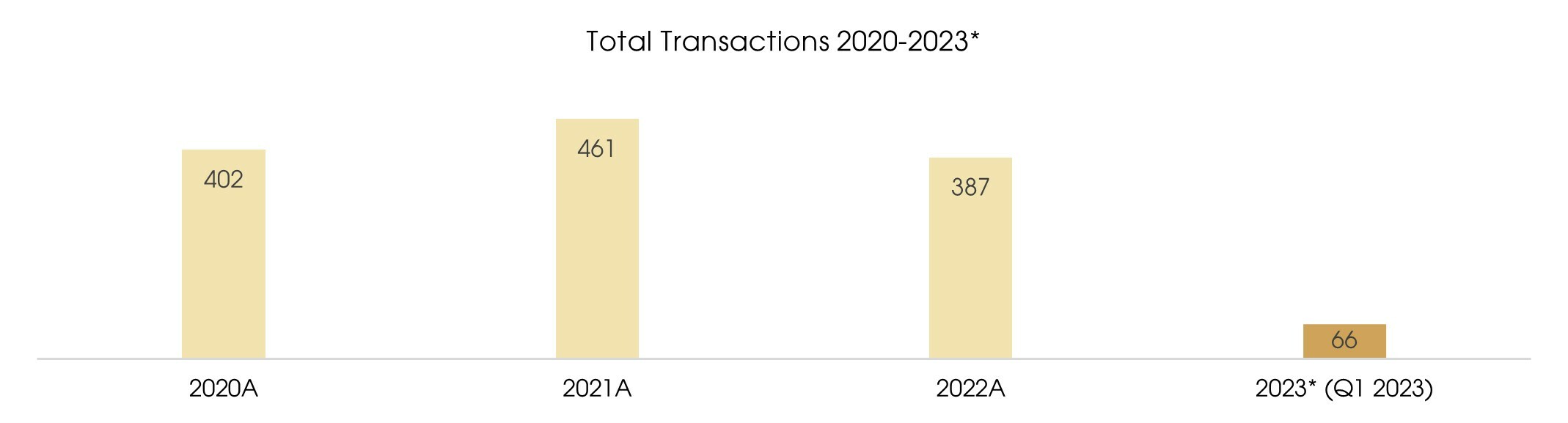

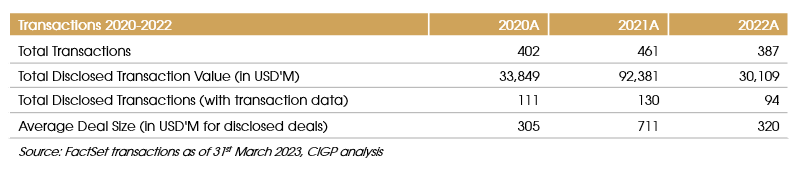

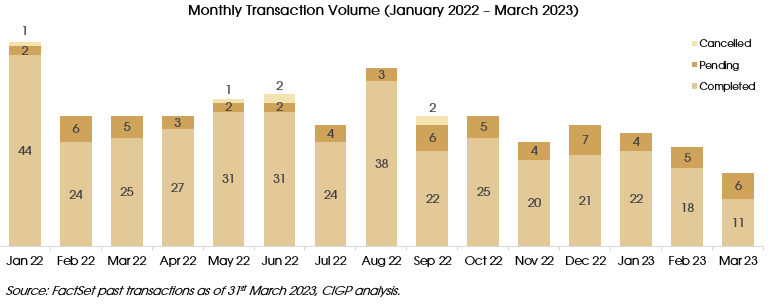

In 2022, there was a decline in deal activity in the T&L industry. A total of 387 deals were announced during 2022, representing a 16% decrease from 461 deals in 2021. In 2021, the average disclosed deal size was c. USD 711 million, while the average disclosed deal value in 2022 amounted to be c. USD 320 million, which translates to a 55% drop in average deal size.

2023 M&A – Search for Growth and Client Retention

Since the beginning of 2022, the economic slowdown has led to a sharp decline in volumes, revenues, and margins. Logistics players are looking for alternative sources of growth via acquisitions with high levels of cash from the market boom-cycle, turning the market into a buyer’s market.

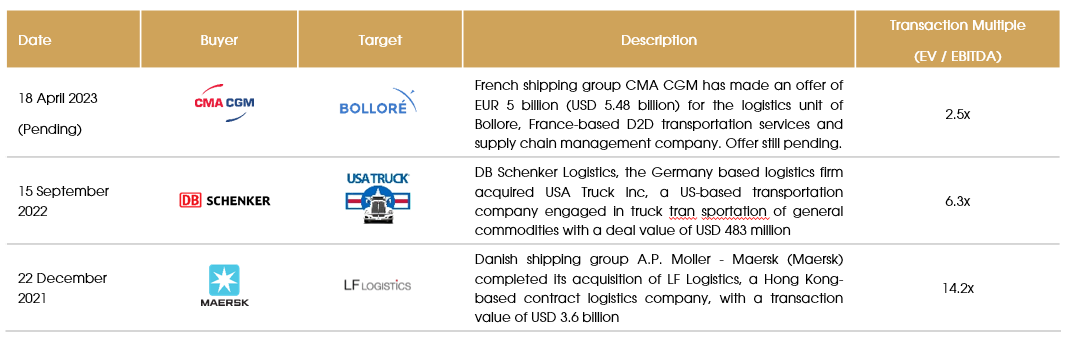

It is clearly demonstrated by the recent offer made by CMA-CGM for Bollore Logistics for EUR 5Bn (2.5x EV/EBITDA), as multiples for notable transactions have significantly decreased from the highs seen in 2021.

Notable Transactions - 2021 to 2023

In addition, the pandemic has led logistics users to re-assess supply chain and its logistics partners. Having a resilient service provider, diversified supply chain, and digital operational platform became a strategic focus point for clients in the logistics industry.

Looking ahead, sellers, having benefited from the market boom cycle during the past few years, are looking to clearly demonstrate their client quality, client stickiness and potential future growth once the downcycle is over, despite shrinking revenue and volumes from the peaks of 2021. Buyers are keenly focusing on the same topics of future growth and retaining clients, but from the perspective of negotiating a better deal and mitigating risks should the current market environment continue for longer.

Looking Ahead – Get Prepared

In view of the current economic downturn and lowered valuation expectations, Buyers and Sellers are getting prepared in different ways.

Buyers can take advantage of the current environment through:

- Self-Reflection: Do the reasons and criteria for doing acquisitions 12 months ago remain valid? Are the internal processes still suited towards the current environment?

- Targeted Screening: Finding and screening the right Target that not only matches the internal search criteria but also at the right time is the key to success. Does the firm have a sufficient network to find the Targets?

- Earlier conversations: Screened potential targets may not be interested to sell at the moment, but Buyers can use this as an opportunity to have conversations with firms, build momentum for when they are ready and facilitate an easier transaction process.

In all of the above instances, having conversations with an M&A advisor, such as CIGP, on these strategic topics makes sense. CIGP helps Buyers screen targets in the T&L industry, initiate conversations with potential Sellers and execute the transaction and negotiate transaction terms.

Sellers, on the other hand, are getting ready for a potential transaction in the buyer’s market as follows:

- Reflection: Examining the business internally and externally through the lens of a Buyer.

- Business Resilience: Demonstrating the business’ resilience through the sluggish economic environment

- Future Forecasts: What happens after a downturn in the T&L industry and how the business is preparing for it will be on the top of the agenda for Buyers.

Leveraging an M&A advisor to prepare the business for a sale, including development of business plan, projection of financial forecasts, ensures that potential Sellers can focus on running the business successfully and the business is examined through the lens of an external investor before an M&A process starts.

The latter half of 2023 is shaping up to be an interesting period for logistics M&A activity, and CIGP is ready to assist.

Reach out to us to explore further at: Advisory@cigp.com.

Important Information

This document is produced by CIGP Partners (Hong Kong) Limited (“CIGP”) and intended for informational purposes only. It may not be reproduced (in whole or in part) or delivered, given, sent or in any other way made accessible, to any other person without the prior written approval of CIGP. The information and opinions contained in this document has been compiled, or arrived at, in good faith and on the and on the basis of publicly available information, internally developed data and sources believed to be reliable as at the date of publication. This document is not subject to any guidelines on financial research and independence of financial analysis. CIGP makes no representations, provides no warranty and gives no undertaking, express or implied, regarding any of the information, projections or opinions contained herein, nor does it accept any liability whatsoever for any errors, omissions or misstatements. The information contained herein is subject to change without prior notice. CIGP gives no undertaking to update this document or to correct any inaccuracies in it which may become apparent.

Sources: Capstone Partners, CF Law, PwC, FactSet, CIGP Analysis